Tron (TRX) has quickly become one of the most talked-about cryptocurrencies in the industry. With its ambitious goals and growing community, many investors and enthusiasts are eagerly watching its progress. In this article, we will take a closer look at the current state of Tron and provide predictions for its future.

Tron was founded in 2017 by Justin Sun with the aim of decentralizing the internet and revolutionizing the entertainment industry. The project aims to create a decentralized platform where content creators can directly interact with their audience, cutting out the intermediaries and giving more control to the users. With partnerships with major companies like Samsung and BitTorrent, Tron has already made significant strides towards its goals.

One of the key factors driving Tron’s success is its strong and active community. TRX holders are actively engaged in the project, participating in voting for Super Representatives and contributing to the overall growth of the ecosystem. This level of engagement has led to the development of a thriving Tron community, which further boosts the project’s prospects.

So, what does the future hold for Tron? Many experts and analysts are optimistic about the cryptocurrency’s prospects. With its growing number of partnerships and development of its ecosystem, Tron has the potential to make significant gains in the coming years. Some predictions suggest that TRX could reach new all-time highs and become a top competitor to other established cryptocurrencies in the market.

However, it is important to note that the cryptocurrency market is highly volatile and unpredictable. Prices can fluctuate drastically within a short period of time, and investors should exercise caution and do their own research before making any investment decisions. While Tron shows promise, it is always wise to approach cryptocurrency investments with a level-headed perspective and a thorough understanding of the risks involved.

In conclusion, Tron has emerged as a promising cryptocurrency with ambitious goals and a strong community. With its potential to revolutionize the entertainment industry and its growing list of partnerships, Tron has the potential to make significant gains in the future. However, investors should approach this market with caution and carefully consider their investment decisions. Only time will tell if Tron can live up to its potential and become a major player in the cryptocurrency industry.

Tron Price Analysis

Tron (TRX) is one of the most promising cryptocurrencies in the market, with a strong focus on revolutionizing the entertainment industry. As the platform continues to gain popularity, investors are interested in understanding its price movement and making accurate predictions for the future.

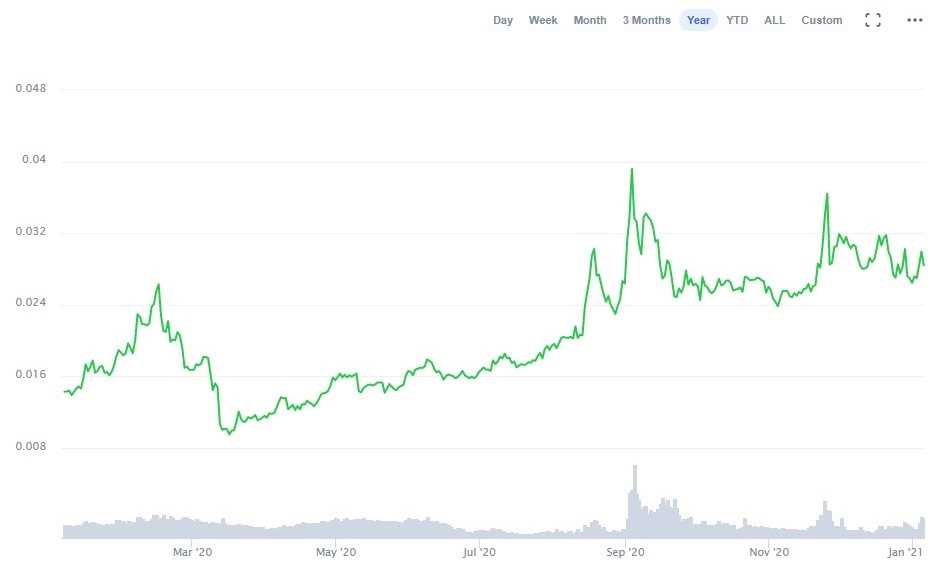

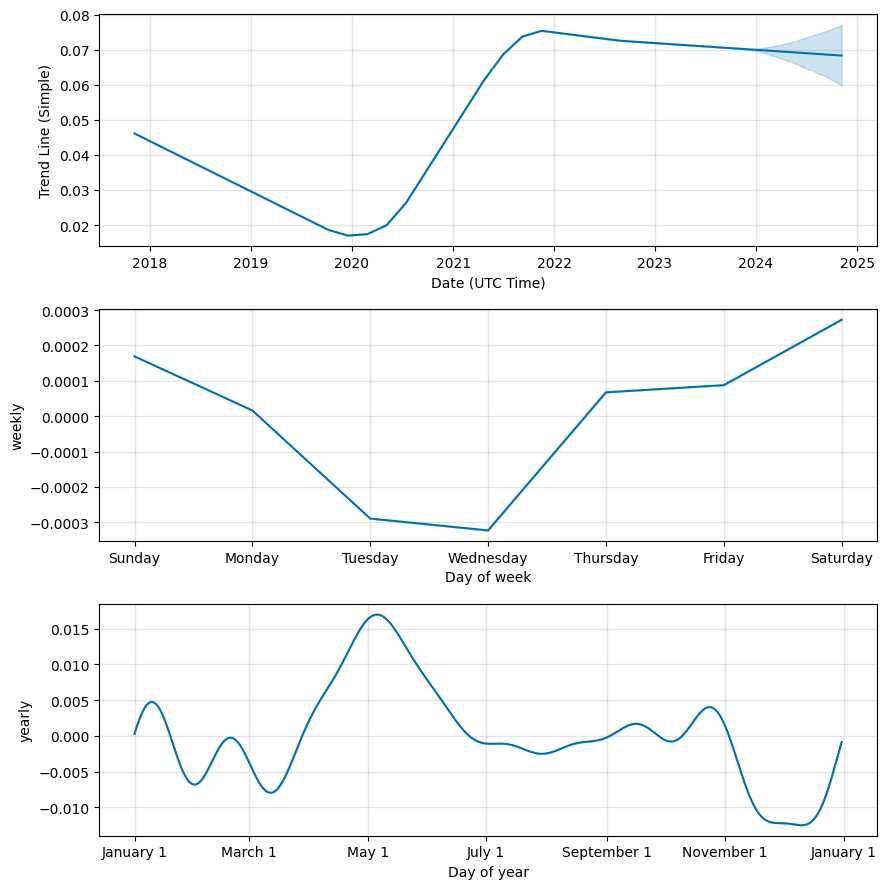

Tron’s price has shown significant volatility in the past, with substantial price swings being observed on a regular basis. However, it has also demonstrated resilience, consistently recovering from dips and continuing its upward trajectory.

One method to analyze Tron’s price is through technical analysis. By examining historical price charts and applying various indicators, such as moving averages, support and resistance levels, and MACD, traders can gain insights into Tron’s price patterns and potential future movements.

Another factor to consider when analyzing Tron’s price is its fundamental strength. Tron has an expanding ecosystem, with numerous partnerships and collaborations with existing entertainment giants. This growing adoption and development could have a positive impact on Tron’s price in the long run.

Furthermore, market sentiment plays a crucial role in Tron’s price analysis. Positive news and announcements can lead to increased investor interest and buying pressure, causing the price to rise. Conversely, negative news or market downturns can lead to a decrease in price.

It is important to note that cryptocurrency markets are highly volatile and unpredictable, making it challenging to make accurate price predictions. Traders and investors should conduct thorough research, considering both technical and fundamental factors, to minimize risks and make informed decisions.

In conclusion, Tron’s price analysis involves a combination of technical analysis, fundamental analysis, and market sentiment. Understanding Tron’s historical price patterns, its fundamental strengths, and the overall market conditions are essential in predicting its future price movements.

| Factors to consider in Tron Price Analysis |

|---|

| Technical Analysis |

| Fundamental Strength |

| Market Sentiment |

Predictions for TRX’s Future

As the cryptocurrency market continues to evolve, many investors are looking to the future of TRX and its potential for growth. Here are some predictions for TRX’s future:

1. Increased Adoption

TRX has already gained significant traction in the gaming and entertainment industries, with partnerships with major companies like Opera and Samsung. As more developers and companies see the potential of TRX’s blockchain platform, we can expect increased adoption in various industries.

2. Expansion into DeFi

The decentralized finance (DeFi) space has been gaining a lot of attention lately, and TRX could potentially expand its capabilities to cater to this growing market. With its fast and scalable blockchain, TRX has the potential to become a major player in the DeFi space.

3. Integration with the Internet of Things (IoT)

With the increasing popularity of IoT devices, there is a growing need for secure and efficient data transfer. TRX’s blockchain technology can provide a solution for this, and we could see more integration of TRX into IoT devices in the future.

Factors Affecting Tron Price

Tron (TRX) is a cryptocurrency that has gained significant attention in recent years. Like any other digital asset, the price of Tron is influenced by various factors. Understanding these factors can help investors make informed decisions and predict the future price of TRX.

1. Market Demand and Sentiment

The demand for Tron in the market plays a crucial role in determining its price. Increased demand from investors and traders can lead to a surge in the price of TRX, while a lack of demand can cause the price to decline. Additionally, market sentiment also affects Tron’s price. Positive news and developments surrounding Tron can create a bullish sentiment, boosting its price, while negative news can trigger a bearish sentiment, leading to a drop in price.

2. Partnerships and Collaborations

Partnerships and collaborations with other companies and projects can significantly impact the price of Tron. When Tron forms strategic alliances with well-known companies or establishes partnerships with influential organizations, it can enhance its credibility and visibility, attracting more investors and driving up the price. On the other hand, negative news or termination of partnerships can adversely affect Tron’s price.

3. Technological Developments

Technological advancements and updates within the Tron network can also impact its price. Positive developments such as the introduction of new features, improvements in scalability and speed, or the successful implementation of upgrades can attract investors and increase their confidence in Tron, resulting in a rise in price. Conversely, technical issues or delays in the development process can have a negative impact on Tron’s price.

4. Market Competition

The competition within the cryptocurrency market can influence Tron’s price. Tron competes with other cryptocurrencies for market share and investor attention. If Tron is perceived as a strong competitor and has a unique selling proposition compared to its rivals, its price could experience an upward trend. However, if other cryptocurrencies gain more popularity or offer superior features, it may have a negative impact on Tron’s price.

5. Regulatory Environment

The regulatory environment surrounding cryptocurrencies can significantly impact Tron’s price. Positive regulatory developments, such as government acceptance and favorable regulations, can instill confidence in investors and promote the adoption of Tron, leading to a price increase. Conversely, negative regulatory actions, such as bans or strict regulations, can erode investor trust and negatively affect Tron’s price.

| Factor | Impact on Tron Price |

|---|---|

| Market Demand and Sentiment | High demand and positive sentiment can increase the price, while low demand and negative sentiment can cause a decline. |

| Partnerships and Collaborations | Positive partnerships can boost the price, while negative news or terminated partnerships can negatively impact the price. |

| Technological Developments | Positive technological advancements can attract investors and increase price, while technical issues or delays can have a negative impact. |

| Market Competition | Strong competition or unique selling proposition can increase the price, while superior competitors can have a negative impact. |

| Regulatory Environment | Positive regulatory developments can increase price, while negative actions or strict regulations can decrease the price. |

What is the current price of TRON (TRX)?

The current price of TRON (TRX) is $0.03443.

Is TRON (TRX) a good investment?

Investing in TRON (TRX) can be a subjective decision. It would be wise to do thorough research, considering factors such as the project’s goals, team, partnerships, and market conditions before making an investment decision.