Cryptocurrencies have taken the world by storm, revolutionizing the way we think about money and transactions. One of the most dynamic and rapidly evolving sectors within the cryptocurrency industry is the world of Bitcoin and its related technologies. As the popularity of Bitcoin and other cryptocurrencies continues to grow, so does the need for reliable and up-to-date information to navigate this complex market.

In this article, we will take a closer look at the latest trends in the cryptocurrency world, with a specific focus on BTT (BitTorrent Token). BTT is a cryptocurrency that operates on the TRON blockchain and is designed to optimize the way content is shared online. With its unique approach to incentivizing content creators and consumers, BTT has gained significant attention in recent months.

One of the trends that we will explore is the increasing use of BTT as a method of payment within the BitTorrent ecosystem. Content creators can now receive BTT as compensation for their work, providing them with a decentralized and secure form of payment. This trend is not only transforming the way content is produced and consumed, but also offers exciting opportunities for aspiring artists and entrepreneurs to monetize their creations.

Furthermore, we will analyze the impact of BTT on the broader cryptocurrency market. As more users adopt BTT and the demand for the token increases, we can expect to see significant price movements and market volatility. Understanding these trends is essential for investors and traders looking to capitalize on the opportunities presented by BTT and cryptocurrencies in general.

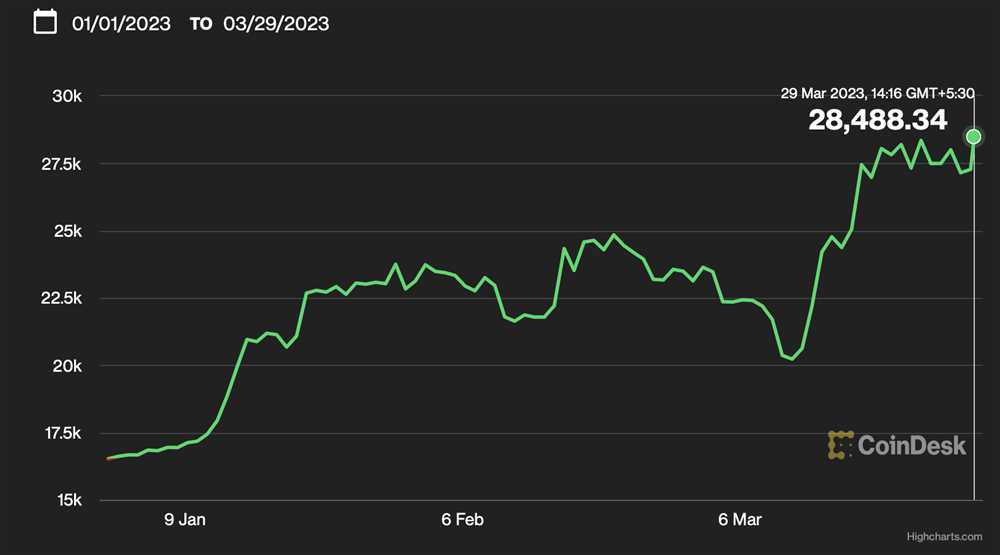

BTT CoinDesk

BTT CoinDesk provides in-depth analysis and coverage of the latest trends in the cryptocurrency world. Whether you are a seasoned investor or just getting started, BTT CoinDesk offers valuable insights and news to help you navigate the ever-changing landscape of cryptocurrencies.

At BTT CoinDesk, we believe in providing accurate and reliable information to our readers. Our team of expert analysts and journalists brings you the most up-to-date market data and trends, helping you make informed decisions about your cryptocurrency investments.

Our coverage includes a wide range of topics, including the latest developments in blockchain technology, regulatory updates, market analysis, and interviews with industry leaders. We aim to provide a comprehensive view of the cryptocurrency market, giving our readers a deeper understanding of this rapidly growing industry.

Whether you’re interested in Bitcoin, Ethereum, Ripple, or any other cryptocurrency, BTT CoinDesk is your go-to source for all things crypto. From in-depth articles to insightful opinion pieces, we strive to keep our readers informed and engaged.

Join us at BTT CoinDesk and stay ahead of the curve in the world of digital currencies. Sign up for our newsletter to receive weekly updates and exclusive content straight to your inbox. Don’t miss out on the latest trends and opportunities in the cryptocurrency world – subscribe to BTT CoinDesk today!

Latest Trends in the Cryptocurrency World

The cryptocurrency world is constantly evolving, with new trends emerging and shaping the industry. Here are some of the latest trends that are making waves:

Rise of Decentralized Finance (DeFi)

DeFi has become one of the fastest-growing trends in the cryptocurrency world. It refers to the use of blockchain technology and smart contracts to recreate traditional financial systems in a decentralized manner. With DeFi, individuals can access financial services, such as lending, borrowing, and trading, without relying on intermediaries like banks. This trend has gained significant popularity due to its potential for democratizing finance and providing equal opportunities to individuals around the world.

NFTs and Digital Art

Non-fungible tokens (NFTs) have taken the world by storm, especially in the art and collectibles space. NFTs represent unique digital assets, such as artwork, music, or virtual real estate, that can be bought, sold, and owned by individuals. The digital art market has experienced a surge in interest, with artists and creators leveraging NFTs to monetize their work. This trend has sparked a new era of digital ownership and has opened up new revenue streams for artists.

Emergence of Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies (CBDCs) are digital forms of fiat currencies issued and regulated by central banks. They aim to provide a secure and efficient means of payment while leveraging the benefits of blockchain technology. Several countries, such as China and Sweden, have already started pilot programs to explore the implementation of CBDCs. This trend has the potential to reshape the global financial system, as it offers governments more control over monetary policies and can enhance financial inclusion.

Integration of Cryptocurrency in Traditional Financial Institutions

Traditional financial institutions, including banks and investment firms, are increasingly embracing cryptocurrencies. Major players like PayPal, Square, and Tesla have started accepting cryptocurrencies as a form of payment, signaling the growing adoption of digital currencies. Additionally, institutional investors are entering the cryptocurrency market, driving up the demand and liquidity. This trend indicates a shift towards mainstream acceptance of cryptocurrencies and paves the way for their integration into existing financial infrastructure.

With the cryptocurrency world constantly evolving, it is crucial to stay updated with the latest trends. These trends mentioned here represent just a glimpse into the exciting developments in the industry, and it will be fascinating to see how they continue to shape the future of finance.

Analyzing the Current Market Situation

The cryptocurrency market is constantly evolving and experiencing various fluctuations. It is important to stay up-to-date with the current trends and analyze the market situation in order to make informed decisions.

Market Volatility

One key aspect of the current market situation is its high level of volatility. Cryptocurrencies are known for their price swings, and this volatility can present opportunities for traders and investors. However, it also increases the risk factor, as prices can change rapidly in a short amount of time.

Market Capitalization

The market capitalization of cryptocurrencies is another important factor to consider when analyzing the current market situation. Market capitalization is the total value of all coins in circulation, and it can be an indicator of the overall health and popularity of a particular cryptocurrency. Traders and investors often look at market capitalization to gauge the potential growth and stability of a cryptocurrency.

Trends and Momentum

Analyzing current trends and momentum is also crucial for understanding the market situation. It is important to look at the trading volume, price movements, and overall sentiment in the market. By analyzing these factors, traders and investors can identify potential opportunities and make well-informed decisions.

Market News and Regulations

Keeping track of market news and regulations is essential for understanding the current market situation. Governments and regulatory bodies around the world are continuously discussing and implementing regulations for cryptocurrencies. Any news or developments in this area can have a significant impact on the market. Additionally, news about partnerships, technological advancements, and market adoption can also influence the market situation.

In conclusion, analyzing the current market situation in the cryptocurrency world requires a comprehensive understanding of various factors such as market volatility, market capitalization, trends and momentum, and market news and regulations. By staying informed and conducting thorough analysis, traders and investors can make better decisions and navigate the ever-changing cryptocurrency market.

Key Factors Affecting Cryptocurrency Prices

The price of cryptocurrencies can be influenced by a variety of factors. Understanding these key factors is essential for investors and traders in the cryptocurrency market. Here are some of the main factors that can affect cryptocurrency prices:

1. Demand and Supply

Similar to traditional markets, demand and supply play a crucial role in determining the price of cryptocurrencies. If there is a high demand for a particular cryptocurrency and the supply is limited, the price is likely to increase. Conversely, if there is a low demand and a large supply, the price may decline.

2. Market Sentiment

The overall sentiment towards cryptocurrencies can impact their prices. Positive news, such as regulatory support or new partnerships, can boost market sentiment and drive prices up. On the other hand, negative news, such as regulatory crackdowns or security breaches, can lead to a decline in prices.

3. Market Liquidity

The liquidity of a cryptocurrency market can also affect its price. A highly liquid market allows for easy buying and selling, which can lead to higher price stability. Conversely, illiquid markets can experience sharp price fluctuations, making them more volatile.

4. Regulatory Environment

Government regulations can significantly impact cryptocurrency prices. Positive regulations, such as recognizing cryptocurrencies as legal tender, can increase investor confidence and drive prices up. Conversely, strict regulations or bans can lead to a decline in prices as it creates uncertainty and limits market participation.

5. Technological Developments

Technological advancements and new developments within the cryptocurrency ecosystem can impact prices. For example, the introduction of a new feature or technology that enhances security, scalability, or functionality can lead to increased investor interest and higher prices.

6. Global Economic Conditions

The overall state of the global economy can also affect cryptocurrency prices. During periods of economic uncertainty or volatility, investors may view cryptocurrencies as alternative investments and flock to them, driving up prices. Similarly, a strong global economy can lead to increased disposable income and investor confidence, which can also have a positive impact on cryptocurrency prices.

These are some of the key factors that can affect cryptocurrency prices. It’s important to keep in mind that the cryptocurrency market is highly speculative and volatile, and prices can be influenced by a multitude of factors beyond those mentioned here. Conducting thorough research and staying updated with the latest market trends and news is essential for any cryptocurrency investor or trader.

The Influence of Regulations on Crypto Adoption

The growth and adoption of cryptocurrencies have been significantly impacted by regulations implemented by governments around the world. While regulations aim to protect investors and prevent illegal activities, they can also hinder the widespread use of cryptocurrencies.

One of the main challenges with crypto adoption is the lack of clear regulatory frameworks. Many governments are still in the process of developing regulatory guidelines for cryptocurrencies, which creates uncertainty for businesses and individuals looking to invest or use cryptocurrencies.

Regulations also vary greatly from country to country, making it difficult for global crypto adoption. Some countries have embraced cryptocurrencies and created favorable regulatory environments, encouraging innovation and investments in the crypto space. On the other hand, some countries have imposed strict regulations or outright bans on cryptocurrencies, stifling their adoption.

Furthermore, regulations can significantly impact the ease of onboarding new users to the crypto ecosystem. KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations require individuals to go through extensive verification processes, which can be time-consuming and discouraging for potential crypto users.

However, regulations also play a crucial role in building trust and credibility in the crypto industry. By implementing regulations, governments can protect investors from scams and fraudulent activities, which can ultimately lead to greater adoption of cryptocurrencies.

Overall, regulations have both positive and negative impacts on the adoption of cryptocurrencies. While they can provide a framework for trust and security, they can also create barriers and uncertainty for businesses and individuals. Striking a balance between regulation and innovation is crucial for the healthy growth of the crypto industry.

How Government Policies Shape the Industry

Government policies play a crucial role in the development and growth of the cryptocurrency industry. The regulatory framework established by governments can either foster innovation and adoption or hinder its progress. Here are some ways government policies shape the industry:

| Policy | Impact |

|---|---|

| Legal Recognition | Government recognition of cryptocurrencies as a legal form of currency or an asset class gives legitimacy to the industry. It helps build trust and encourages more individuals and businesses to participate. |

| Licensing and Registration | Requiring cryptocurrency businesses to obtain licenses and register with regulatory authorities helps prevent fraud, money laundering, and other illegal activities. It ensures that businesses operate in a compliant and transparent manner. |

| Taxation | Government policies on how cryptocurrencies are taxed can impact their use and adoption. Favorable tax regulations can attract investment and encourage economic activity, while excessive taxation can discourage participation. |

| Consumer Protection | Government regulations can help protect consumers from scams, fraud, and security breaches. By establishing rules and standards for exchanges, wallets, and other service providers, governments can foster trust and confidence in the industry. |

| International Cooperation | Cryptocurrencies are a global phenomenon, and government policies need to be coordinated internationally. Collaborative efforts and agreements between governments can help address cross-border regulatory challenges and promote the industry’s growth. |

Overall, government policies have a significant impact on the cryptocurrency industry. It is crucial for governments to strike the right balance between promoting innovation and protecting consumers and the overall financial system.

What are some of the latest trends in the cryptocurrency world?

Some of the latest trends in the cryptocurrency world include the rise of decentralized finance (DeFi), the growth of non-fungible tokens (NFTs), and the increasing acceptance of cryptocurrencies by institutional investors.

How has decentralized finance (DeFi) impacted the cryptocurrency industry?

Decentralized finance (DeFi) has had a major impact on the cryptocurrency industry by offering users the ability to engage in financial activities without the need for intermediaries. DeFi platforms, such as decentralized exchanges and lending protocols, have seen significant growth and are transforming the way people interact with and use cryptocurrencies.

What are non-fungible tokens (NFTs) and why are they gaining popularity?

Non-fungible tokens (NFTs) are unique digital assets that represent ownership or proof of authenticity of a particular item, such as artwork, collectibles, or virtual real estate. They are gaining popularity because they allow for the creation and trade of digital assets in a transparent and secure manner, opening up new possibilities for artists, creators, and collectors.