When it comes to investing, there are numerous options available in the market. And with the rise of blockchain technology, new investment opportunities have emerged, one of which is Tronstaking. Tronstaking is a unique way of earning passive income by staking TRX, the cryptocurrency of the Tron network. But how does it compare to traditional investments?

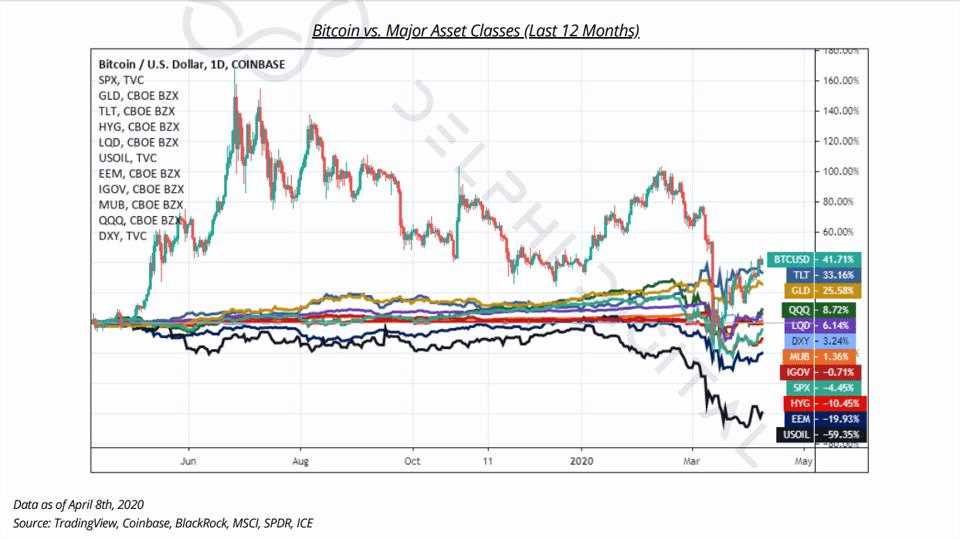

Traditional investments, such as stocks, bonds, and real estate, have been the go-to options for years. They offer stability and generally have a proven track record. However, Tronstaking presents an alternative approach that promises higher returns and greater decentralization.

Unlike traditional investments that require significant capital, Tronstaking allows you to start with as little as a few TRX coins. This accessibility makes it appealing to a wider audience, including individuals who may not have the means to invest in traditional assets. Moreover, staking TRX doesn’t involve complex paperwork or intermediaries, which can be time-consuming and costly in traditional investments.

Another advantage of Tronstaking is the potential for higher returns. While traditional investments may generate consistent but modest profits, Tronstaking offers the possibility of earning a percentage of the block rewards issued by the Tron network. This means that as the network grows and more transactions occur, your staked TRX can generate increasing returns.

Additionally, Tronstaking is a more decentralized investment option compared to traditional investments. In traditional investments, you rely on centralized financial institutions and intermediaries, which can have limitations and pose risks. With Tronstaking, your investment is secured by the blockchain technology, which ensures transparency, immutability, and reduced counterparty risk.

It’s important to note that Tronstaking, like any investment, carries some risks. The value of cryptocurrencies can be volatile, and the market can fluctuate. However, with proper research and risk management, Tronstaking can offer a unique opportunity to diversify your investment portfolio and potentially earn higher returns compared to traditional investments.

Understanding Tronstaking Basics

Tronstaking is a revolutionary concept in the world of cryptocurrency investing. It is a process that allows individuals to earn passive income by staking their TRX tokens on the Tron blockchain. Staking involves holding and locking up a certain amount of TRX tokens in a staking contract for a specific period of time, during which the tokens are used to validate transactions and secure the network. In return, participants are rewarded with additional TRX tokens.

One of the key benefits of Tronstaking is the ability to earn passive income. Unlike traditional investments where you rely on the price appreciation of your assets, staking allows you to generate income simply by holding and locking up your tokens. This can be especially beneficial for individuals who have a long-term investment strategy and want to earn a consistent return on their TRX holdings.

The Process of Tronstaking

The process of Tronstaking involves a few simple steps. First, you need to acquire TRX tokens, which can be done through various cryptocurrency exchanges. Once you have obtained the tokens, you need to choose a staking platform or service that supports Tronstaking. There are several options available, each with its own set of features and benefits.

After selecting a staking platform, you need to create an account and deposit your TRX tokens into the staking contract. The tokens will then be staked, and you will start earning rewards based on the staking requirements and the duration of the staking period. It’s important to note that during the staking period, you will not be able to withdraw or use the staked tokens.

The Risks and Rewards of Tronstaking

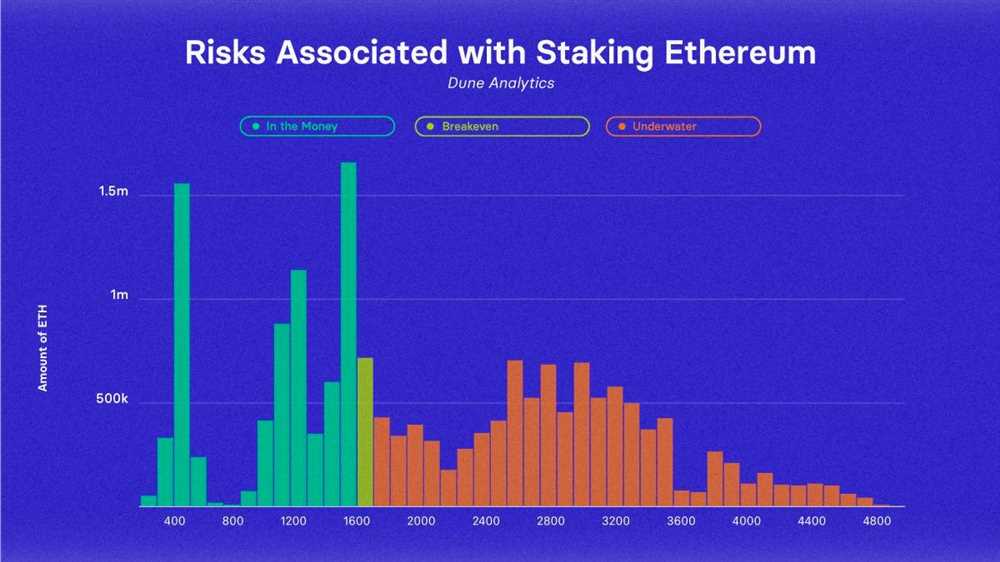

Like any investment, Tronstaking comes with its own set of risks and rewards. One of the main risks is the potential loss of the staked tokens. While Tronstaking is generally considered safe, there is always a possibility of network attacks or vulnerabilities that could result in the loss of your tokens. It’s important to research and choose a reputable staking platform to minimize this risk.

On the other hand, the rewards of Tronstaking can be quite lucrative. By staking your TRX tokens, you have the opportunity to earn additional TRX tokens as rewards. The amount of rewards you earn will depend on various factors such as the staking requirements, the duration of the staking period, and the overall network participation.

In conclusion, Tronstaking offers a unique and potentially profitable way to earn passive income by staking your TRX tokens. By understanding the basics of Tronstaking and carefully selecting a reliable staking platform, you can take advantage of this innovative investment opportunity.

Key Benefits of Tronstaking

Tronstaking offers several key benefits for investors looking to maximize their returns:

| Benefit | Description |

|---|---|

| High Returns | Tronstaking provides the opportunity to earn high returns on investment. By staking TRX tokens, investors can participate in the Tron network and earn passive income in the form of staking rewards. |

| Low Risk | Compared to traditional investments, Tronstaking carries a lower risk. The Tron network is built on blockchain technology, which provides increased security and transparency. Additionally, staked TRX tokens are locked, reducing the risk of price volatility. |

| Accessibility | Tronstaking is accessible to anyone with a TRON wallet and TRX tokens. There are no barriers to entry, and investors can start staking with a small amount of tokens. This makes Tronstaking a more inclusive investment option. |

| Flexibility | Tronstaking offers flexibility in terms of staking duration. Investors can choose to stake their tokens for short or long periods, depending on their investment goals. This allows for customization and the ability to adapt to changing market conditions. |

| Community Participation | By staking TRX tokens, investors become active participants in the Tron community. They have the opportunity to vote on important network decisions and contribute to the governance and development of the Tron ecosystem. |

Overall, Tronstaking provides a lucrative and low-risk investment opportunity with accessibility and community involvement, making it an attractive option for investors seeking to diversify their portfolio.

Advantages of Traditional Investments

Traditional investments offer several advantages over Tronstaking or other alternative investment options. Here are some key advantages:

1. Stability:

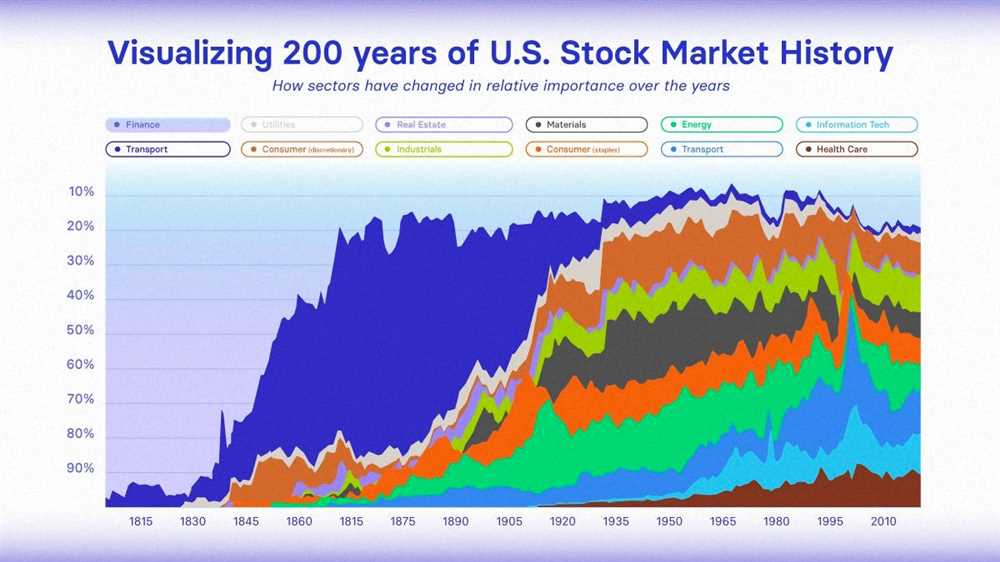

Traditional investments, such as stocks, bonds, and real estate, have a long history of stability. They are less volatile compared to newer investment options like cryptocurrencies. This stability provides a sense of security and predictability for investors.

2. Diversification:

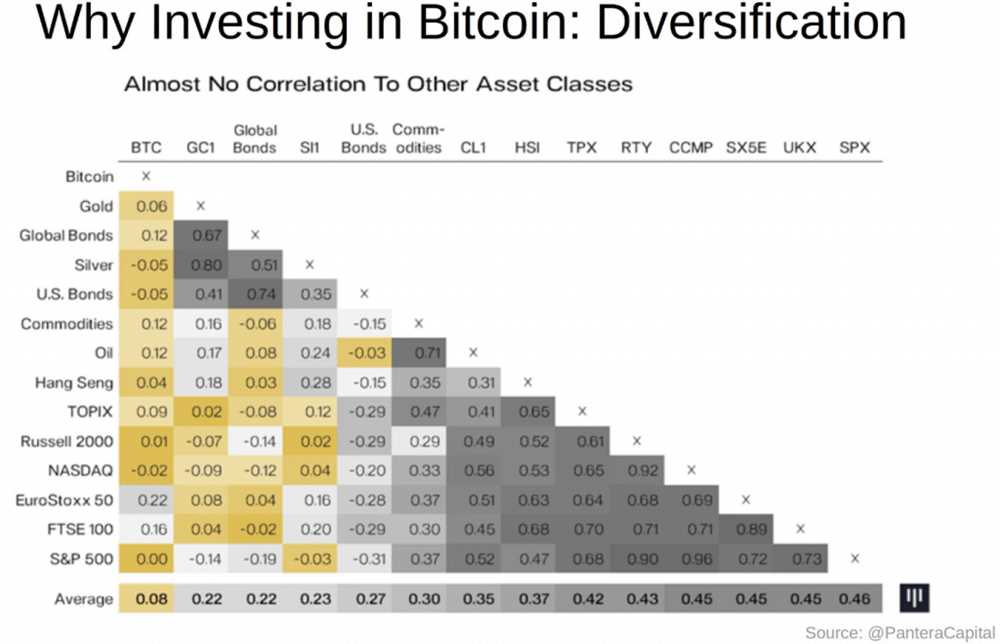

Traditional investments allow for diversification. Investors can spread their investments across different asset classes, industries, and geographic regions to reduce risk. This diversification can help mitigate the impact of market fluctuations and protect against substantial losses.

3. Potential for Long-Term Growth:

Traditional investments have the potential for long-term growth. Stocks, for example, have historically shown solid returns over the long run. By investing in established companies with a proven track record, investors can benefit from compounding returns and accumulate wealth over time.

4. Income Generation:

Many traditional investments offer regular income generation. Dividend stocks, bonds, and rental properties can provide a steady stream of income through dividends, interest payments, or rental payments. This income can be used to cover expenses or reinvested for further growth.

5. Established Infrastructure:

Traditional investments benefit from an established infrastructure. Stock exchanges, brokerage firms, and banks have well-developed systems and processes in place to facilitate investment transactions. This makes it easier for investors to buy, sell, and transfer traditional investment assets.

6. Regulatory Oversight:

Traditional investments are subject to regulatory oversight and investor protection laws. Governments and regulatory bodies enforce rules and regulations to safeguard investors’ interests, ensure transparency, and prevent fraudulent activities. This regulatory oversight provides a layer of security for investors.

In summary, traditional investments offer stability, diversification, long-term growth potential, income generation, an established infrastructure, and regulatory oversight. These advantages make them an attractive option for investors looking for a more traditional approach to investing.

Comparing Tronstaking and Traditional Investments

When it comes to investing, there are several options to choose from. Tronstaking and traditional investments are two popular choices, each with their own pros and cons. In this article, we will compare the two to help you make an informed decision.

| Tronstaking | Traditional Investments | |

|---|---|---|

| Definition | Tronstaking involves locking your TRX tokens in a smart contract to support the Tron network and earn staking rewards. | Traditional investments refer to investing in traditional assets like stocks, bonds, real estate, or mutual funds. |

| Level of Risk | Tronstaking carries some level of risk as the value of TRX tokens can fluctuate. However, the risk is generally lower compared to other cryptocurrencies. | Traditional investments can vary significantly in terms of risk, depending on the asset class. Stocks, for example, can be more volatile compared to bonds. |

| Return on Investment | Tronstaking offers a potential return on investment in the form of staking rewards, which are typically higher than traditional interest rates offered by banks. | Traditional investments can provide returns through dividends, interest payments, or capital appreciation. |

| Liquidity | Tronstaking might have limited liquidity, depending on the lock-up period. Some staking programs have a minimum lock-up period, which means your funds may be tied up for a specific duration. | Traditional investments generally offer more liquidity, as you can sell your assets on the market and access your funds relatively quickly. |

| Accessibility | Tronstaking is accessible to anyone with TRX tokens and a compatible wallet. It doesn’t require a large amount of capital to start. | Traditional investments may have higher barriers to entry, such as minimum investment requirements or access to certain markets. |

It’s important to consider your risk tolerance, financial goals, and investment knowledge when deciding between Tronstaking and traditional investments. Both options have their own advantages and disadvantages, and it’s up to you to choose the one that aligns with your investment strategy.

How does Tronstaking work?

Tronstaking is a process where users lock their TRX tokens in a smart contract in order to earn rewards. These rewards are usually in the form of additional TRX tokens that are distributed to users who participate in the staking process. The staking period can vary, but typically, the longer users stake their TRX tokens, the higher the rewards they can earn.

What are the benefits of Tronstaking compared to traditional investments?

Tronstaking offers several advantages over traditional investments. Firstly, it provides a way for users to earn passive income by simply holding and staking their TRX tokens. This can be particularly attractive for individuals who are looking for alternative investment opportunities. Additionally, Tronstaking typically offers higher interest rates compared to traditional savings accounts, allowing users to potentially earn higher returns on their investments.