In today’s digital age, where virtually everything is done online, the concept of anonymous cash might seem outdated. However, as the world becomes increasingly interconnected and the threat of financial fraud and identity theft looms larger than ever, the importance of protecting your financial identity cannot be overstated.

Anonymous cash refers to physical currency, such as banknotes and coins, that can be used for transactions without leaving behind a digital trail. While the majority of transactions are now conducted electronically, there is still a need for anonymous cash in certain situations. Whether it’s purchasing goods and services without revealing your identity, or wanting to maintain privacy in an increasingly surveilled world, anonymous cash provides a level of financial freedom that digital transactions cannot.

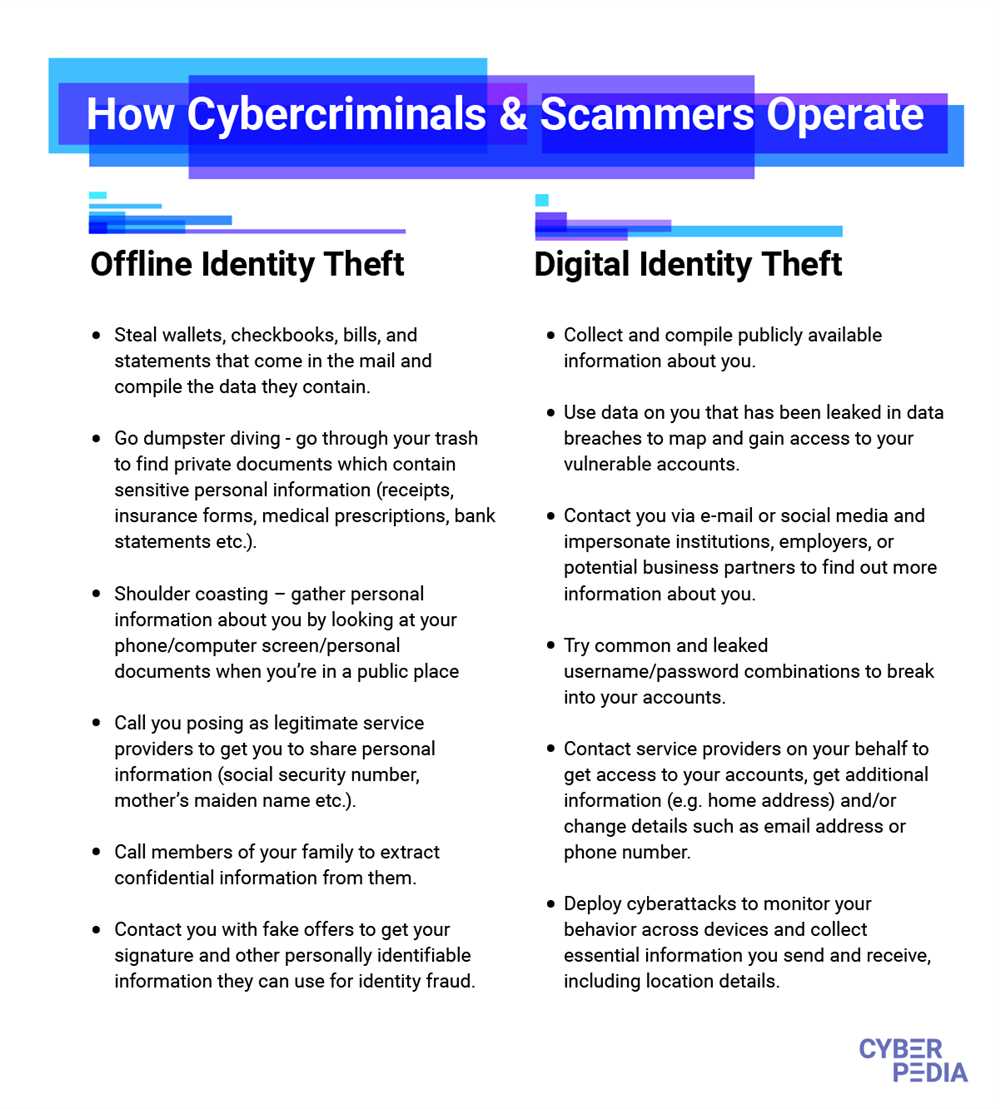

One of the main reasons why protecting your financial identity is crucial is the prevalence of financial fraud. With the rise of online shopping and digital transactions, criminals have found new ways to exploit vulnerable individuals and steal their personal and financial information. From phishing scams to data breaches, no one is immune to the dangers of cybercrime. By using anonymous cash for certain transactions, you can greatly reduce the risk of becoming a victim of financial fraud.

Another important consideration is the issue of privacy. In an age where your every move can be tracked and your personal information is constantly being sold and shared, maintaining privacy has become increasingly challenging. By utilizing anonymous cash, you can make transactions without revealing your identity, thereby preserving your privacy and protecting yourself from potential surveillance and exploitation.

In conclusion, while digital transactions have taken center stage in today’s society, the importance of anonymous cash cannot be overlooked. Whether it’s protecting yourself from financial fraud or maintaining your privacy, using physical currency can provide a level of anonymity and security that digital transactions simply cannot match. So next time you reach for your wallet, consider the value of anonymous cash in protecting your financial identity.

The Importance of Financial Identity Protection: Understanding the Rise of Anonymous Cash

In today’s digital age, where nearly every transaction can be conducted online, it is more important than ever to protect your financial identity. With the rise of anonymous cash, individuals have the opportunity to maintain greater privacy and security when it comes to their financial transactions.

Anonymous cash refers to physical currency that allows individuals to make purchases without leaving a digital footprint. Unlike digital payment methods, such as credit cards or online transfers, anonymous cash allows users to remain untraceable, keeping their financial identities secure.

The rise of anonymous cash is driven by various factors. First and foremost, privacy concerns have become increasingly prevalent in recent years. With the constant threat of identity theft and data breaches, individuals are understandably hesitant to share their financial information online. Anonymous cash offers a solution by providing a physical means of making transactions without revealing personal information.

Additionally, anonymous cash can protect individuals from surveillance or tracking. In an era when governments and corporations can easily monitor online activity, using anonymous cash provides a level of freedom and autonomy. It allows individuals to maintain control over their financial transactions and prevent third parties from gathering data about their spending habits.

Furthermore, anonymous cash is particularly important for marginalized communities. It provides a means for individuals who may not have access to traditional banking systems to participate in the economy. It allows those without a bank account or credit history to make purchases, pay bills, and engage in financial transactions without discrimination or exclusion.

While the rise of anonymous cash offers benefits in terms of privacy and inclusivity, it is essential to understand the potential risks and drawbacks. As with any financial instrument, there are always concerns regarding counterfeit currency or illegal activities facilitated by anonymous cash. It is crucial for individuals to exercise caution and be aware of the risks associated with using anonymous cash.

In conclusion, financial identity protection is of utmost importance in today’s digital world. Understanding the rise of anonymous cash provides individuals with the knowledge and tools to safeguard their financial identities. By using anonymous cash, individuals can enjoy increased privacy, autonomy, and inclusivity in their financial transactions.

The Evolution of Financial Transactions

Throughout history, the way we conduct financial transactions has evolved significantly. From bartering and trading goods to using precious metals as a form of currency, we have seen numerous changes in how people exchange value. However, perhaps the most significant transformation in recent times is the rise of digital transactions.

In the past few decades, technological advancements and the internet have revolutionized the way we handle our finances. Traditional methods of payment, such as cash and checks, have gradually been replaced by electronic forms of payment. This shift has made transactions faster, more convenient, and more secure.

One major milestone in the evolution of financial transactions was the introduction of credit cards. With credit cards, people no longer needed to carry large amounts of cash with them. Instead, they could make purchases and pay for services by simply swiping their card. This not only added convenience but also provided an extra layer of protection against fraud.

As technology continued to advance, the next significant development was the emergence of online banking and electronic funds transfer. This allowed individuals to manage their finances and make transactions from the comfort of their homes or offices. The rise of mobile banking further increased accessibility, enabling people to conduct financial transactions on the go using their smartphones.

More recently, cryptocurrencies, such as Bitcoin, have emerged as an alternative form of digital currency. These decentralized digital assets offer a level of anonymity and security that traditional forms of currency cannot match. They have gained popularity among individuals who value privacy and want to safeguard their financial identity.

As we look to the future, it is likely that financial transactions will continue to evolve. With the advent of technologies such as blockchain and biometrics, we may see even greater security and convenience in the way we handle our finances. However, it is important to remember that with these advancements come new challenges and risks that need to be addressed to protect the financial identity of individuals.

In conclusion, the evolution of financial transactions has transformed the way we exchange value. From bartering to digital currencies, each advancement has brought us closer to a more efficient and secure financial system. As we move forward, it is crucial to strike a balance between embracing new technologies and protecting our financial identity.

Advantages of Anonymous Cash

Using anonymous cash offers several advantages in today’s increasingly digital world:

- Privacy: With anonymous cash, you can maintain your financial privacy and prevent unwanted tracking of your spending habits. Unlike electronic transactions, which leave behind a digital trail, anonymous cash allows you to keep your financial activities discreet.

- Security: When using anonymous cash, you eliminate the risk of identity theft and cyber fraud. Without connected bank accounts or personal information linked to your transactions, there is no target for hackers or online criminals.

- Control: Anonymous cash gives you complete control over your money. You don’t have to rely on financial institutions or payment processors to access or transfer your funds. With cash in hand, you have immediate and direct control over every aspect of your finances.

- Flexibility: Unlike credit or debit cards, anonymous cash is widely accepted, regardless of location or technological limitations. It provides you with the freedom to make purchases or conduct transactions, even in areas with limited or no access to electronic payment options.

- Financial Independence: With anonymous cash, you don’t need to rely on a bank or financial institution to manage your money. This financial independence allows you to avoid fees, surcharges, and potential restrictions imposed by these institutions.

In conclusion, using anonymous cash offers a range of advantages, including privacy, security, control, flexibility, and financial independence. By embracing anonymous cash, you can protect your financial identity and enjoy greater freedom and control over your finances.

Safeguarding Your Financial Identity

Protecting your financial identity is crucial in today’s world where online transactions and digital payments are becoming increasingly common. Here are some key steps you can take to safeguard your financial identity:

1. Monitor your accounts regularly

Regularly review your bank and credit card statements to check for any unauthorized transactions or suspicious activities. If you notice anything unusual, report it to your financial institution immediately.

2. Create strong and unique passwords

Use a combination of upper and lowercase letters, numbers, and symbols to create strong passwords for your online banking and other financial accounts. Avoid using easily guessable information such as your name, birthdate, or address.

3. Enable two-factor authentication

Two-factor authentication adds an extra layer of security to your accounts by requiring a second form of verification, usually a code sent to your mobile device. Enable this feature whenever possible to protect your financial information.

4. Be cautious when sharing personal information

Avoid sharing sensitive financial information, such as your social security number or bank account details, unless necessary. Be wary of phishing attempts or unsolicited requests for personal information.

5. Keep your devices and software up to date

Regularly update the operating systems and software on your devices to ensure you have the latest security patches. Install reputable antivirus and anti-malware software to protect against potential threats.

By following these tips, you can greatly reduce the risk of your financial identity being compromised and ensure the security of your online transactions and digital payments.

Why is protecting your financial identity important?

Protecting your financial identity is important because it helps to prevent unauthorized access to your financial accounts and personal information. This can help to safeguard your finances and protect against identity theft and fraudulent activities.

What are some ways to protect your financial identity?

There are several ways to protect your financial identity. First, it is important to regularly monitor your financial accounts and transactions to look for any suspicious activity. Second, you should create strong and unique passwords for your financial accounts and avoid sharing them with anyone. Additionally, you can use two-factor authentication, secure your devices and networks, be cautious of phishing scams, and regularly update your software and antivirus programs.

How can anonymous cash contribute to protecting financial identity?

Anonymous cash can contribute to protecting financial identity by providing an alternative method of payment that does not require divulging personal information. When using cash, there is no electronic trail that can be traced back to an individual, reducing the risk of identity theft and financial fraud. However, it is important to note that anonymous cash also has its limitations and may not be suitable for all transactions or situations.