Discover the future of finance in Latin America as cryptocurrencies gain traction and revolutionize the region’s financial landscape. Latin American countries are leading the way in embracing digital currencies such as MXNT, Mexican Ethereum, and Tron, enabling greater financial inclusion for millions of individuals.

Experience the power of decentralized finance as Latin America seizes the opportunities provided by blockchain technology. With increased accessibility and security, these emerging cryptocurrencies are unlocking financial potential for unbanked populations and promoting economic growth.

MXNT: Explore the groundbreaking potential of MXNT, a cryptocurrency designed to address the unique needs of the Mexican market. With its robust and scalable platform, MXNT is bridging the gap between traditional financial systems and the world of digital assets.

Mexican Ethereum: Join the revolution with Mexican Ethereum, a decentralized blockchain platform that offers smart contracts and decentralized applications. With its secure and transparent infrastructure, Mexican Ethereum is empowering individuals and businesses to access financial services and participate in a borderless economy.

Tron: Experience the future of entertainment and digital content with Tron, a cryptocurrency that aims to revolutionize the way content is created, shared, and monetized. Tron’s decentralized ecosystem ensures fair and transparent transactions, transforming the entertainment industry and empowering content creators across Latin America.

Don’t miss out on the financial revolution sweeping Latin America. Embrace the potential of cryptocurrencies like MXNT, Mexican Ethereum, and Tron, and be part of the movement towards greater financial inclusion and economic empowerment.

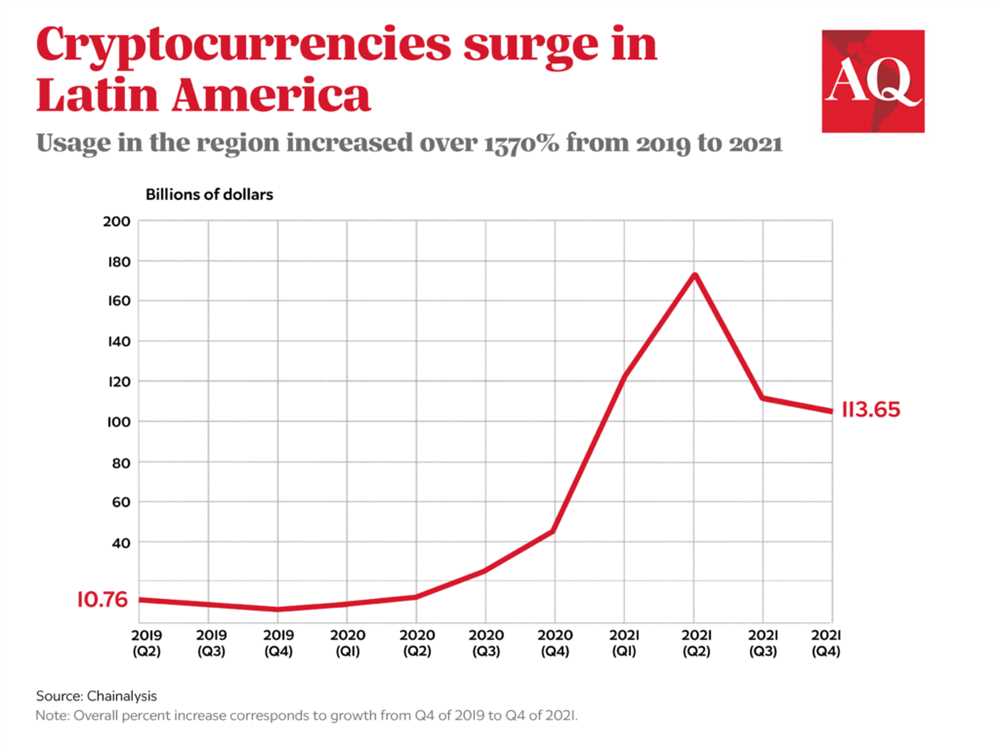

The Rise of Cryptocurrencies in Latin America

In recent years, Latin America has experienced a significant rise in the popularity and adoption of cryptocurrencies. This region, with its historically volatile economy and limited access to traditional banking services, has found a new hope in digital currencies like MXNT, Mexican Ethereum, and Tron.

Financial Inclusion through Cryptocurrencies

Latin America has a large unbanked population, with millions of individuals lacking access to basic financial services. Cryptocurrencies have emerged as a solution to this problem, offering a decentralized and accessible alternative to traditional banking systems.

By utilizing cryptocurrencies, individuals in Latin America are able to easily store, send, and receive money, regardless of their location or socio-economic status. This financial inclusion is particularly beneficial for those in rural areas or underserved communities, who may have limited access to physical banks.

Economic Stability and Protection

The volatility of Latin American economies has been a long-standing concern for many individuals in the region. Cryptocurrencies offer a level of stability and protection against economic instability, as they are not tied to any particular government or financial institution.

In countries like Venezuela and Argentina, where hyperinflation and economic crises have been prevalent, cryptocurrencies have provided a safe haven for individuals seeking to protect their wealth and assets. The use of digital currencies has allowed them to preserve the value of their money and safeguard it from the rampant inflation that has affected their national currencies.

| Benefits of Cryptocurrencies in Latin America |

|---|

| 1. Financial inclusion for unbanked populations |

| 2. Security and protection against economic instability |

| 3. Accessibility and ease of use |

| 4. Empowerment of underserved communities |

| 5. Potential for economic growth and innovation |

The rise of cryptocurrencies in Latin America has not only provided financial opportunities for individuals and businesses but has also fostered innovation and economic growth. The region is embracing these digital currencies as a tool for empowerment, offering a new way to participate in the global economy.

As cryptocurrencies continue to gain popularity in Latin America, it is clear that they are reshaping the financial landscape and unlocking the potential for a more inclusive and prosperous future.

Understanding the Potential:

In recent years, Latin America has emerged as a hotbed for cryptocurrency adoption, with countries like Mexico embracing digital assets like MXNT, Mexican Ethereum, and Tron as a means of achieving financial inclusion.

One of the main reasons why cryptocurrencies have gained traction in Latin America is the region’s high rates of unbanked and underbanked individuals. Traditional banking services have often excluded large portions of the population due to various factors, including lack of documentation, high fees, and limited access to financial services.

Cryptocurrencies offer a decentralized alternative to traditional banking, providing individuals with the opportunity to store, transact, and invest their money without the need for a traditional bank account. This has allowed many people in Latin America to gain access to financial services that were previously out of reach.

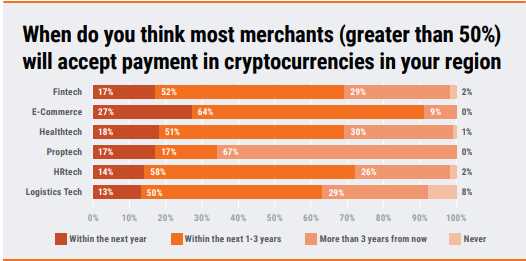

Beyond financial inclusion, cryptocurrencies also offer Latin America the potential to foster economic growth and innovation. By embracing digital currencies, countries in the region can attract investment, encourage entrepreneurship, and create new job opportunities in the emerging blockchain and cryptocurrency sectors.

Additionally, cryptocurrencies provide Latin American businesses with the ability to transact globally without being restricted by traditional banking systems or high transaction fees. This has the potential to boost international trade and facilitate economic integration within the region.

Furthermore, the use of cryptocurrencies can help combat issues such as inflation and currency volatility that have plagued many Latin American economies. Stablecoins, for example, offer a solution for individuals and businesses to store and transact in a more stable currency, reducing the risk of value erosion.

However, it is important to note that with the adoption of cryptocurrencies comes the need for regulation and oversight. Latin American governments and regulatory bodies are beginning to recognize the potential of digital assets but are also taking steps to ensure consumer protection and prevent illicit activities.

In conclusion, the embrace of cryptocurrencies in Latin America holds immense potential for financial inclusion, economic growth, and innovation. As the region continues to unlock this potential, it is crucial for both governments and individuals to understand the risks and benefits associated with this emerging technology.

Embracing Financial Inclusion

Latin America is at the forefront of embracing cryptocurrencies as a means to achieve financial inclusion. With the rise of digital currencies like MXNT, Mexican Ethereum, and Tron, more and more people in the region are gaining access to financial services that were previously out of reach.

One of the main advantages of cryptocurrencies in achieving financial inclusion is the ability to bypass traditional banking systems. In Latin America, many people do not have access to basic banking services, such as a bank account or credit card. This means they are excluded from participating in the formal economy and are unable to access loans or other financial services.

However, with cryptocurrencies, anyone with a smartphone and internet connection can now participate in the global financial system. They can receive payments, make purchases, and transfer money without the need for a traditional bank account. This opens up new opportunities for individuals and businesses to transact and grow their wealth.

Benefits for the Unbanked

Latin America has a significant percentage of unbanked individuals, who have been historically marginalized from the formal financial system. Cryptocurrencies offer a lifeline to these individuals, providing them with access to financial services that were previously unavailable.

By embracing cryptocurrencies like MXNT, Mexican Ethereum, and Tron, the unbanked can now store their wealth in digital wallets, make online purchases, and send money to family members in other countries. This not only provides them with financial freedom but also helps to stimulate local economies and bridge the wealth gap.

Moreover, cryptocurrencies have the potential to empower entrepreneurs and small businesses in Latin America. By accepting digital payments, these businesses can expand their customer base and reach a wider audience. This levels the playing field and allows for greater competition and economic growth.

The Road to Financial Inclusion

While the adoption of cryptocurrencies in Latin America is gaining momentum, there are still challenges that need to be addressed. Public education and awareness about cryptocurrencies are essential to ensure that individuals understand how to use them safely and securely. Governments and regulatory authorities also need to establish clear guidelines and policies to protect consumers and prevent fraud.

Overall, the embrace of cryptocurrencies in Latin America represents a transformative shift towards financial inclusion. As more people gain access to digital currencies like MXNT, Mexican Ethereum, and Tron, the region will experience greater economic empowerment and prosperity.

The Role of MXNT

MXNT, also known as Mexican Ethereum, is a cryptocurrency that is playing a crucial role in the financial inclusion movement in Latin America. With its decentralized nature and secure blockchain technology, MXNT is empowering individuals and businesses to participate in the global economy.

1. Facilitating Cross-Border Transactions

One of the key features of MXNT is its ability to facilitate fast and low-cost cross-border transactions. Traditional banking systems often impose high fees and lengthy processing times for international transfers, making it challenging for individuals and businesses to engage in global trade.

MXNT removes these barriers by leveraging blockchain technology to enable near-instantaneous transactions with minimal fees. This not only enhances financial inclusion but also fosters economic growth by promoting international trade and investment.

2. Empowering the Unbanked Population

In Latin American countries, a significant portion of the population is unbanked or underbanked, meaning they lack access to basic financial services. MXNT is addressing this issue by providing a digital financial infrastructure that is accessible to anyone with a smartphone and internet connection.

By using MXNT, unbanked individuals can store, send, and receive money securely without the need for a traditional bank account. This enables them to participate in the digital economy, access credit and loans, and build their financial identity.

3. Promoting Financial Stability

MXNT is also contributing to financial stability in Latin America by reducing the dependency on traditional fiat currencies. Cryptocurrencies like MXNT are not subject to the same volatility and inflation risks as national currencies, providing individuals and businesses with a more stable store of value.

Additionally, MXNT’s transparent blockchain technology helps combat corruption and improves accountability in financial transactions. By recording all transactions on the blockchain ledger, MXNT ensures transparency and eliminates the risk of fraud or manipulation.

In conclusion, MXNT is playing a pivotal role in driving financial inclusion and economic growth in Latin America. Through its cross-border transaction capabilities, empowerment of the unbanked population, and promotion of financial stability, MXNT is unlocking the potential of individuals and businesses in the region.

Exploring Mexican Ethereum

Mexican Ethereum, or MXNT, is a cryptocurrency that is gaining popularity in Latin America, particularly in Mexico. MXNT is a digital currency that operates on the Ethereum blockchain, offering users a decentralized and secure way to transact and store value.

One of the main advantages of using MXNT is its potential for financial inclusion. In a region where traditional banking services may be inaccessible to many, MXNT allows individuals to participate in the global economy and take control of their financial future.

MXNT is designed to be user-friendly and accessible to all. The currency can be easily stored and managed using digital wallets, which are widely available on mobile devices. This allows users to make transactions anytime, anywhere, without the need for a traditional bank account.

Benefits of MXNT

There are several benefits to using MXNT as a digital currency:

- Security: MXNT utilizes the Ethereum blockchain, which is known for its robust security measures. Transactions made using MXNT are encrypted and recorded on the blockchain, ensuring transparency and preventing fraud.

- Low Fees: Compared to traditional banking services, MXNT transactions often come with lower fees. This makes it an attractive option for individuals looking to save money on their financial transactions.

- Fast Transactions: MXNT transactions are typically processed quickly, allowing users to send and receive funds in a timely manner. This is especially beneficial for individuals who rely on remittances or need to make time-sensitive payments.

How to Get Started with MXNT

If you’re interested in exploring MXNT and experiencing the benefits it offers, here’s how you can get started:

- Download a digital wallet that supports MXNT.

- Create an account and follow the instructions to set up your wallet.

- Once your wallet is set up, you can purchase MXNT from cryptocurrency exchanges or through peer-to-peer trading.

- Start using MXNT to transact, store value, and take advantage of the financial opportunities it provides.

With the increasing adoption of cryptocurrencies like MXNT, Latin America is unlocking new possibilities for financial inclusion and economic growth. By exploring MXNT, individuals in Mexico and beyond can embrace the power of decentralized finance and take control of their financial future.

Tron: A Game Changer

Tron is a digital currency that has been making waves in the Latin American market. With its low transaction costs and fast processing times, Tron has quickly become a game changer for financial inclusion in the region.

One of the main advantages of Tron is its ability to bridge traditional financial systems with decentralized technologies. This means that individuals and businesses can easily transfer funds between different currencies and platforms, without relying on intermediaries or paying exorbitant fees.

In addition, Tron has gained popularity in Latin America due to its focus on entertainment and gaming. The platform allows users to create and distribute content, as well as participate in decentralized applications (dApps), such as online casinos and virtual reality experiences.

Tron’s impact on the Latin American market has been significant. It has provided individuals with access to financial services that were previously inaccessible or too expensive. This has helped to promote financial inclusion and empower individuals to take control of their own finances.

Furthermore, Tron has also opened up new opportunities for businesses in the region. By leveraging Tron’s technology, businesses can streamline their operations, reduce costs, and reach a wider audience. This has been particularly beneficial for small and medium-sized enterprises, which often struggle to access traditional financing options.

Overall, Tron has proven to be a game changer in the Latin American market. Its low transaction costs, fast processing times, and focus on entertainment and gaming have revolutionized financial inclusion in the region. As more individuals and businesses embrace Tron, the potential for economic growth and development in Latin America is immense.

What is “Unlocking the Potential: How Latin America is Embracing Cryptocurrencies like MXNT, Mexican Ethereum, and Tron for Financial Inclusion” about?

“Unlocking the Potential: How Latin America is Embracing Cryptocurrencies like MXNT, Mexican Ethereum, and Tron for Financial Inclusion” is a book that explores how Latin America is adopting cryptocurrencies like MXNT, Mexican Ethereum, and Tron to promote financial inclusion. It discusses the benefits of these cryptocurrencies and their potential to provide financial services to the unbanked and underbanked population in Latin America.

What are MXNT, Mexican Ethereum, and Tron?

MXNT, Mexican Ethereum, and Tron are cryptocurrencies that are being embraced by Latin America for financial inclusion. MXNT is a digital currency designed to be used in Mexico, Mexican Ethereum is a blockchain platform that enables the development of decentralized applications, and Tron is a blockchain-based platform that aims to decentralize the web.

How are cryptocurrencies like MXNT, Mexican Ethereum, and Tron promoting financial inclusion in Latin America?

Cryptocurrencies like MXNT, Mexican Ethereum, and Tron are promoting financial inclusion in Latin America by providing a decentralized and accessible financial system. These cryptocurrencies allow individuals without access to traditional banking services to participate in the economy, make secure transactions, and access financial services such as lending and remittances.

What are the advantages of using cryptocurrencies like MXNT, Mexican Ethereum, and Tron for financial inclusion?

There are several advantages of using cryptocurrencies like MXNT, Mexican Ethereum, and Tron for financial inclusion in Latin America. Firstly, these cryptocurrencies provide a secure and transparent way of conducting financial transactions. They also eliminate the need for intermediaries, reducing transaction costs. Additionally, cryptocurrencies can be accessed by anyone with a smartphone and an internet connection, enabling financial services for the unbanked and underbanked population.

Are there any challenges or risks associated with using cryptocurrencies like MXNT, Mexican Ethereum, and Tron for financial inclusion in Latin America?

While cryptocurrencies have the potential to promote financial inclusion, there are challenges and risks that need to be considered. One challenge is the lack of regulatory framework in many Latin American countries, which can lead to uncertainty and potential risks for consumers. Additionally, the volatility of cryptocurrencies can pose risks for individuals using them for financial transactions. It is important for individuals and policymakers to be aware of these challenges and work towards creating a safe and inclusive cryptocurrency ecosystem.