Latin America is a region known for its vibrant culture, diverse economies, and emerging markets. As technology continues to advance and financial systems evolve, cryptocurrency has gained significant attention and adoption throughout the world. One cryptocurrency that has shown immense potential in the Latin American market is Tether.

Tether, also known as USDT, is a stablecoin that is pegged to the value of the US dollar. This means that for every Tether in circulation, there is an equivalent US dollar held in reserves. Tether provides a unique solution to the volatility often associated with other cryptocurrencies, making it an attractive option for individuals and businesses in Latin America.

One of the key benefits of Tether in Latin America is its potential to provide stability and protection against inflation. Many countries in the region have experienced high levels of inflation, which can significantly impact the purchasing power of individuals and the stability of businesses. By utilizing Tether, individuals and businesses can protect their assets from the devaluation of local currencies and mitigate the risks associated with inflation.

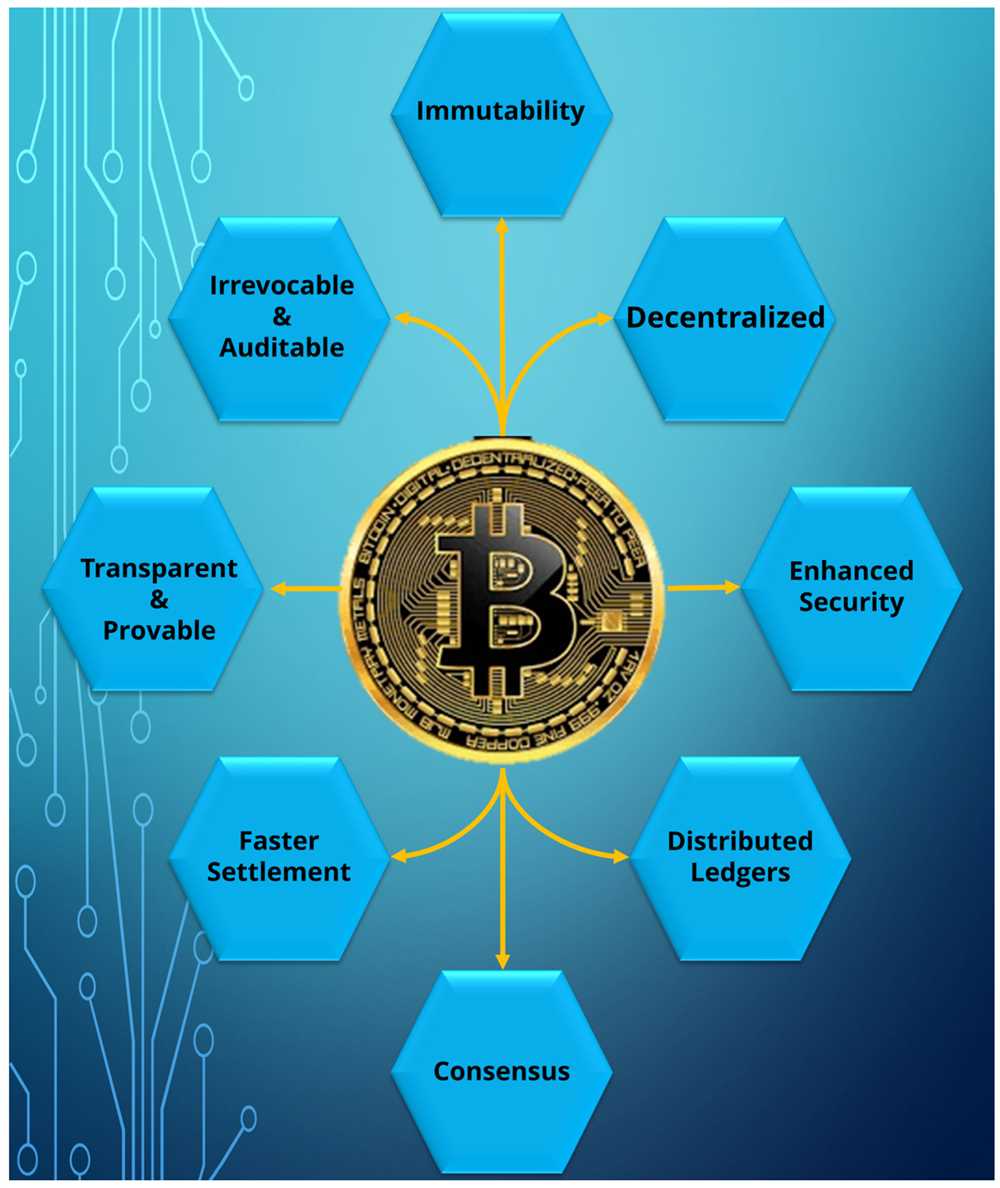

Additionally, Tether offers a faster and more cost-effective alternative to traditional banking systems in Latin America. With Tether, individuals can easily transfer funds across borders without the need for expensive intermediaries or lengthy processing times. This can be particularly beneficial for individuals and businesses engaged in cross-border trade or remittances, as it allows for faster and cheaper transactions.

While Tether presents numerous benefits in the Latin American market, it also faces certain challenges. One of the key challenges is regulatory uncertainty. As cryptocurrencies are a relatively new phenomenon, governments in Latin America are still navigating how to regulate and manage their use. This uncertainty can create barriers to entry and hinder widespread adoption of Tether and other cryptocurrencies.

Despite the challenges, the future outlook for Tether in Latin America is promising. As financial systems continue to evolve and cryptocurrency adoption grows, the demand for stablecoins like Tether is expected to increase. With its ability to provide stability, speed, and cost-effectiveness, Tether has the potential to be a game-changer in the Latin American market, empowering individuals and businesses to thrive in an increasingly digital economy.

Exploring the Potential of Tether in Latin America

Tether, a popular stablecoin, has the potential to make a significant impact in the Latin American market. The unique characteristics of Tether, such as its stability and ability to bypass traditional banking systems, make it an attractive option for individuals and businesses in the region.

One of the main benefits of Tether in Latin America is its stability. While many Latin American countries experience high inflation and economic instability, Tether is pegged to the US dollar, providing a reliable store of value. This stability makes it an ideal currency for everyday transactions, savings, and remittances.

In addition, Tether offers a solution to the challenges faced by the unbanked population in Latin America. Traditional banking systems often exclude large portions of the population, making it difficult for them to access financial services and engage in economic activities. Tether, on the other hand, operates on blockchain technology, allowing anyone with a smartphone and internet connection to participate in the global economy.

Tether’s borderless nature also makes it an attractive option for cross-border transactions and remittances in Latin America. With Tether, individuals can send and receive money quickly and at a lower cost compared to traditional methods. This is especially beneficial for Latin American countries that heavily rely on remittances from abroad as a source of income.

However, there are also challenges to the adoption of Tether in Latin America. One of the main concerns is the lack of regulatory oversight. As Tether operates outside of traditional banking systems, there is a need to establish clear regulations and guidelines to ensure consumer protection and prevent illicit activities.

Additionally, education and awareness of Tether and cryptocurrencies in general are still limited in Latin America. Many people are unfamiliar with the concept of stablecoins and the potential benefits they offer. Efforts should be made to educate the public and promote the use of Tether as a reliable and accessible financial tool.

In conclusion, the potential of Tether in Latin America is significant. Its stability, accessibility, and cost-effectiveness make it an attractive option for individuals and businesses in the region. However, addressing regulatory concerns and increasing awareness are essential steps in realizing the full potential of Tether in Latin America.

Benefits of Tether in Latin America

Tether, the popular stablecoin pegged to the US dollar, has the potential to bring significant benefits to Latin America. Here are some of the key advantages:

1. Stability

Tether provides stability to a region that has historically experienced high inflation rates and volatile currencies. With its peg to the US dollar, Tether offers a reliable store of value and a stable medium of exchange. This can help businesses and individuals better plan their budgets and protect their wealth from rapid currency devaluation.

2. Financial Inclusion

Latin America has a significant unbanked population, with many people lacking access to traditional financial services. Tether can help bridge this gap by providing a digital currency that can be accessed by anyone with a smartphone and internet connection. This can enable individuals and businesses to participate in the global economy, make cross-border transactions, and access financial services such as remittances and microloans.

3. Cost-Effectiveness

Using Tether for transactions can be more cost-effective compared to traditional banking systems. Traditional methods often involve high fees for international transfers and currency conversions. Tether eliminates the need for middlemen and reduces transaction costs, making it an attractive option for businesses engaged in cross-border trade and remittances.

4. Transparency

Tether operates on the blockchain, which provides transparency and immutability of transactions. Every Tether transaction is recorded on the blockchain, allowing for real-time auditing and verification. This transparency can help reduce corruption, increase trust in financial transactions, and attract foreign investments to the region.

In conclusion, Tether has the potential to bring stability, financial inclusion, cost-effectiveness, and transparency to Latin America. By leveraging this digital currency, the region can unlock new economic opportunities and improve the financial well-being of its population.

Challenges of Implementing Tether in Latin America

The implementation of Tether in Latin America presents a number of challenges that need to be addressed in order for widespread adoption and success. These challenges include:

1. Regulatory and Legal Environment

The regulatory and legal environment in Latin America can be complex and varies from country to country. Implementing Tether requires compliance with local laws and regulations, which can be time-consuming and expensive. The lack of clear guidelines and regulations on cryptocurrencies in some countries may also create uncertainties and hinder the adoption of Tether.

2. Trust and Confidence

Building trust and confidence among users is crucial for the successful implementation of Tether in Latin America. Many people in the region are not familiar with cryptocurrencies and may view them with skepticism. Additionally, the lack of a central authority to regulate Tether may raise concerns about its stability and security.

Therefore, educating the public about Tether and its benefits, as well as implementing strong security measures, is essential to gain trust and confidence in the system.

3. Infrastructure and Access

Improving the infrastructure and access to technology is another challenge for implementing Tether in Latin America. Many people in the region still lack access to internet services and have limited knowledge of digital technologies. Without proper infrastructure and access, it may be difficult for individuals and businesses to use Tether effectively.

Efforts need to be made to expand internet coverage and provide training and education programs to ensure widespread access and adoption of Tether.

In conclusion, implementing Tether in Latin America comes with its own set of challenges. These challenges include navigating the regulatory and legal environment, building trust and confidence, and improving infrastructure and access. However, with proper planning, education, and collaboration with local stakeholders, these challenges can be overcome, paving the way for the future growth and adoption of Tether in the region.

Future Outlook for Tether in Latin America

As Tether expands its presence in Latin America, the future outlook for the stablecoin looks promising. There are several factors that contribute to the potential success and growth of Tether in the region.

1. Financial Inclusion

Latin America has a large unbanked population, and Tether can provide a means for these individuals to access financial services. With Tether, anyone with a smartphone and internet connection can participate in the global digital economy. This can greatly improve financial inclusion and empower individuals who have been excluded from traditional banking systems.

2. Remittances

Remittances play a significant role in the Latin American economy, with millions of individuals relying on money sent from abroad. Tether can offer a faster and more cost-effective way to send and receive remittances, compared to traditional methods. By leveraging Tether’s blockchain technology, transactions can be processed quickly and securely, reducing fees and providing greater convenience for individuals and businesses.

Furthermore, Tether’s price stability can mitigate the impact of currency fluctuations, offering a reliable store of value for recipients of remittances. This can help protect the purchasing power of funds and contribute to the overall economic stability of the region.

3. Investment Opportunities

Tether’s presence in Latin America opens up new investment opportunities for individuals and businesses. With Tether, individuals can easily access global markets and invest in a wide range of assets, including cryptocurrencies, stocks, and commodities. This can help diversify investment portfolios and potentially generate higher returns for investors.

Additionally, businesses can benefit from accepting Tether as a form of payment. Tether’s fast and secure transactions can streamline business operations and reduce costs associated with traditional payment methods. This can attract more customers and expand market reach for businesses in Latin America.

In conclusion, the future outlook for Tether in Latin America is promising. The stablecoin can contribute to financial inclusion, improve remittance services, and offer new investment opportunities. As Tether continues to expand and innovate, its impact in Latin America is likely to grow, benefiting individuals, businesses, and the overall economy of the region.

What is Tether and how does it work?

Tether is a cryptocurrency that is pegged to the value of a fiat currency, usually the US dollar. It works by maintaining a reserve of dollars equal to the number of tether tokens in circulation.

What are the benefits of using Tether in Latin America?

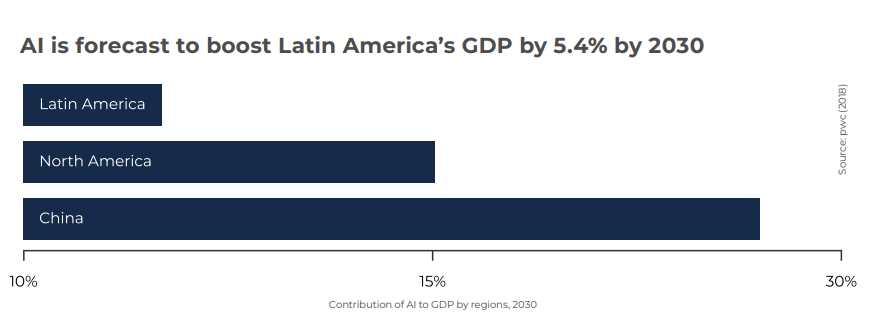

There are several benefits of using Tether in Latin America. First, it provides a stable store of value, which can help to combat inflation and currency volatility in the region. Additionally, it offers low transaction fees and fast settlement times, making it a convenient and efficient form of payment.