Ethereum has quickly risen to become one of the most influential platforms in the cryptocurrency market. At the heart of Ethereum lies its onchain functionality, which distinguishes it from other blockchain networks. Onchain Ethereum refers to the ability to execute smart contracts and interact with decentralized applications (dApps) directly on the blockchain.

Unlike offchain transactions, which rely on intermediaries and are subject to their limitations and fees, onchain Ethereum transactions are conducted directly between parties on the blockchain. This means that transactions are not processed or controlled by any centralized authority, offering greater security, transparency, and efficiency.

Onchain Ethereum has had a profound impact on the crypto market as a whole. It has opened up new possibilities for developers and entrepreneurs to create innovative decentralized applications, revolutionizing industries such as finance, gaming, and supply chain management. The ability to execute smart contracts on the Ethereum blockchain has paved the way for the creation of decentralized exchanges, decentralized finance platforms, and even decentralized autonomous organizations (DAOs).

Furthermore, onchain Ethereum has also played a significant role in the rise of non-fungible tokens (NFTs) as a new asset class. NFTs are unique digital assets that can represent ownership of various types of media, including artwork, music, and virtual real estate. The ability to securely transfer ownership of these assets on the Ethereum blockchain has sparked a worldwide craze and generated billions of dollars in transactions.

In conclusion, onchain Ethereum is a key feature of the Ethereum platform that enables the execution of smart contracts and the development of dApps directly on the blockchain. Its impact on the crypto market has been significant, fostering innovation, decentralization, and the rise of NFTs. As the crypto market continues to evolve, understanding onchain Ethereum is essential for investors, developers, and enthusiasts alike.

Ethereum and Its Impact on the Crypto Market

Ethereum, a decentralized blockchain platform, has revolutionized the world of cryptocurrencies and has had a significant impact on the overall crypto market. With its introduction in 2015, Ethereum paved the way for the development of decentralized applications (dApps) and smart contracts, opening up a wide array of possibilities for innovation and disruption.

One of the key features that sets Ethereum apart from other cryptocurrencies is its ability to execute smart contracts. Smart contracts are self-executing agreements that are coded directly onto the blockchain. These contracts automatically execute when certain conditions, as agreed upon by the parties involved, are met. This feature eliminates the need for intermediaries and significantly reduces transaction costs. The existence of smart contracts on the Ethereum platform has made it a popular choice for developers and businesses looking to create decentralized applications.

Furthermore, Ethereum’s impact on the crypto market can be seen in its role as the platform for Initial Coin Offerings (ICOs). ICOs allow startups and projects to raise funds by selling tokens on the Ethereum blockchain. This has democratized fundraising and has provided opportunities for smaller investors to participate in investment opportunities that were previously only accessible to venture capitalists. The popularity of ICOs and the ability to launch them on the Ethereum platform has led to a surge in new cryptocurrency projects and investments.

The Ethereum Virtual Machine (EVM)

The Ethereum Virtual Machine (EVM) is another important aspect of Ethereum’s impact on the crypto market. The EVM is a runtime environment that allows developers to execute smart contracts on the Ethereum network. It provides a secure and predictable environment for the execution of code, ensuring that the outcome of a smart contract is consistent across all nodes in the network.

Developers can write smart contracts using Solidity, a programming language specifically designed for the Ethereum platform. The EVM then compiles and executes these contracts, making them globally accessible and tamper-proof. The existence of the EVM has spurred the development of a wide range of decentralized applications, including decentralized finance (DeFi) platforms, decentralized exchanges (DEXs), and blockchain-based games.

The Impact on the Crypto Market

Ethereum’s impact on the crypto market has been significant. It has not only provided a platform for innovation and the development of new applications but has also contributed to the formation of a vibrant ecosystem of developers, entrepreneurs, and investors. The availability of smart contracts and the ability to create decentralized applications has attracted talent and resources to the Ethereum platform.

Moreover, Ethereum’s market capitalization has grown significantly over the years, making it the second-largest cryptocurrency by market cap after Bitcoin. Its prominence and influence have led to the rise of the ERC-20 token standard, which has become the de facto standard for creating and managing tokens on the Ethereum blockchain. This standard has further solidified Ethereum’s position as a key player in the crypto market.

In conclusion, Ethereum has had a profound impact on the crypto market. With its ability to execute smart contracts, facilitate ICOs, and provide a platform for decentralized applications, it has opened up a new world of possibilities and has fostered innovation and growth within the cryptocurrency space.

Understanding Onchain Ethereum

Onchain Ethereum represents the infrastructure and protocol that allows for decentralized applications (dApps) and smart contracts to be built and executed on the Ethereum blockchain. Unlike traditional applications that rely on a centralized server, onchain Ethereum enables developers to create applications that operate on a decentralized network of computers.

How does onchain Ethereum work?

Onchain Ethereum operates using a distributed network of nodes that run the Ethereum software. These nodes communicate with each other to validate transactions and execute smart contracts. By distributing the data and computations across multiple nodes, onchain Ethereum ensures transparency, security, and immutability, making it a trusted platform for decentralized applications.

When a transaction is initiated on the Ethereum network, it is broadcasted to all the nodes, who then compete to validate and add the transaction to a block. This validation process, known as mining, involves solving complex mathematical puzzles. Once a block is mined, it is added to the Ethereum blockchain, creating an immutable record of all transactions and smart contracts executed on the network.

The impact of onchain Ethereum on the crypto market

The development of onchain Ethereum has had a significant impact on the crypto market. It has opened up a world of possibilities for developers and entrepreneurs to create innovative decentralized applications and launch token sales through initial coin offerings (ICOs).

Onchain Ethereum has also facilitated the rise of decentralized finance (DeFi) platforms, which provide traditional financial services like lending, borrowing, and trading, without the need for intermediaries. These platforms have gained popularity due to their transparency, accessibility, and ability to provide financial services to underserved populations.

Furthermore, onchain Ethereum has paved the way for the emergence of non-fungible tokens (NFTs). NFTs are unique digital assets that can represent ownership of digital art, collectibles, and virtual real estate, among other things. They have gained widespread adoption and have attracted significant attention from investors and collectors alike.

Overall, onchain Ethereum has revolutionized the crypto market by providing a decentralized and secure platform for the development and execution of smart contracts and decentralized applications. It has empowered developers and entrepreneurs to create innovative solutions and has given rise to new sectors within the blockchain industry, such as DeFi and NFTs.

In conclusion, understanding onchain Ethereum is essential for grasping the full potential of the Ethereum platform and its impact on the crypto market. It represents a fundamental shift towards decentralization and has opened up new possibilities for developers, entrepreneurs, and users alike.

Role of Ethereum in the Crypto Market

Ethereum has a significant role in the crypto market as one of the leading blockchain platforms. It was created to go beyond Bitcoin’s limited functionality and provide developers with a platform to build decentralized applications (dApps) and smart contracts.

One of Ethereum’s key contributions to the crypto market is its ability to enable the creation and execution of smart contracts. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automatically execute once the predefined conditions are met, without the need for intermediaries. This innovation has opened up a wide range of use cases, from decentralized finance (DeFi) and supply chain management to voting systems and decentralized applications.

Decentralized Finance (DeFi)

Ethereum has played a crucial role in the rise of decentralized finance (DeFi). DeFi applications built on the Ethereum blockchain provide financial services without relying on traditional intermediaries like banks. These applications allow users to borrow, lend, trade, and earn interest on their cryptocurrencies directly, without the need for a centralized authority. Ethereum’s programmability and smart contract capabilities have enabled the development of different DeFi protocols and platforms, such as decentralized exchanges, lending platforms, and stablecoins.

Tokens and Initial Coin Offerings (ICOs)

Ethereum also facilitated the rise of tokens and initial coin offerings (ICOs) in the crypto market. Using Ethereum’s ERC-20 token standard, developers can easily create and launch their own tokens on the Ethereum blockchain. This has led to a flood of token offerings, allowing projects to raise funds through ICOs. While the ICO craze has cooled down, tokens remain an essential part of the crypto market, enabling various functionalities and investment opportunities.

In summary, Ethereum’s role in the crypto market is multifaceted. It has revolutionized the way decentralized applications are built and executed through its smart contract capabilities. Additionally, Ethereum has been instrumental in the growth of decentralized finance and the emergence of tokens and ICOs, further expanding the possibilities and opportunities within the crypto market.

Ethereum’s Influence on Decentralized Finance

Ethereum, with its smart contract capabilities, has played a crucial role in the development and growth of decentralized finance (DeFi). DeFi refers to the use of blockchain technology and cryptocurrencies to recreate traditional financial systems and services, making them more inclusive, accessible, and transparent. Ethereum’s programmable blockchain has provided the foundation for the creation of various DeFi applications and protocols.

One of the key features that Ethereum offers to the DeFi ecosystem is the ability to create and execute smart contracts. Smart contracts are self-executing agreements with the terms of the agreement directly written into lines of code. These contracts automatically execute when the predefined conditions are met, eliminating the need for intermediaries or trust in counterparties.

The use of smart contracts on Ethereum has enabled the creation of decentralized lending and borrowing platforms, decentralized exchanges (DEXs), and decentralized stablecoins, among other DeFi applications. These platforms and protocols allow users to lend or borrow assets directly from other users, trade cryptocurrencies without relying on centralized exchanges, and use stablecoins that are pegged to mainstream currencies like the US dollar.

Additionally, Ethereum’s native cryptocurrency, Ether (ETH), plays a central role in many DeFi applications. Ether is used as a means of exchange, collateral, and governance within the Ethereum network. Various DeFi protocols require users to stake or lock up their Ether as collateral to borrow assets or participate in liquidity mining programs. This integration of ETH within the DeFi ecosystem has further solidified Ethereum’s influence in shaping the future of finance.

Ethereum’s impact on DeFi has not gone unnoticed in the crypto market. The growing popularity and adoption of DeFi applications built on Ethereum have led to an increase in demand for Ether and subsequently contributed to the rise in its price. Moreover, the success of Ethereum’s DeFi ecosystem has inspired other blockchain platforms to develop their own DeFi solutions, further expanding and diversifying the DeFi market.

In conclusion, Ethereum’s programmable blockchain and smart contract capabilities have revolutionized the field of decentralized finance. The ability to create and execute smart contracts on Ethereum has paved the way for the development of various DeFi applications and protocols, enabling users to access financial services in a decentralized, efficient, and transparent manner. As the DeFi market continues to grow, Ethereum’s influence is expected to remain at the forefront of this transformative industry.

Future Prospects of Onchain Ethereum

Onchain Ethereum has shown immense potential and is set to shape the future of the crypto market. With its innovative features and robust infrastructure, the platform is well-positioned to revolutionize various industries. Here are some future prospects that Onchain Ethereum holds:

Expanding Use Cases

One of the key strengths of Onchain Ethereum is its versatility and ability to support various use cases. Its smart contract functionality enables the creation of decentralized applications (dApps) and facilitates the automation of complex processes. As the platform evolves, we can expect to see a wider range of industries harnessing the power of Onchain Ethereum, including finance, supply chain management, healthcare, gaming, and more.

Improved Scalability

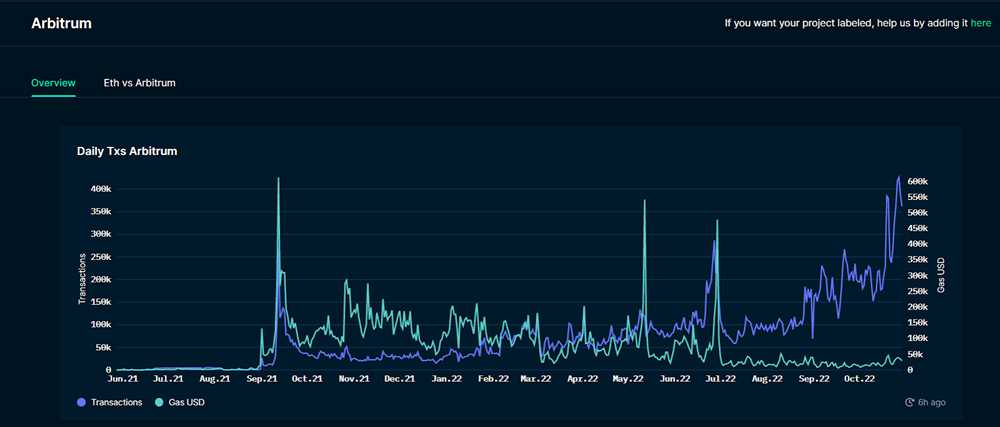

Scalability has been a challenge for many blockchain platforms, including Ethereum. However, with the implementation of Ethereum 2.0, which includes the shift to a proof-of-stake consensus mechanism and the introduction of shard chains, Onchain Ethereum aims to address scalability issues. This upgrade will significantly enhance the platform’s capacity to handle a larger number of transactions per second, making it more efficient and appealing for enterprises and developers.

Furthermore, the introduction of layer 2 solutions, such as state channels and sidechains, will further enhance scalability by allowing off-chain transactions while leveraging the security of the main Ethereum network.

Interoperability and Cross-chain Compatibility

Onchain Ethereum has the potential to become a key player in the interoperability landscape. With the development of technologies like Polkadot and Cosmos, it is becoming easier to connect different blockchain networks. Onchain Ethereum can leverage these interoperability protocols to establish seamless communication and data transfer between multiple blockchains. This opens up opportunities for cross-chain decentralized applications and promotes a more interconnected and efficient blockchain ecosystem.

In conclusion, Onchain Ethereum is poised for a bright future. Its expanding use cases, improved scalability, and interoperability capabilities make it an attractive platform for enterprises, developers, and users alike. As the crypto market continues to mature, we can expect Onchain Ethereum to play a significant role in shaping the future of decentralized technologies.

What is Onchain Ethereum?

Onchain Ethereum refers to the data and transactions that occur on the Ethereum blockchain. It includes all the information stored on the blockchain, such as smart contracts, token transfers, and interactions between dApps.

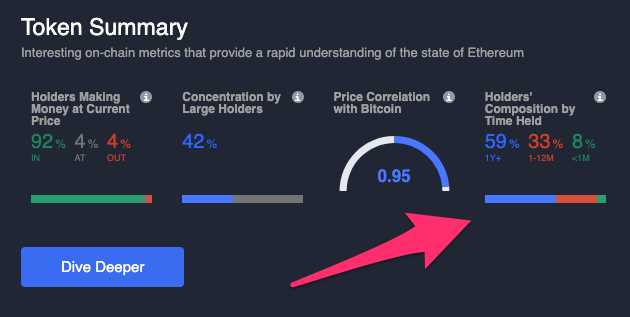

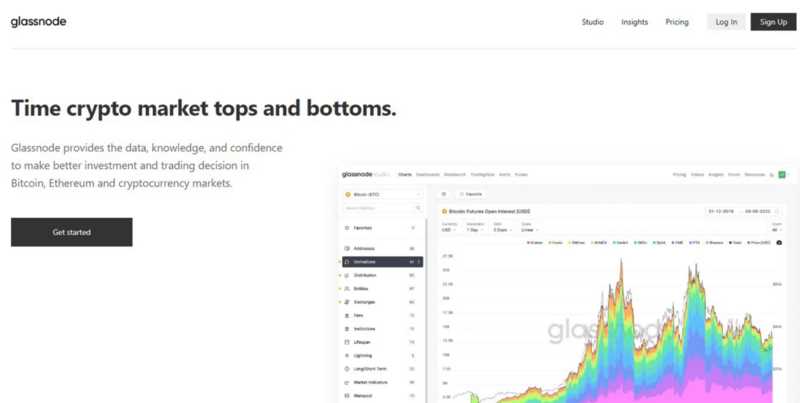

How does Onchain Ethereum affect the crypto market?

Onchain Ethereum has a significant impact on the crypto market. It provides transparency and immutability, making it a reliable platform for projects and investors. The transactions and data recorded on the blockchain can influence market sentiment and drive the prices of cryptocurrencies.

Can you explain the concept of smart contracts on Onchain Ethereum?

Smart contracts on Onchain Ethereum are self-executing contracts with predefined conditions written in code. They automatically execute when these conditions are met. Smart contracts eliminate the need for intermediaries and enable secure and trustless transactions. They have a wide range of applications, including decentralized finance, tokenization, and supply chain management.