The market price of TRON, a popular cryptocurrency, is a topic of great interest for investors and traders. As with any cryptocurrency, the worth of TRON is subject to a multitude of factors that can significantly impact its value. Understanding these factors is crucial for informed decision-making in the crypto market.

1. Market Sentiment: The sentiment of traders and investors plays a vital role in shaping the market price of TRON. Positive sentiment can lead to increased demand and, consequently, a rise in its value, while negative sentiment can result in a decline.

2. Technology Development: TRON’s worth is influenced by advancements in its underlying blockchain technology. Innovations such as the introduction of new features, scalability improvements, and increased security can enhance its credibility and attract more investors.

3. Network Usage: The level of network usage on TRON’s blockchain network can impact its value. Higher usage indicates increased adoption and utility, which can positively affect the market price.

4. Regulatory Environment: Regulation plays a significant role in the cryptocurrency market. Changes in regulations or government policies regarding cryptocurrencies can have a profound impact on TRON’s value.

It is important to note that the market price of TRON is highly volatile and can be influenced by a combination of these factors, as well as other external factors such as global economic conditions and investor speculation. Conducting comprehensive research and analysis is essential for staying informed and making sound investment decisions.

Factors Affecting TRON’s Market Price

As with any cryptocurrency, the market price of TRON (TRX) is influenced by a variety of factors. These factors can impact the demand, supply, and overall perception of TRON and its value among investors and traders. Understanding these factors can help individuals make informed decisions when it comes to buying, selling, or holding TRON.

1. Market Sentiment: The overall sentiment of the cryptocurrency market can have a significant impact on TRON’s market price. Positive news, such as partnerships or new developments, can bolster investor confidence and drive up demand for TRON, leading to an increase in its price. On the other hand, negative news or market trends can create fear and uncertainty, causing a decline in price.

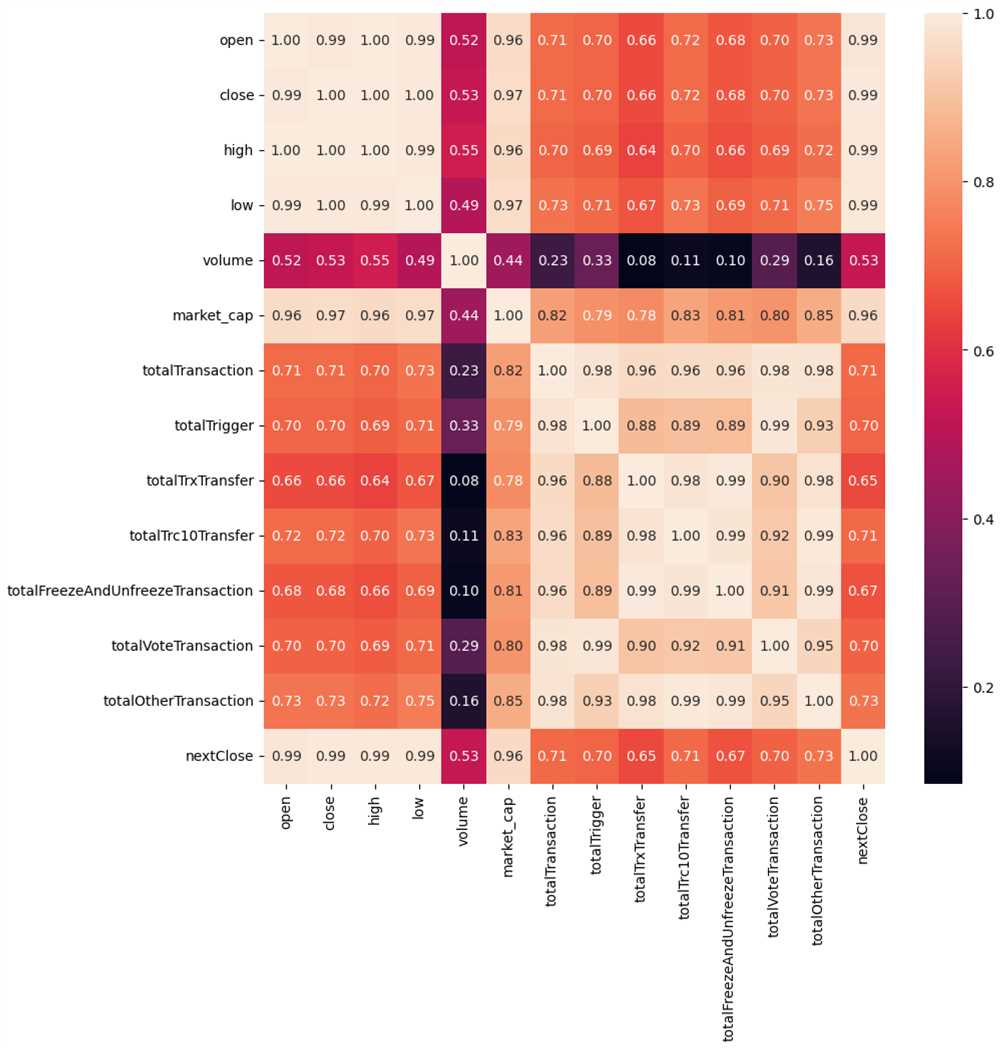

2. Adoption and Usage: The level of adoption and usage of TRON’s blockchain platform is another key factor affecting its market price. The more widely used and accepted TRON becomes, the more valuable it is likely to be perceived by investors. Factors such as the number of active users, transaction volumes, and the success of decentralized applications built on the TRON network can all impact its market price.

3. Competition: TRON operates in a highly competitive market, with numerous other blockchain platforms vying for attention and market share. The competitive landscape and the success of competing platforms can influence TRON’s market price. Positive developments or advancements by competitors may attract investor interest away from TRON, potentially putting downward pressure on its price.

4. Regulatory Environment: The regulatory environment surrounding cryptocurrencies and blockchain technology can also affect TRON’s market price. Changes in regulations or government policies can create uncertainty and impact investor sentiment. Increased regulation may make it more difficult for TRON to operate or dampen overall market demand, potentially leading to a decline in its price.

5. Technological Developments: The technological advancements and updates made to TRON’s blockchain platform can also influence its market price. Improvements in scalability, speed, security, or the introduction of new features and functionalities can increase TRON’s appeal to users and investors. Positive technological developments can drive up demand and subsequently impact TRON’s market price.

It is important for individuals interested in TRON to stay informed about these and other factors that may affect its market price. By keeping a close eye on market trends, news, and developments, investors and traders can make more educated decisions and potentially maximize their returns.

Economic Conditions

Economic conditions have a significant impact on TRON’s market price. Understanding the economic climate and its influence on cryptocurrencies is essential for investors and traders.

1. Macroeconomic Factors

The macroeconomic factors, such as inflation, interest rates, and fiscal policies, can affect the value of TRON. Inflation erodes the purchasing power of currencies, making cryptocurrencies like TRON an attractive alternative investment.

Interest rates play a crucial role in determining investment opportunities. High-interest rates can lead to capital outflows from cryptocurrencies to traditional investment instruments, affecting TRON’s demand and market price.

Fiscal policies, such as taxation and government spending, can also impact TRON’s price. Stimulus measures or tax incentives can drive demand for cryptocurrencies, while stringent regulations can have the opposite effect.

2. Global Geopolitical Landscape

The global geopolitical landscape can create uncertainties that influence TRON’s value. Political instability, trade disputes, and economic sanctions can disrupt financial markets and lead to increased demand for decentralized digital assets like TRON.

For example, during times of geopolitical tension, investors may seek refuge in cryptocurrencies as a hedge against traditional currency fluctuations and economic volatility.

3. Technological Advances

The advancement of technology has a profound impact on TRON’s market price. Innovations in blockchain technology, scalability solutions, and smart contracts can enhance TRON’s usability, attracting more users and investors to the ecosystem.

Moreover, technological advancements in the broader cryptocurrency and blockchain industry can positively or negatively affect TRON’s price. Positive developments, such as the integration of cryptocurrencies into mainstream financial institutions, can lead to increased adoption and demand for TRON.

However, negative developments, such as security breaches or regulatory crackdowns, can result in decreased trust and utility for TRON, leading to a decline in its market price.

In conclusion, TRON’s market price is influenced by various economic conditions. Macroeconomic factors, the global geopolitical landscape, and technological advances all play a significant role in shaping TRON’s value. Therefore, monitoring and analyzing these factors is crucial for any investor or trader interested in the cryptocurrency market.

Technological Developments

The market price of TRON is greatly influenced by the technological developments surrounding the cryptocurrency. TRON is continuously evolving to improve its scalability, security, and functionality, which in turn affects its value in the market.

One of the significant technological developments in the TRON ecosystem is the implementation of the TRON Virtual Machine (TVM). The TVM is a lightweight, Turing complete virtual machine that allows developers to create and execute smart contracts on the TRON blockchain. This innovation provides developers with the tools and resources needed to build decentralized applications (DApps) on the TRON platform, which increases its utility and attracts more users.

In addition to the TVM, TRON constantly works on improving its network throughput and transaction speeds. The introduction of the Sun Network, a Layer 2 scaling solution, aims to address the scalability limitations of the TRON blockchain. This upgrade enhances the network’s capacity and reduces congestion, making TRON a more efficient and user-friendly platform for conducting transactions.

Furthermore, TRON is actively exploring and integrating cutting-edge technologies like artificial intelligence (AI) and machine learning (ML) into its ecosystem. These technological advancements enable TRON to develop innovative solutions and improve the overall user experience. For example, TRON is leveraging AI and ML algorithms to enhance its decentralized file storage system, making it more secure, reliable, and cost-effective.

Overall, the continuous technological developments of TRON contribute to its growth and potential as an investment. As the TRON ecosystem expands and becomes more robust, it attracts a larger user base and increases demand for TRON tokens, ultimately influencing its market price.

Regulatory Environment

The regulatory environment plays a crucial role in influencing the worth of TRON in the market. Government policies and regulations can have a significant impact on the cryptocurrency market as a whole.

Like other cryptocurrencies, TRON faces various regulatory challenges that can affect its market price. Different countries have different regulatory frameworks when it comes to cryptocurrencies, and these regulations can create both opportunities and obstacles for TRON.

One of the key factors in the regulatory environment is the stance of governments towards cryptocurrencies. Some governments embrace cryptocurrencies and have implemented favorable regulations to encourage their use and adoption, while others have taken a more cautious approach. The level of government support or resistance can have a direct impact on the price of TRON.

Another crucial aspect is the legal status of cryptocurrencies. Some countries have legalized cryptocurrencies, recognizing them as legitimate financial instruments. This legal recognition provides a certain level of stability and trust, which can positively impact the market price of TRON. On the other hand, countries that have banned or restricted cryptocurrencies can create uncertainty and negatively affect TRON’s price.

Besides government regulations, international regulatory bodies, such as the Financial Action Task Force (FATF), also play a significant role in shaping the regulatory environment. The FATF sets global standards for anti-money laundering and counter-terrorism financing measures. Compliance with these standards can enhance the credibility and trustworthiness of cryptocurrencies like TRON, further impacting its market value.

Investors closely monitor the regulatory environment to assess the risks and opportunities associated with TRON. They consider factors such as government support, legal recognition, and compliance with international standards when making investment decisions. Any changes in the regulatory landscape can directly affect market demand and, subsequently, TRON’s market price.

| Government Support | Positive |

|---|---|

| Legal Status | Varies by country |

| FATF Compliance | Important |

What is TRON’s current market price?

As of [insert date], TRON’s current market price is [insert price]. Please note that the market price of TRON may vary due to various factors such as market demand and supply.

What factors influence the worth of TRON in the market?

There are several factors that can influence the worth of TRON in the market. These factors include the overall demand and popularity of TRON, technological advancements and developments in the TRON network, market sentiment and investor confidence, regulatory developments and government policies, as well as global macroeconomic factors such as inflation and interest rates.

How can I analyze TRON’s market price?

To analyze TRON’s market price, you can consider various factors such as TRON’s trading volume, price trends, market sentiment, and overall market conditions. You can also use technical analysis tools and indicators to examine patterns and trends in TRON’s price charts. Additionally, it can be helpful to stay informed about the latest news and developments related to TRON and the cryptocurrency market as a whole.

What are the potential risks associated with TRON’s market price?

Like any other cryptocurrency, TRON’s market price is subject to various risks. These risks can include market volatility, regulatory changes, security vulnerabilities, competition from other cryptocurrencies, and overall market sentiment. It’s important to conduct thorough research and consider your risk tolerance before making any investment decisions related to TRON.

Is TRON a good investment option?

Deciding whether TRON is a good investment option depends on individual circumstances and risk tolerance. It’s important to conduct thorough research, consider the potential risks and rewards, and seek advice from financial professionals before making any investment decisions. Keep in mind that the cryptocurrency market can be highly volatile and unpredictable, so it’s essential to approach investments with caution.