As the popularity of cryptocurrencies continues to rise, more and more investors are turning to staking platforms as a way to earn passive income. Staking involves holding a certain amount of a cryptocurrency in a digital wallet to support the functionality of the network. In return, stakers are rewarded with additional tokens.

Tronstaking has emerged as one of the leading staking platforms in the crypto space. With its high transaction speed and low fees, Tronstaking offers a convenient and efficient way for investors to participate in proof-of-stake (PoS) consensus. However, it is important to understand how Tronstaking compares to other staking platforms in terms of rewards and risks.

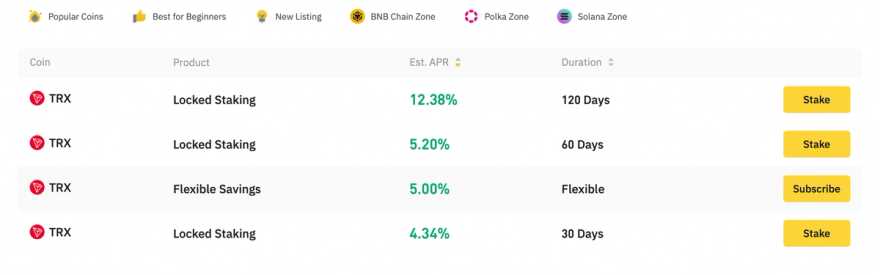

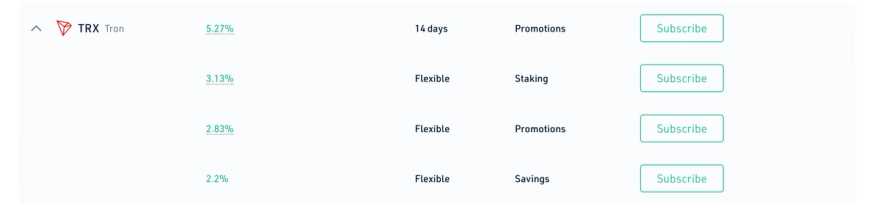

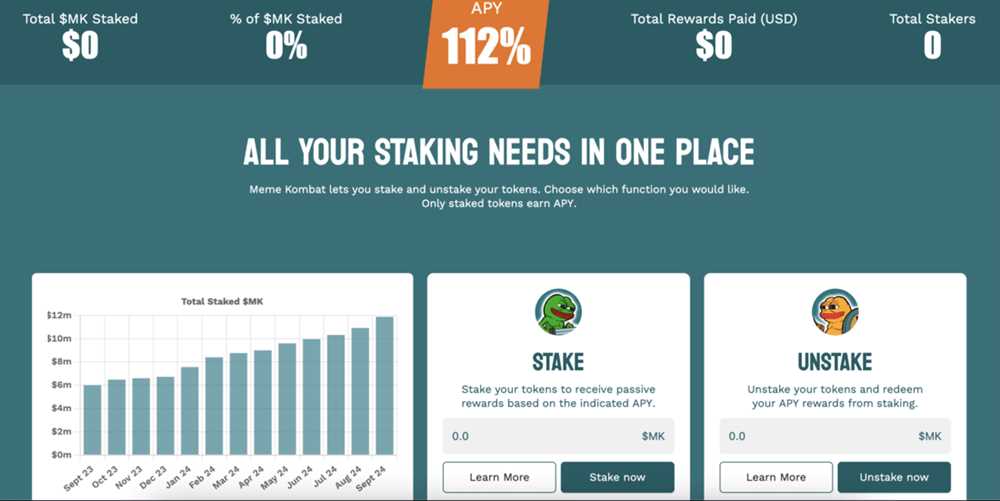

One of the key factors that sets Tronstaking apart from other platforms is its attractive reward structure. Tronstaking offers a competitive annual percentage yield (APY), allowing stakers to earn a substantial return on their investment. This high APY can be attributed to the growing popularity of the Tron ecosystem and the increasing number of transactions on its network.

While Tronstaking offers lucrative rewards, it is essential for investors to consider the potential risks involved. Like any investment, staking comes with its own set of risks, including the volatility of the cryptocurrency market. The value of the staked tokens can fluctuate, potentially resulting in a loss of investment. Additionally, there is always the risk of technical glitches or security breaches that could compromise the staked funds.

In conclusion, Tronstaking presents a compelling option for investors looking to earn passive income through staking. With its attractive rewards and efficient network, Tronstaking stands out among other staking platforms. However, it is crucial for investors to carefully assess the risks involved and make informed decisions based on their individual financial goals and risk tolerance.

Tronstaking Platforms

Tronstaking platforms are online platforms that allow users to stake their TRX (Tron) tokens and earn rewards in return. These platforms are built on the Tron blockchain and provide a secure and decentralized way to stake TRX.

One of the main advantages of Tronstaking platforms is the high level of rewards they offer. By staking TRX, users can earn additional TRX tokens as rewards. The exact reward rate may vary depending on the platform and the type of TRX staking option chosen.

Another advantage of Tronstaking platforms is the flexibility they provide. Users can choose various staking options, such as short-term or long-term staking, depending on their preferences and investment goals. Some platforms also offer additional features, such as the ability to vote on Tron network proposals and participate in decision-making processes.

Tronstaking platforms also have their risks. One of the major risks is the potential for hacking and security breaches. While these platforms implement various security measures, there is always a possibility of a vulnerability being exploited, leading to loss of funds.

It is also important to consider the volatility of the cryptocurrency market. The value of TRX tokens can fluctuate greatly, which means that the rewards earned through Tronstaking may vary in value over time. Users should be aware of this risk and consider their tolerance for volatility before staking their TRX.

To mitigate these risks, it is advisable to choose reputable and reliable Tronstaking platforms. It is also important to keep track of the platform’s security measures and any updates or improvements that are implemented.

In conclusion, Tronstaking platforms offer a lucrative opportunity for TRX holders to earn additional tokens as rewards. However, users should also be aware of the risks involved and take necessary precautions to ensure the security of their funds.

Overview of Rewards and Risks

Tronstaking and other staking platforms offer opportunities for investors to earn rewards on their digital assets. However, with these rewards come certain risks that investors should be aware of.

When it comes to rewards, Tronstaking has several advantages. Users can earn TRX tokens as rewards for staking their TRX coins, providing an incentive for long-term investment. Additionally, Tronstaking offers higher annual percentage yields (APY) compared to other staking platforms, making it an attractive option for investors looking to maximize their returns.

However, it’s important to note that there are also risks involved in staking on Tronstaking or other platforms. One of the main risks is the potential for loss of funds. Staked assets are not as liquid as non-staked assets, meaning that investors may not be able to easily access or sell their coins if they need to. This lack of liquidity can be a disadvantage in volatile markets or in the event of emergencies.

Another risk to consider is the potential for technical issues or security breaches. Staking platforms rely on sophisticated technology and security measures to protect users’ funds, but there is always a risk of system failures or hacking attempts. Investors should carefully research the platform they choose and consider the security measures in place.

Lastly, it’s important to be aware of the potential for regulatory changes. The cryptocurrency industry is still largely unregulated, and governments around the world are continuously developing new regulations. These regulatory changes could impact the rewards and risks associated with staking, so it’s important for investors to stay informed and adapt to any changes that may occur.

In conclusion, Tronstaking and other staking platforms offer rewards in the form of staking rewards and higher APY, but they also come with risks such as potential loss of funds, technical issues, and regulatory changes. It’s important for investors to carefully consider these risks and rewards before participating in staking activities.

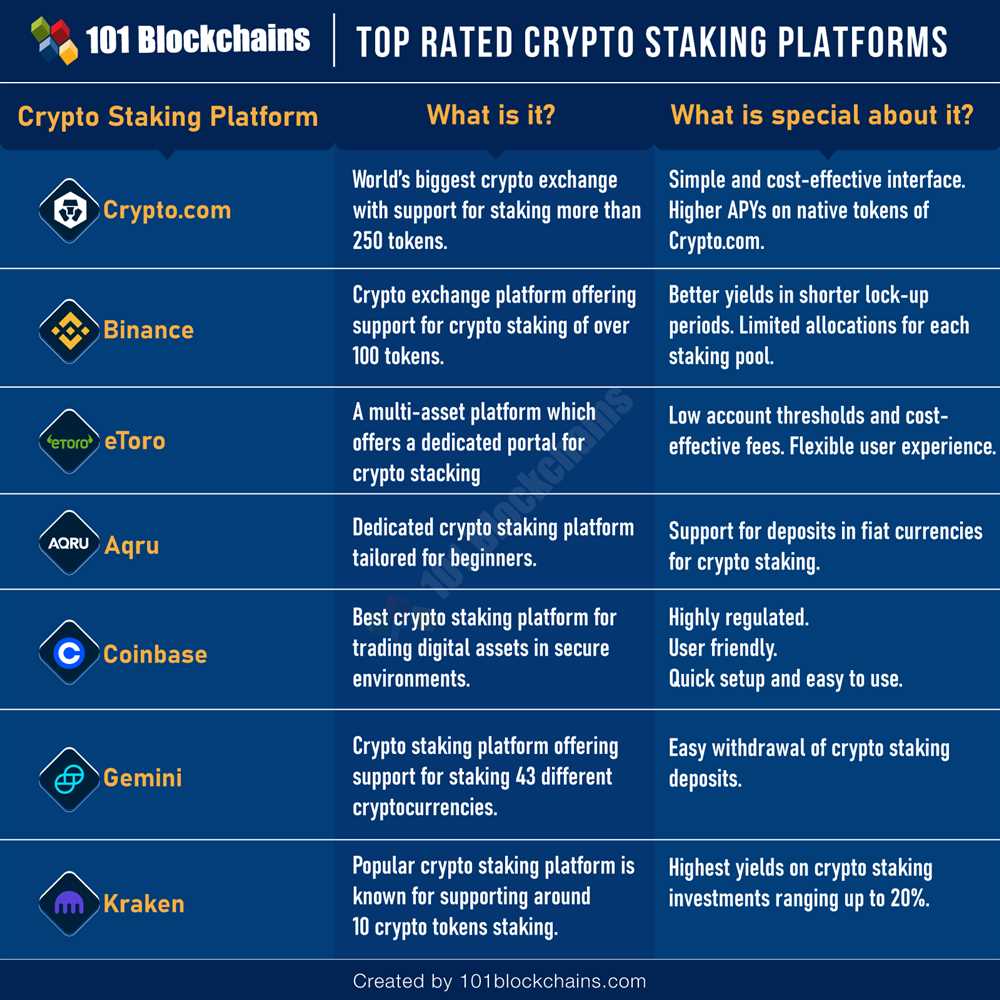

Comparison with Other Staking Platforms

When considering staking platforms for your Tron tokens, it’s important to compare the rewards and risks offered by different options. Here, we compare Tronstaking with other popular staking platforms:

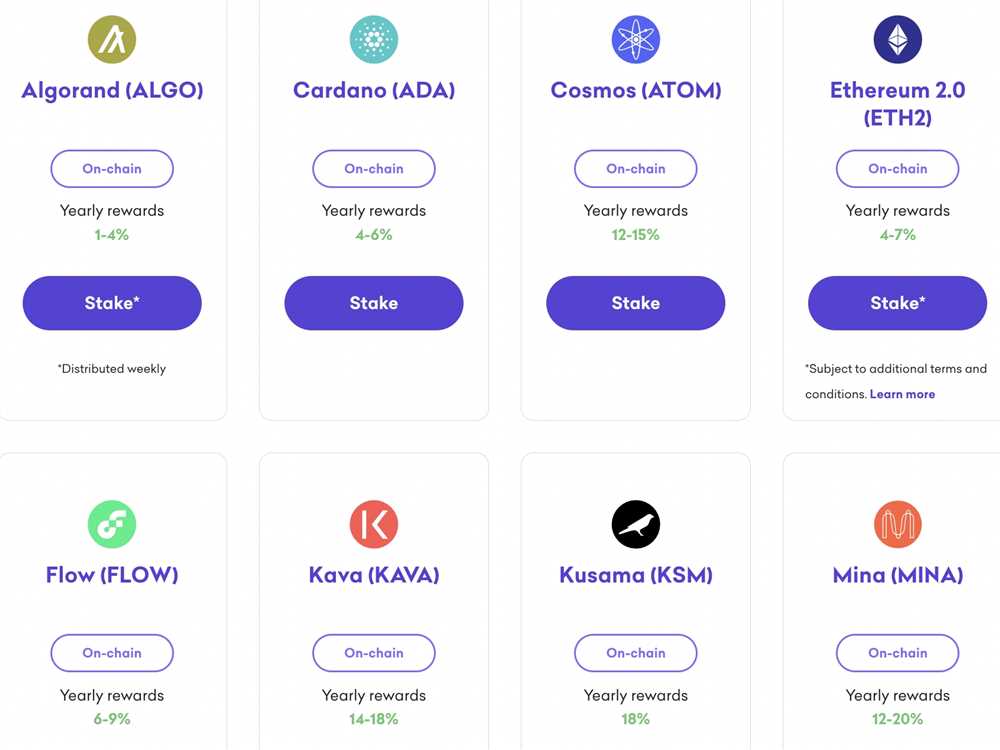

- Ethereum 2.0 Staking: Ethereum 2.0 is a highly anticipated upgrade to the Ethereum network that introduces staking as a way to secure the network and earn rewards. While Ethereum 2.0 offers staking with potentially high returns, it is still in the early stages and may carry higher risks compared to Tronstaking.

- Cardano Staking: Cardano is a blockchain platform that also allows for staking. Cardano has a unique approach to staking with its Ouroboros protocol, which aims to provide a secure and scalable staking experience. However, Cardano staking may have different reward structures and risk profiles compared to Tronstaking.

- Polkadot Staking: Polkadot is a multi-chain platform that enables interoperability between different blockchains. Staking on Polkadot allows token holders to secure the network and earn rewards. As with other platforms, Polkadot staking may have different rewards and risks compared to Tronstaking.

Before deciding on a staking platform, it’s important to carefully evaluate the rewards, risks, and overall suitability for your investment goals. Each platform may have its own unique features, governance structures, and token economics, so it’s important to do thorough research and consider your risk tolerance before making a decision.

Rewards and Risks of Other Staking Platforms

When it comes to staking platforms, there are several options available besides Tronstaking. Each of these platforms offers their own unique rewards and risks for participants. Understanding these rewards and risks can help individuals make informed decisions about which staking platform is right for them. Here are some of the rewards and risks associated with other staking platforms:

Rewards:

Earning Passive Income: One of the main incentives for participating in staking platforms is the opportunity to earn passive income. By holding and staking cryptocurrencies, individuals can earn additional tokens or coins as rewards. This additional income can be a great way to grow one’s wealth over time.

Higher Rewards Potential: Some staking platforms offer higher rewards potential than others. These platforms may have higher staking requirements or longer lock-up periods, but the potential returns can make it worthwhile for those willing to take the risk. It’s important to carefully evaluate the potential rewards before jumping into any staking platform.

Risks:

Market Volatility: One of the biggest risks associated with staking platforms is market volatility. The value of cryptocurrencies can be highly volatile, and this volatility can impact the overall rewards earned through staking. It’s important to consider the potential for price fluctuations and its impact on staking rewards.

Security Risks: Staking platforms also come with their own security risks. Participants must trust the platform to safeguard their assets and ensure that all transactions are secure. Unfortunately, there have been instances of hacking and theft in the cryptocurrency industry, so it’s crucial to choose a reputable platform with strong security measures.

Lock-Up Periods: Some staking platforms impose lock-up periods during which participants cannot access their staked assets. This lock-up period can range from days to months, depending on the platform. While this can result in higher rewards, it also means that individuals cannot easily liquidate their assets if they need immediate access to funds.

Platform Risks: Not all staking platforms are created equal. Some platforms may have higher risks due to factors such as poor governance, technical issues, or the potential for scams. It’s important to thoroughly research and choose a reliable and trustworthy platform to mitigate these risks.

In conclusion, participating in staking platforms other than Tronstaking can provide individuals with various rewards and risks. It’s essential to carefully evaluate the potential rewards, market volatility, security, lock-up periods, and platform risks before deciding which staking platform to choose. By doing so, individuals can make informed decisions and maximize their earning potential while minimizing the risks involved.

Different Platforms, Different Rewards

When it comes to staking, not all platforms are created equal. Each platform offers different rewards and benefits to users. It’s important to consider these differences when deciding where to stake your TRX.

Tronstaking

Tronstaking, as the name suggests, is a staking platform specifically designed for Tron (TRX) holders. One of the main advantages of Tronstaking is its high staking rewards. The platform offers generous returns on staked TRX, making it an attractive option for investors looking to maximize their earnings. Additionally, Tronstaking has a user-friendly interface, making it easy for beginners to get started.

Other Staking Platforms

In addition to Tronstaking, there are other platforms that offer staking services for TRX and other cryptocurrencies. These platforms may have different reward structures and features, so it’s important to research and compare before making a decision.

For example, some platforms may offer lower staking rewards but have additional perks such as a referral program or the ability to stake multiple cryptocurrencies. Others may have higher minimum staking amounts or longer staking periods. It’s important to consider these factors and determine what is most important to you as an investor.

| Platform | Reward Structure | Additional Features |

|---|---|---|

| Platform A | High staking rewards | Referral program |

| Platform B | Lower staking rewards | Stake multiple cryptocurrencies |

| Platform C | Medium staking rewards | Longer staking periods |

As you can see, each platform has its own unique rewards and features. It’s important to compare and determine which platform aligns with your investment goals and risk tolerance.

Remember, staking involves locking up your TRX for a certain period of time, so it’s essential to choose a platform that offers the rewards and benefits that you find most attractive. Happy staking!

Diverse Risks in Other Staking Platforms

While other staking platforms may offer attractive rewards, it is important to consider the diverse risks involved. Here are some of the key risks that investors should be aware of when exploring other staking platforms:

1. Network Security Vulnerabilities

Other staking platforms may have different levels of network security, which can expose users to potential risks such as hacking and unauthorized access. It is crucial to thoroughly research the security measures implemented by each platform before committing to stake your assets.

2. Regulatory Compliance

Depending on the jurisdiction in which the staking platform operates, there may be specific regulatory requirements and restrictions. Failure to comply with these regulations can result in legal issues and potential loss of funds. Investors should carefully assess the regulatory landscape and the platform’s compliance efforts.

3. Platform Reliability

Staking platforms may vary in terms of their technical infrastructure and operational stability. It is important to consider the platform’s track record, uptime, and reliability to minimize the risk of downtime or technical failures that could impact staking rewards.

4. Token Volatility

The value of staked tokens can be subject to significant price fluctuations, which could impact the overall returns from staking. Investors need to be prepared for potential losses if the token’s value decreases during the staking period.

5. Smart Contract Risks

Smart contracts are an essential part of many staking platforms. While they provide automation and efficiency, they can also be subject to vulnerabilities and bugs. Investors should assess the security audits and code reviews conducted on the platform’s smart contracts to mitigate the risk of exploitation.

| Risk | Description |

|---|---|

| Network Security Vulnerabilities | Potential risks of hacking and unauthorized access due to insufficient network security measures. |

| Regulatory Compliance | Possible legal issues and loss of funds if the platform fails to comply with relevant regulations. |

| Platform Reliability | Varying levels of technical infrastructure and operational stability, leading to potential downtime and impact on staking rewards. |

| Token Volatility | Fluctuations in the value of staked tokens that can affect overall returns from staking. |

| Smart Contract Risks | Security vulnerabilities and bugs in the platform’s smart contracts that can be exploited by malicious actors. |

What is Tronstaking?

Tronstaking is the process of holding and staking TRX, the native cryptocurrency of the Tron blockchain, in order to support the network’s operations and earn rewards.

What are the advantages of Tronstaking compared to other staking platforms?

One of the main advantages of Tronstaking is the potentially higher rewards compared to other staking platforms. Tron offers staking rewards in the form of TRX and other tokens, which can result in significant earnings for stakers. Additionally, Tronstaking is known for its fast transaction times and low fees, making it a convenient option for users.

What are the potential risks of Tronstaking?

Like any investment, Tronstaking carries certain risks. One of the main risks is the volatility of cryptocurrency prices. The value of TRX and other staking rewards can fluctuate greatly, potentially leading to a decrease in earnings or even loss of value. Additionally, there is always the risk of technical glitches or security breaches on the Tron network, which can have implications for stakers.