Are you looking for a futuristic and innovative cryptocurrency to invest in? Look no further than Tron! With its groundbreaking technology and growing popularity, Tron offers unique opportunities for investors. However, before diving into the world of Tron, it’s essential to understand the benefits and risks associated with this investment.

Benefits

One of the significant advantages of investing in Tron is its potential for massive returns. Tron has experienced significant growth in recent years, making it an attractive investment option for many. Additionally, Tron’s blockchain technology allows for fast and secure transactions, making it a reliable choice for those seeking efficiency.

Another benefit of Tron is its focus on decentralized applications (DApps). Tron’s platform supports a wide range of DApps, which opens up avenues for innovation and development in various industries. This focus on DApps sets Tron apart from other cryptocurrencies, making it a promising long-term investment.

Risks

Like any investment, Tron is not without its risks. One of the primary concerns is regulatory uncertainty. The cryptocurrency landscape is constantly evolving, and new regulations can significantly impact Tron’s value and legality in different jurisdictions.

Furthermore, Tron faces competition from other cryptocurrencies and blockchain platforms. While Tron has shown promise, it’s crucial to consider the potential threats from established and emerging players in the market.

Lastly, investing in Tron requires careful research and analysis. Cryptocurrencies are highly volatile, and their value can fluctuate rapidly. It’s vital to stay informed and make informed decisions when investing in Tron.

In conclusion, investing in Tron offers exciting opportunities and potential rewards. However, it’s crucial to understand the benefits and risks associated with this investment. By being aware of the potential pitfalls and doing thorough research, you can make an informed decision and maximize your chances of success when investing in Tron.

The Benefits and Risks of Investing in Tron

Tron is a cryptocurrency that has gained a lot of attention in recent years. It is a decentralized platform that aims to create a global digital content entertainment system using blockchain technology. While investing in Tron may seem like a lucrative opportunity, it is important to consider the benefits and risks before making a decision.

Benefits of Investing in Tron

1. Potential for High Returns: Tron has experienced significant growth since its inception, and many investors have seen substantial gains. The cryptocurrency market is known for its volatility, but Tron’s potential to deliver high returns makes it an attractive investment option for some.

2. Strong Development Team: Tron was founded by Justin Sun, a prominent figure in the blockchain industry. Sun and his team have a vision to revolutionize the entertainment industry, and they have made significant progress in achieving their goals. Their dedication and expertise make Tron a promising investment.

3. Wide Adoption: Tron has gained significant traction and has partnered with several high-profile companies and projects. These partnerships increase the platform’s visibility and potential for growth, making it an appealing investment opportunity.

Risks of Investing in Tron

1. Market Volatility: As with any cryptocurrency, Tron is subject to market fluctuations. The value of Tron can be unpredictable, leading to potential losses for investors. It is essential to be aware of the risks associated with investing in a volatile market.

2. Regulatory Uncertainty: The cryptocurrency market is still largely unregulated in many countries. This lack of regulation creates uncertainty and can lead to legal and regulatory challenges for Tron and its investors. It is important to stay informed about the legal and regulatory environment surrounding cryptocurrencies.

3. Competition: Tron operates in a highly competitive market, with many other blockchain platforms vying for dominance. The success of Tron will depend on its ability to differentiate itself from its competitors and gain widespread adoption. Investors should carefully consider the competitive landscape before investing in Tron.

In conclusion, investing in Tron offers the potential for high returns, driven by a strong development team and wide adoption. However, it is crucial to be aware of the market volatility, regulatory uncertainty, and competition that come with investing in Tron. It is recommended that investors conduct thorough research and consult with financial professionals before making any investment decisions.

Potential for High Returns

One of the most enticing aspects of investing in Tron is the potential for high returns. Tron is a blockchain-based platform that aims to revolutionize the entertainment industry by decentralizing content distribution and empowering content creators.

Tron’s native cryptocurrency, TRX, has shown significant growth since its launch, making it an attractive investment option. With its extensive partnerships and collaborations with big-name companies, Tron has been able to create a strong ecosystem that supports the growth of its cryptocurrency.

Investing in Tron offers the opportunity to take advantage of the platform’s continued development and expansion. As more users and companies adopt Tron’s technology, the demand for TRX is likely to increase, potentially driving up its value.

However, it is important to note that investing in cryptocurrencies, including Tron, carries inherent risks. The cryptocurrency market is highly volatile, and prices can fluctuate rapidly. While the potential for high returns exists, there is also the possibility of significant losses.

It is crucial for investors to carefully research and consider their risk tolerance and financial situation before investing in Tron or any other cryptocurrencies. The potential for high returns should be balanced with an understanding of the potential risks involved.

Volatility and Market Fluctuations

When considering investing in Tron, one of the important factors to take into account is the volatility of the cryptocurrency market and the fluctuations it experiences. The value of Tron can change rapidly, sometimes within a matter of minutes or even seconds. This can be both a benefit and a risk.

On one hand, the volatility of Tron presents an opportunity for investors to make significant profits. If you can accurately predict and take advantage of price movements, you could potentially make substantial gains. Tron has experienced several instances of rapid price increases in the past, attracting the attention of both seasoned traders and newcomers to the market.

However, the flip side to volatility is the risk it poses. The cryptocurrency market is known for its unpredictability, and investing in Tron comes with the inherent risk of losing money. With price fluctuations happening frequently, it’s possible to experience significant losses if the market turns against you. It’s crucial to be aware of this before making any investment decisions.

The Role of Market Fluctuations

Market fluctuations play a major role in the volatility of Tron and other cryptocurrencies. These fluctuations can be triggered by various factors, such as changes in government regulations, global economic conditions, or even social media trends. Any news or events that impact the overall sentiment towards cryptocurrencies can lead to rapid shifts in prices.

It’s important for investors to stay informed about the latest market developments and trends. Monitoring news sources, following cryptocurrency influencers, and participating in online communities can help you gain insights into potential market fluctuations. Additionally, it’s crucial to have a solid risk management strategy in place to mitigate the potential impact of market volatility.

Diversification and Risk Mitigation

One approach to managing the risks associated with volatility and market fluctuations is diversification. Spreading your investments across different cryptocurrencies or asset classes can help reduce the impact of any single event or price movement. By investing in a diverse range of assets, you can potentially mitigate losses if one investment underperforms.

It’s also important to have a long-term perspective when investing in Tron. Cryptocurrency markets can be highly volatile in the short term, but historical data suggests that they have the potential for significant growth over the long term. By holding onto your investments and weathering the ups and downs of the market, you may increase your chances of realizing substantial returns.

Overall, volatility and market fluctuations are key considerations when investing in Tron. While they present opportunities for profit, they also come with inherent risks. It’s essential to stay informed, have a risk management strategy in place, and consider diversification to mitigate potential losses.

Regulatory and Legal Challenges

While investing in Tron can offer many potential benefits, it is important to also consider the regulatory and legal challenges that may arise. These challenges can have a significant impact on the success and profitability of your investment.

One of the main regulatory challenges facing Tron investors is the lack of clear and consistent regulations in many jurisdictions. Cryptocurrencies, including Tron, are a relatively new asset class, and governments around the world are still grappling with how to regulate them effectively. This lack of clarity can create uncertainty and can make it difficult for investors to navigate the legal landscape.

Another challenge is the potential for increased regulation in the future. As cryptocurrencies become more popular and widely adopted, governments may seek to impose stricter regulations to protect investors and prevent illicit activities such as money laundering and fraud. These regulations could include stricter KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements, which may add additional burdens and costs for Tron investors.

Furthermore, the legal challenges surrounding Tron involve intellectual property rights. Tron is an open-source decentralized platform that allows developers to create and deploy smart contracts and decentralized applications (DApps). However, this open nature can also lead to legal disputes over ownership and infringement of intellectual property rights. Investors need to be aware of these potential legal challenges and the risks they may pose to their investments.

It is crucial for Tron investors to stay informed about the regulatory and legal developments in the jurisdictions they operate in. This includes understanding the existing regulations, keeping up with any proposed changes, and ensuring compliance with all applicable laws. Seeking legal and regulatory guidance from professionals with expertise in cryptocurrency and blockchain can also help investors navigate these challenges and ensure their investments are in compliance with the law.

By being aware of and addressing the regulatory and legal challenges surrounding Tron, investors can better protect their investments and mitigate potential risks. While these challenges may pose obstacles, they should not discourage individuals from exploring the opportunities that Tron and the wider cryptocurrency market offer.

| Benefits | Risks |

|---|---|

| High potential for growth and profitability | Volatility and price fluctuations |

| Access to a decentralized and transparent ecosystem | Regulatory and legal challenges |

| Opportunity to participate in the future of finance | Lack of mainstream adoption |

| Diversification of investment portfolio | Security vulnerabilities |

What is Tron?

Tron is a blockchain-based platform that aims to build a decentralized internet.

What are the benefits of investing in Tron?

Investing in Tron offers several benefits. Firstly, it provides an opportunity to support the development of a decentralized internet. Additionally, Tron has a growing user base and a dedicated community, which can contribute to the potential value appreciation of the Tron cryptocurrency. Furthermore, Tron offers various applications and services, such as decentralized finance (DeFi) and gaming. These applications can provide additional opportunities for investors.

What are the risks of investing in Tron?

Investing in Tron carries certain risks. Firstly, the cryptocurrency market is highly volatile, and the value of Tron can fluctuate significantly. There is also the risk of regulatory uncertainty, as governments around the world continue to develop their stance on cryptocurrencies. Tron may also face competition from other blockchain platforms, which could affect its long-term viability. Additionally, investing in Tron requires careful research and analysis, as well as a thorough understanding of the technology and market dynamics.

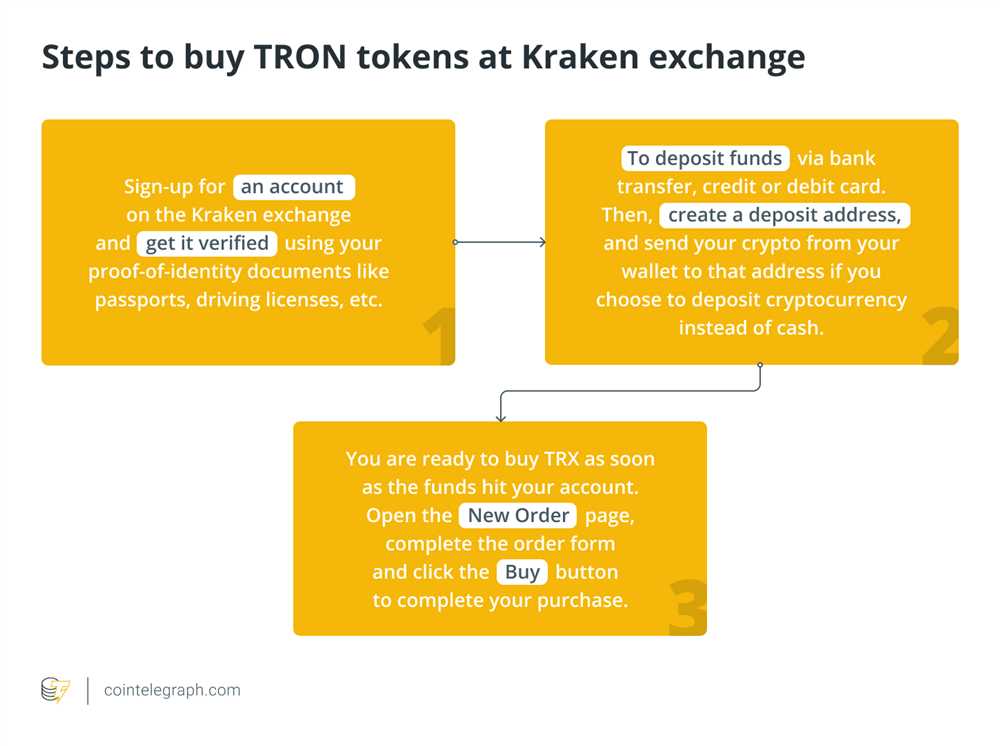

How can I invest in Tron?

Investing in Tron can be done through various cryptocurrency exchanges. First, you would need to create an account on a reputable exchange that supports Tron. Then, you can deposit funds into your account and use them to purchase Tron tokens. It is important to note that cryptocurrency investments carry risks, so it is advisable to only invest what you can afford to lose and to do thorough research before making any investment decisions.