In recent years, the cryptocurrency market has seen a tremendous rise in popularity and adoption. As more and more people become interested in these digital assets, various developments and partnerships within the industry are constantly shaping the market’s landscape. One such development that has garnered significant attention is the partnership between Tether and Tron. This collaboration has the potential to have far-reaching implications not only for these two projects but also for the wider cryptocurrency market as a whole.

Firstly, it is important to understand the role that Tether plays in the cryptocurrency market. Tether is a type of digital currency known as a stablecoin, which is designed to maintain a stable value by pegging it to a specific fiat currency, such as the US dollar. This stability has made Tether a popular choice for traders and investors as it provides a reliable store of value and a means of transferring funds across different exchanges.

On the other hand, Tron is a blockchain-based platform that aims to revolutionize the entertainment industry. By leveraging blockchain technology, Tron aims to create a decentralized ecosystem that bypasses intermediaries and allows content creators to have direct control over their work. With a strong focus on scalability and speed, Tron has gained a significant following and has positioned itself as a potential competitor to established platforms such as Ethereum.

With the partnership between Tether and Tron, there are several implications that can be explored. Firstly, the integration of Tether’s stablecoin onto the Tron platform could potentially increase the liquidity and accessibility of Tron’s native token, TRX. This could attract more investors and traders to participate in the Tron ecosystem, leading to increased trading volumes and potentially driving up the value of TRX.

Furthermore, the partnership could also have implications for the wider cryptocurrency market. Tether has been a controversial player in the industry, with ongoing concerns about its transparency and whether it holds sufficient reserves to back its circulating supply. The collaboration with Tron could help address some of these concerns, as the increased usage of Tether on the Tron platform may require greater transparency and accountability from both projects. This could have a positive impact on the overall trust and credibility of stablecoins in the market.

In conclusion, the partnership between Tether and Tron has the potential to bring about significant changes in the cryptocurrency market. From increased liquidity and accessibility to addressing concerns about transparency, this collaboration could have far-reaching implications for both projects and the wider industry. As the market continues to evolve, it will be crucial to closely examine these developments and their impact on the ever-changing landscape of cryptocurrencies.

Overview

In recent years, the cryptocurrency market has witnessed the rise of stablecoins, which aim to provide price stability similar to traditional fiat currencies. One of the most popular stablecoins in the market is Tether (USDT), which is pegged to the value of the US dollar. Tether has achieved its significant user base and market capitalization by forming partnerships with various blockchain networks, including Ethereum, Omni, and Tron.

In particular, Tether’s recent partnership with Tron has generated significant interest and speculation in the cryptocurrency community. Tron is a decentralized blockchain platform that focuses on the development and execution of smart contracts and decentralized applications (DApps). By joining forces with Tron, Tether aims to leverage the platform’s robust infrastructure and growing user base.

Through the partnership, Tether aims to expand its capabilities and provide its users with more options for utilizing and transferring their assets. The integration of Tether’s stablecoin into the Tron ecosystem allows for seamless transactions and cross-platform interoperability. This collaboration is expected to enhance the overall liquidity and accessibility of the stablecoin, further solidifying its position as one of the leading cryptocurrencies in the market.

Furthermore, the partnership will also benefit Tron by attracting more users and developers to its platform. As Tether is widely used in the cryptocurrency market, its integration into Tron’s ecosystem will likely attract more institutional investors and traders. This increased adoption will contribute to the Tron network’s overall growth and reputation.

However, it is essential to consider the potential implications of the Tether-Tron partnership on the cryptocurrency market as a whole. Some experts argue that the integration of Tether’s stablecoin into Tron’s ecosystem could lead to increased centralization, as Tether Holdings Limited has faced scrutiny in the past regarding its transparency and reserves. Moreover, any issues or controversies surrounding Tether could also impact the Tron network, potentially affecting its reputation and user trust.

| Pros | Cons |

|---|---|

| – Increased liquidity and accessibility for Tether users | – Potential centralization concerns |

| – Enhanced reputation and growth for Tron | – Tether’s controversies impacting Tron’s reputation |

| – Attracting more institutional investors and traders to Tron |

Impact on Tether’s Role in the Cryptocurrency Market

Tether has long been a dominant player in the cryptocurrency market, with its stablecoin USDT serving as a popular choice among traders and investors. However, its recent partnership with Tron has raised some questions about its role and influence in the market.

Increased Market Presence

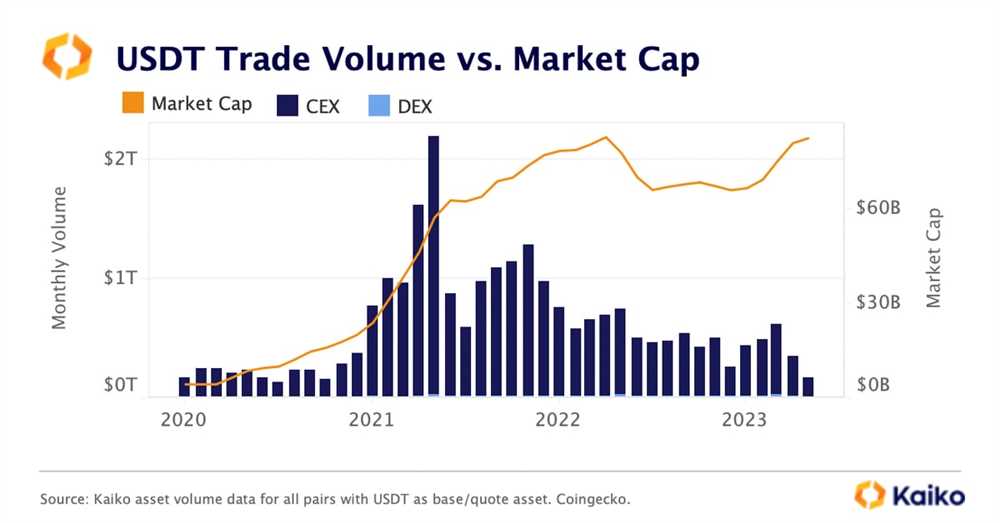

The collaboration between Tether and Tron has expanded the reach and market presence of Tether. With Tron’s large user base and growing ecosystem, Tether’s stablecoin is now available to a wider audience. This increased market presence has solidified Tether’s position as a leading stablecoin in the cryptocurrency market.

Heightened Liquidity

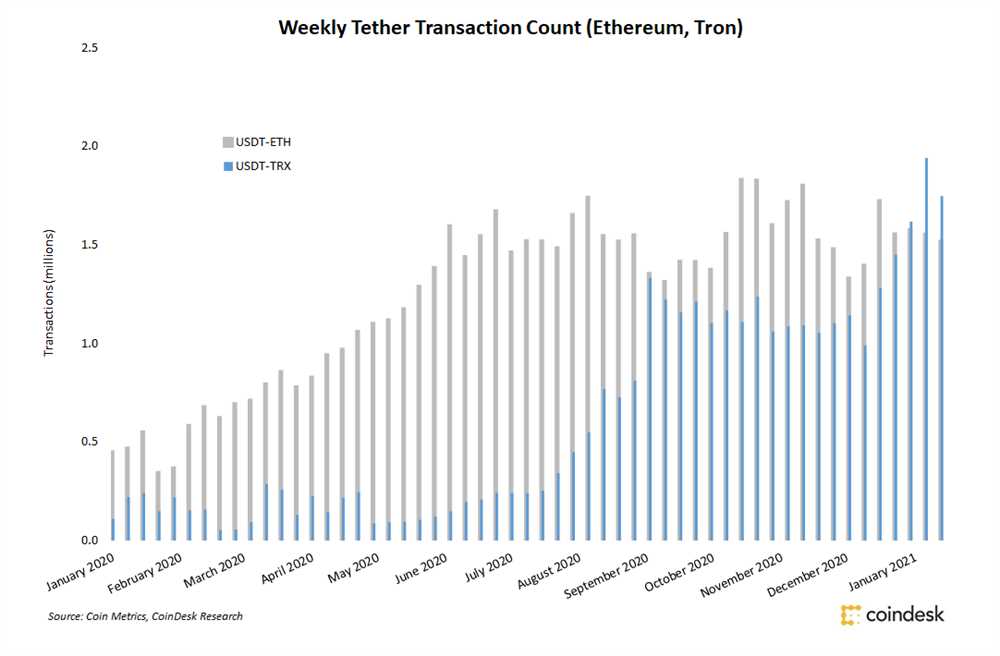

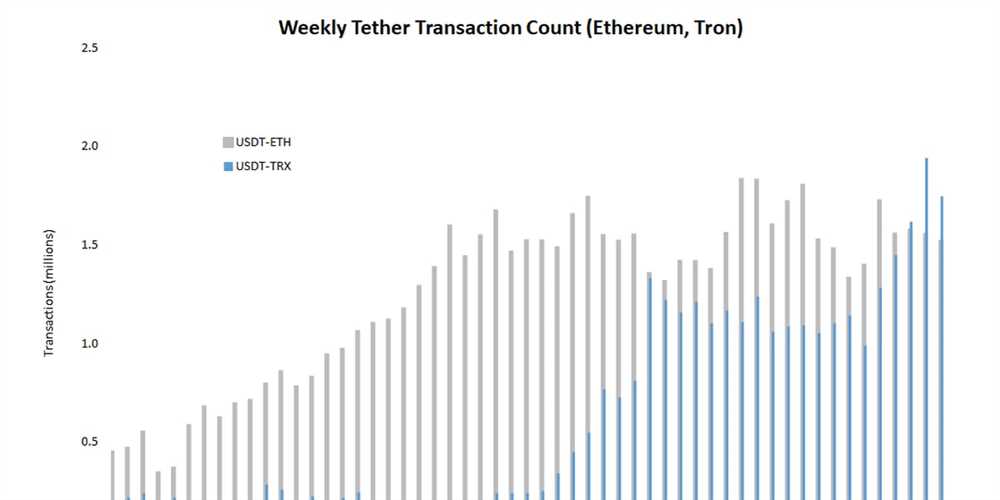

Tether’s partnership with Tron has also resulted in increased liquidity for its stablecoin. Tron’s high transaction volume and active user base have contributed to a more liquid market for Tether, allowing traders to easily convert their cryptocurrencies to USDT and vice versa.

The heightened liquidity of Tether has improved the market efficiency, as traders can quickly enter and exit positions using USDT. This has made Tether a go-to choice for many traders, as it provides a stable and reliable option for parking funds during periods of market volatility.

Moreover, the increased liquidity has also made Tether a preferred stablecoin for decentralized finance (DeFi) applications built on the Tron network. With more liquidity, DeFi platforms can offer better borrowing and lending options, further reinforcing Tether’s role in the crypto market.

Concerns and Regulatory Scrutiny

While Tether’s partnership with Tron has enhanced its role in the cryptocurrency market, it has also raised concerns and attracted regulatory scrutiny. Tether’s relationship with its audit firm and the transparency of its reserves have long been under question, and the Tron partnership has brought this issue to the forefront.

Furthermore, regulatory bodies are closely monitoring Tether’s operations and the potential impact on the stability of the global financial system. The scale and influence of Tether in the cryptocurrency market have raised concerns about its role as a systemic risk and the need for increased oversight and regulation.

Overall, Tether’s partnership with Tron has had a significant impact on its role in the cryptocurrency market. It has strengthened its market presence, increased liquidity, and raised concerns over regulatory scrutiny. As the market evolves, Tether’s role will continue to be a subject of interest and contention among industry players and regulators alike.

Influence on Tron’s Position in the Cryptocurrency Market

The partnership between Tether and Tron has the potential to significantly impact Tron’s position in the cryptocurrency market. Tether is the largest stablecoin by market capitalization and its integration with Tron’s blockchain will bring increased liquidity and stability to the Tron ecosystem.

One of the main implications of this partnership is the ability to easily move value between Tron and the traditional financial system. Tether’s stablecoin, USDT, is widely accepted and recognized as a reliable digital representation of fiat currency. By leveraging this partnership, Tron users will have access to a stable and widely accepted digital asset, which can enhance Tron’s reputation and attract more users to the platform.

Furthermore, the partnership with Tether can also have a positive impact on Tron’s trading volume and market liquidity. Tether’s integration with Tron will enable traders to access a wider range of trading pairs and increase their options for conducting transactions. This increased trading activity can lead to higher liquidity and a more vibrant trading community on the Tron platform.

Additionally, Tether’s presence on the Tron blockchain can also enhance Tron’s overall ecosystem development. Tether’s integration can attract more developers and projects to build on the Tron platform, as they will have access to a stablecoin with a large user base and strong market presence. This can contribute to the growth and expansion of the Tron ecosystem, further solidifying its position in the cryptocurrency market.

Overall, the partnership between Tether and Tron has the potential to significantly enhance Tron’s position in the cryptocurrency market. The increased liquidity, stability, and access to a widely recognized stablecoin can attract more users, increase trading activity, and foster ecosystem development on the Tron platform. As a result, Tron can establish itself as a prominent player in the cryptocurrency market.

Broader Implications for the Cryptocurrency Market

The partnership between Tether and Tron has significant implications for the broader cryptocurrency market. As two major players in the industry, their collaboration is likely to have a ripple effect on other cryptocurrencies and blockchain projects.

One key implication is the potential for increased liquidity in the market. Tether, as a stablecoin, is designed to maintain a value pegged to a fiat currency, typically the US dollar. By partnering with Tron, Tether gains access to Tron’s extensive network and user base, which could lead to a greater demand for Tether and increased liquidity in the cryptocurrency market as a whole.

Another implication is the potential for increased adoption and integration of cryptocurrencies into the mainstream financial system. Tether’s partnership with Tron could facilitate the use of cryptocurrencies as a medium of exchange and store of value, making them more accessible to the general public. This could lead to greater acceptance and adoption of cryptocurrencies by traditional financial institutions and regulators.

Furthermore, the partnership between Tether and Tron could also have implications for regulatory scrutiny and oversight of the cryptocurrency market. As stablecoins like Tether gain more prominence and usage, regulators may intensify their efforts to monitor and regulate such assets. This could have both positive and negative consequences for the market, as increased regulation can provide greater investor protection but may also stifle innovation and growth.

Overall, the partnership between Tether and Tron has the potential to shape the future of the cryptocurrency market. It could lead to increased liquidity, adoption, and regulatory scrutiny, all of which have significant implications for the industry as a whole. As the market continues to evolve, it will be interesting to see how this partnership and others like it impact the trajectory of cryptocurrencies and blockchain technology.

What is Tether’s Tron partnership?

Tether’s Tron partnership refers to the collaboration between the popular stablecoin Tether (USDT) and the blockchain platform Tron (TRX). This partnership allows users to issue and monitor USDT tokens on the Tron blockchain, providing them with greater flexibility and accessibility in using the stablecoin.

How does Tether’s Tron partnership impact the cryptocurrency market?

Tether’s Tron partnership has several implications for the cryptocurrency market. Firstly, it increases the availability and usage of Tether, which is one of the most widely used stablecoins in the industry. This can contribute to increased trading volumes and liquidity in the market. Additionally, the partnership enhances the capabilities of the Tron blockchain by providing it with a stablecoin option, attracting more developers and users to the platform. Overall, the Tether-Tron collaboration has the potential to strengthen the cryptocurrency market as a whole.