Protecting customer data and preventing fraud

At Suncorp, we prioritize the security and privacy of our customers’ information. That’s why we have implemented a robust electronic payment process that ensures the utmost protection for your transactions. With advanced encryption technology and strict authentication protocols, we go above and beyond to safeguard your sensitive data.

Protecting customer data:

Our state-of-the-art encryption technology ensures that your financial information is securely transmitted and stored. We use industry-standard encryption algorithms to protect your data from unauthorized access. From the moment you enter your payment details, you can rest assured that your information remains confidential.

Preventing fraud:

Our dedicated team of security experts constantly monitors and analyzes transaction patterns to detect and prevent fraudulent activities. We use advanced fraud detection tools and machine learning algorithms to stay one step ahead of sophisticated fraudsters. Your safety is our top priority, and we work tirelessly to protect your financial wellbeing.

When it comes to electronic payment security, trust Suncorp to keep your information safe. Relax and enjoy seamless, worry-free transactions with the peace of mind that your data is fully protected.

The Importance of Payment Security

Ensuring the security of electronic payments is crucial for both businesses and customers. In today’s digital age, where transactions are conducted online, it is more important than ever to protect customer data and prevent fraud.

Payment security not only safeguards sensitive information, such as credit card numbers and personal details, but it also helps to build trust and confidence in the payment process. When customers know their data is secure, they are more likely to continue using electronic payment methods and transact with businesses that prioritize their security.

Without strong payment security measures in place, businesses face the risk of data breaches and unauthorized access to customer information. This can lead to financial losses, reputational damage, and legal implications. Furthermore, customers may become reluctant to share their personal and payment details if they do not trust the security measures implemented by a business.

By implementing robust payment security protocols, businesses can protect customer data throughout the entire payment process. Encryption methods and secure data storage ensure that sensitive information is kept safe from cyber threats. Additionally, two-factor authentication adds an extra layer of security, requiring customers to provide a second form of verification before completing a transaction.

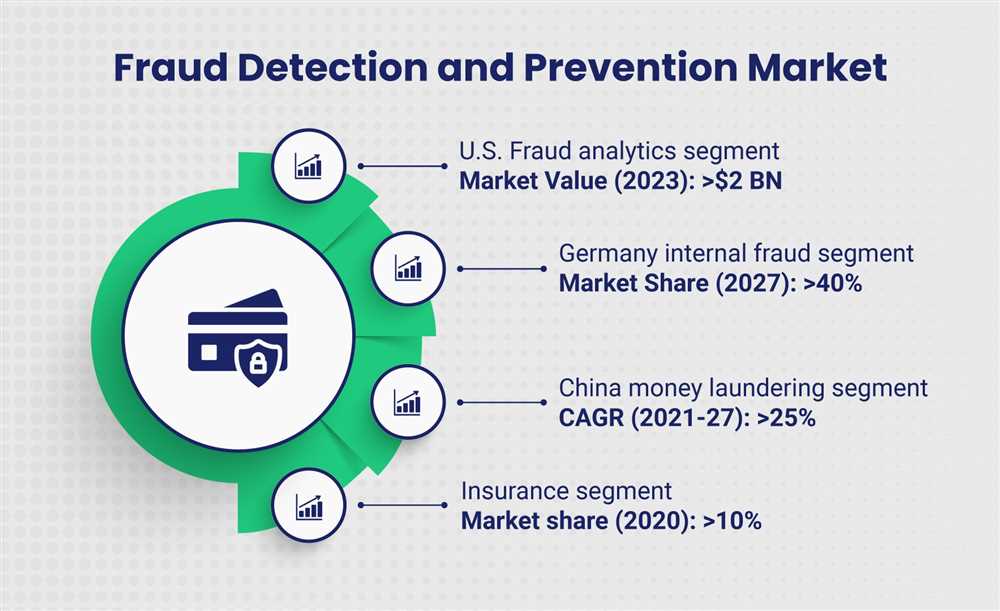

In addition to protecting customer data, payment security also helps to prevent fraudulent activities. Advanced fraud detection systems can identify suspicious transactions and flag them for further investigation. By proactively monitoring and analyzing payment data, businesses can quickly respond to and mitigate potential fraud, ensuring a secure payment ecosystem.

In summary, the importance of payment security cannot be overstated. By prioritizing the protection of customer data and preventing fraud, businesses can maintain trust and confidence in their electronic payment processes. Investing in robust security measures not only safeguards the interests of both businesses and customers, but it also ensures the continued growth and success of a digital economy.

Protecting Customer Data

At Suncorp, we prioritize the security and protection of our customers’ data in every step of the electronic payment process. We understand the importance of safeguarding personal and financial information, and we have implemented robust measures to ensure the utmost privacy and security.

Advanced Encryption Technology

We utilize state-of-the-art encryption technology to ensure that all customer data transmitted during the electronic payment process is securely and confidentially protected. Our systems employ industry-standard encryption protocols that safeguard sensitive information, making it virtually impossible for unauthorized individuals to intercept or decipher.

Secure Data Storage

Customer data is stored in highly secure, restricted-access environments that comply with stringent data protection regulations. Our data centers are equipped with advanced security measures, including multi-layered authentication, digital surveillance systems, and 24/7 monitoring. These measures ensure that customer data remains safe and secure from unauthorized access or theft.

Furthermore, we regularly update and test our security systems to identify and address any potential vulnerabilities or threats promptly. Our dedicated team of security experts actively monitors for any suspicious activities and takes immediate action to prevent fraud or unauthorized access.

Protecting our customers’ data is of paramount importance to us at Suncorp. We continuously strive to stay ahead of emerging threats and maintain the highest level of security and integrity throughout the electronic payment process.

Preventing Fraud in Electronic Payments

With the rise of electronic payments, ensuring security has become a top priority for Suncorp. We understand the importance of protecting our customers’ data and preventing fraud in the payment process.

At Suncorp, we have implemented a range of proactive measures to prevent fraud in electronic payments:

- Multi-factor authentication: We use advanced technologies to verify the identity of our customers, including the use of biometrics, such as fingerprint or facial recognition, along with traditional username and password.

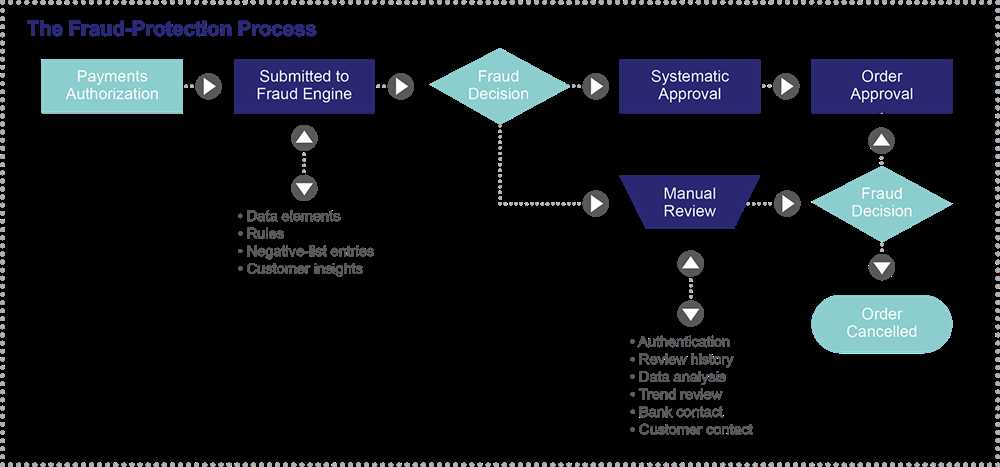

- Transaction monitoring: Our sophisticated monitoring systems constantly analyze transaction patterns and detect any suspicious activities. If any abnormal transaction is detected, our dedicated team immediately investigates and takes appropriate action.

- Encryption: All customer data and sensitive information are encrypted to ensure that it is transmitted securely and cannot be accessed by unauthorized individuals.

- Secure networks: Our payment systems are built on secure networks with industry-standard firewalls and intrusion prevention systems. This helps prevent any unauthorized access or hacking attempts.

- Fraud detection algorithms: We employ advanced algorithms to detect patterns of fraudulent behavior and stop any fraudulent transactions before they are processed.

By implementing these measures, Suncorp ensures that our customers can make electronic payments with confidence, knowing that their data is protected and fraud is actively prevented. We are committed to staying ahead of evolving threats and providing a secure payment environment for our valued customers.

Payment Fraud Risks

When it comes to electronic payments, there are certain risks involved that can lead to payment fraud. It is important for customers and businesses to be aware of these risks and take necessary measures to protect themselves.

Phishing: Phishing is a common tactic used by fraudsters to trick individuals into revealing their personal and financial information. They often disguise themselves as legitimate organizations or individuals, using emails, phone calls, or text messages to deceive unsuspecting victims. It is important to be cautious and never provide sensitive information to unknown sources.

Identity Theft: Identity theft occurs when someone steals another person’s personal information and uses it for fraudulent purposes. This can include stealing credit card details, social security numbers, or other confidential information. Businesses should implement robust security measures to protect customer data and regularly monitor for any suspicious activities.

Card Skimming: Card skimming is a technique used by criminals to capture credit card information during legitimate transactions. They install devices on ATM machines, point-of-sale terminals, or gas pumps that can read and store card data. This information is then used to create counterfeit cards or make unauthorized transactions. Customers should always be vigilant and check for any suspicious devices or activities when using their credit cards.

Malware Attacks: Malware attacks are a common method used by fraudsters to gain unauthorized access to a customer’s financial data. This can include installing malicious software, such as keyloggers or spyware, on a customer’s device to track their keystrokes or capture sensitive information. It is crucial to have up-to-date security software and regularly scan devices for any potential threats.

Account Takeover: Account takeover occurs when a fraudster gains unauthorized access to a customer’s account and takes control of it. This can happen through various means, such as weak passwords, phishing attacks, or social engineering tactics. Businesses should implement strong authentication protocols and regularly monitor for any suspicious activities to prevent account takeovers.

At Suncorp, we understand the importance of ensuring security in the electronic payment process. We have implemented robust security measures to protect customer data and prevent payment fraud. By staying informed about the risks and taking necessary precautions, together we can create a safer and more secure payment ecosystem.

Security Measures for Suncorp Electronic Payments

At Suncorp, we understand the importance of ensuring the security of our customers’ electronic payments. That’s why we have implemented a number of robust security measures to protect customer data and prevent fraud.

One of the primary ways we ensure security is through encryption. All customer data transmitted during the electronic payment process is encrypted using industry-standard encryption algorithms. This ensures that sensitive information is kept secure and cannot be intercepted by unauthorized individuals.

In addition to encryption, we also employ strict access controls and utilize multi-factor authentication. This means that only authorized personnel have access to customer data, and any attempts to access the system require multiple forms of verification. This helps to prevent unauthorized access and further safeguards customer information.

To further enhance security, we regularly monitor our systems for any suspicious activity or anomalies. This allows us to identify and respond to potential threats in real-time, minimizing the risk of fraud and ensuring the ongoing protection of our customers’ data.

Furthermore, we have implemented robust fraud detection and prevention measures. Our systems employ advanced machine learning algorithms to analyze patterns and detect any fraudulent activity. If any suspicious transactions are identified, our dedicated fraud prevention team takes immediate action to investigate and resolve the issue.

We also maintain ongoing relationships with industry-leading security firms to stay updated on the latest threats and best practices. This allows us to continuously improve our security measures and stay one step ahead of potential attackers.

At Suncorp, the security of our customers’ electronic payments is our top priority. We are committed to providing a secure and trusted platform that our customers can rely on for their financial transactions. Rest assured that when you choose Suncorp, you are choosing a company that is dedicated to protecting your data and preventing fraud.

Advanced Encryption Techniques

At Suncorp, we take the security of our electronic payment process very seriously. To ensure the protection of customer data and prevent fraud, we implement advanced encryption techniques.

End-to-End Encryption

End-to-end encryption is a vital component of our security measures. This technique ensures that sensitive customer information, such as payment details and personal data, is securely transmitted from the customer’s device to our secure servers. By encrypting the data at the source and decrypting it only at the destination, we prevent unauthorized access and ensure that customer information remains confidential.

Strong Encryption Algorithms

To further enhance the security of our electronic payment process, we utilize strong encryption algorithms. These algorithms scramble the data in such a way that it is virtually impossible for unauthorized individuals to decode it. By employing these robust encryption techniques, we make it incredibly difficult for hackers and fraudsters to intercept and manipulate the sensitive data transferred during the payment process.

By investing in and integrating these advanced encryption techniques into our electronic payment process, Suncorp provides our customers with the peace of mind that their data is protected from potential threats and risks. We are committed to maintaining the highest standards of security and continuously updating our encryption measures to stay ahead of evolving cybersecurity challenges. Trust Suncorp for secure and reliable electronic payments.

Why is ensuring security in the electronic payment process important?

Ensuring security in the electronic payment process is important because it helps protect customer data from being compromised and prevents fraud. It is essential to safeguard sensitive information, such as credit card numbers and personal details, to maintain customer trust and confidence in the payment system.

How does Suncorp ensure the security of its electronic payment process?

Suncorp employs various security measures to ensure the security of its electronic payment process. These measures include encryption techniques to protect customer data during transmission, strict access controls to prevent unauthorized access, regular security audits and testing, and dedicated fraud detection systems to identify and prevent fraudulent transactions.

What steps does Suncorp take to protect customer data?

Suncorp takes several steps to protect customer data. This includes implementing industry-standard encryption protocols to protect data during transmission, storing customer information in secure databases with restricted access, regularly updating and patching security systems, and educating employees on best security practices to prevent data breaches.

How does Suncorp prevent fraud in its electronic payment process?

Suncorp employs various measures to prevent fraud in its electronic payment process. This includes using advanced fraud detection systems that analyze transaction patterns and identify suspicious activity, implementing multi-factor authentication for high-risk transactions, conducting regular monitoring and analysis of payment data, and collaborating with law enforcement agencies to investigate and prosecute fraudulent activities.

What happens if there is a security breach in the Suncorp electronic payment process?

If there is a security breach in the Suncorp electronic payment process, the company has a proactive incident response plan in place. This includes notifying affected customers, conducting a thorough investigation to determine the cause and extent of the breach, implementing necessary security measures to prevent further breaches, and cooperating with relevant authorities and regulators to mitigate the impact and ensure the security of customer data.