In a recent interview, Coinbase CEO Brian Armstrong shared his thoughts on the impact of U.S. regulations on the rapidly growing cryptocurrency industry. As one of the largest cryptocurrency exchanges in the world, Coinbase has had a front-row seat to the evolving regulatory landscape.

Armstrong emphasized the need for clear and fair regulations that foster innovation and protect investors. He noted that while some regulations are necessary to prevent fraud and abuse, overly burdensome regulations could stifle the industry’s growth and potential.

Armstrong believes that the United States has a unique opportunity to become a global leader in the crypto space, but it needs to strike the right balance with its regulatory approach. He expressed concerns over the lack of regulatory clarity, which has forced many blockchain and cryptocurrency companies to seek more favorable jurisdictions abroad.

Despite these challenges, Armstrong remains optimistic about the future of cryptocurrencies in the United States. He highlighted the growing interest among institutional investors and the general public, which indicates a shift towards mainstream adoption. However, he cautioned that without sensible regulations, the United States risks falling behind other countries in the global crypto race.

Armstrong concluded the interview by calling on regulators to work closely with industry leaders to develop a regulatory framework that encourages innovation while safeguarding consumers and investors. He believes that by striking the right balance, the United States can create an environment that fosters technological advancements and positions itself as a leader in the digital economy.

Coinbase CEO Brian Armstrong

Brian Armstrong is the CEO and co-founder of Coinbase, one of the largest cryptocurrency exchanges in the world. As a prominent figure in the crypto industry, Armstrong has been at the forefront of discussions surrounding the impact of U.S. regulations on the industry.

Armstrong has previously expressed concerns about the regulatory landscape in the United States, arguing that excessive regulations could stifle innovation and hinder the growth of the crypto industry. He has called for clear and reasonable regulations that provide certainty for businesses and investors while also protecting consumers.

Advocating for Regulatory Clarity

Armstrong has been vocal about the need for regulatory clarity, particularly in regards to securities laws and the classification of cryptocurrencies. He believes that the lack of clear guidelines from regulatory agencies has resulted in uncertainty and ambiguity, creating obstacles for companies and individuals operating in the industry.

In an effort to address these concerns, Armstrong has advocated for a regulatory framework that treats cryptocurrencies and blockchain technology as separate entities from traditional financial assets. He argues that a one-size-fits-all approach to regulation does not work for the unique characteristics of cryptocurrencies and that a more nuanced and flexible approach is needed.

Engagement with Regulators

Despite his concerns, Armstrong has actively engaged with regulators and policymakers to advocate for the interests of the crypto industry. He has participated in congressional hearings, industry conferences, and other forums to educate lawmakers and regulators about the benefits and potential of cryptocurrencies.

Armstrong has also emphasized the importance of collaboration between industry stakeholders and regulators in developing effective regulations. He believes that open dialogue and cooperation are key to creating a regulatory framework that balances innovation and consumer protection.

In conclusion, Coinbase CEO Brian Armstrong has been a strong advocate for regulatory clarity and innovation-friendly regulations in the crypto industry. His insights and engagement with regulators have played a significant role in shaping the ongoing regulatory discussions in the United States and beyond.

Discusses Impact of U.S. Regulations

The impact of U.S. regulations on the crypto industry has been a topic of much discussion and debate. Coinbase CEO Brian Armstrong recently shared his insights on how these regulations are shaping the future of cryptocurrencies and blockchain technology.

Regulatory Challenges

According to Armstrong, one of the biggest challenges faced by the crypto industry is the lack of clear and consistent regulations in the United States. The regulatory landscape is fragmented, with different state and federal agencies having different approaches to cryptocurrencies. This lack of regulatory clarity creates uncertainty for businesses and investors, inhibiting innovation and growth in the industry.

Armstrong believes that a more coordinated and harmonized approach to regulations is needed to provide a stable and predictable environment for cryptocurrencies to thrive. He called for clearer guidelines on issues such as taxation, custody, and securities laws, which would give companies and individuals the confidence to invest and participate in the crypto economy.

Building Trust

Another aspect of regulations that Armstrong discussed is the importance of building trust in the crypto industry. He acknowledged that there have been instances of fraud and manipulation in the market, which have shaken public trust in cryptocurrencies. However, he emphasized that regulations should be designed to protect consumers and investors without stifling innovation.

Armstrong proposed a collaborative approach where regulators work closely with industry participants to develop effective regulations that address concerns without impeding progress. He highlighted the need for a balance between safeguarding against illegal activities and allowing for innovation and experimentation in this rapidly evolving space.

Conclusion

The impact of U.S. regulations on the crypto industry cannot be overstated. As the industry continues to grow and mature, it is crucial to establish a regulatory framework that fosters innovation, protects consumers, and builds trust. Coinbase CEO Brian Armstrong’s insights shed light on the challenges and opportunities that lie ahead, and his call for clearer and coordinated regulations resonates with many stakeholders in the crypto community.

on Crypto Industry

The impact of U.S. regulations on the crypto industry cannot be underestimated. As the CEO of Coinbase, Brian Armstrong is on the forefront of this ongoing discussion. He understands that regulations have the power to shape the future of cryptocurrency and blockchain technology.

Armstrong acknowledges the importance of striking a balance between protecting investors and promoting innovation. While he acknowledges the need for regulations to prevent fraudulent activities and ensure consumer protection, he also emphasizes the importance of creating an environment that fosters innovation and allows businesses to thrive.

Regulatory Challenges

One of the biggest challenges faced by the crypto industry is the lack of clarity in regulations. The uncertain regulatory landscape creates barriers to entry for businesses and stifles innovation. Start-ups and established companies alike are often left in a state of limbo, unsure of how to navigate the complex regulatory environment.

Armstrong highlights the need for clear and concise regulations that provide guidance to businesses while also allowing for flexibility and adaptation. He believes that a collaborative approach between regulators and industry leaders is crucial to developing effective regulations that strike the right balance.

The Global Perspective

The impact of U.S. regulations extends beyond the borders of the country. As the global leader in the crypto industry, the United States has the power to influence the direction of the industry on a global scale. Other countries often look to the U.S. as a model for regulation, leading to a ripple effect that can shape the industry worldwide.

Armstrong stresses the importance of taking a global perspective when developing regulations. He emphasizes the need for international collaboration and a harmonized approach to regulation to avoid fragmentation and promote a healthy global crypto ecosystem.

In Conclusion

The impact of U.S. regulations on the crypto industry is undeniable. As the CEO of Coinbase, Brian Armstrong recognizes the need for regulations to protect investors and prevent fraudulent activities. However, he also emphasizes the importance of creating a regulatory environment that supports innovation and allows businesses to thrive. Clear and concise regulations, global collaboration, and a balanced approach are key factors in shaping the future of the crypto industry.

Current State of U.S. Cryptocurrency Regulations

The cryptocurrency industry in the United States is currently operating in a gray area when it comes to regulations. While some progress has been made in providing clarity, there is still a long way to go in establishing comprehensive rules that protect investors and facilitate innovation.

Regulatory Challenges

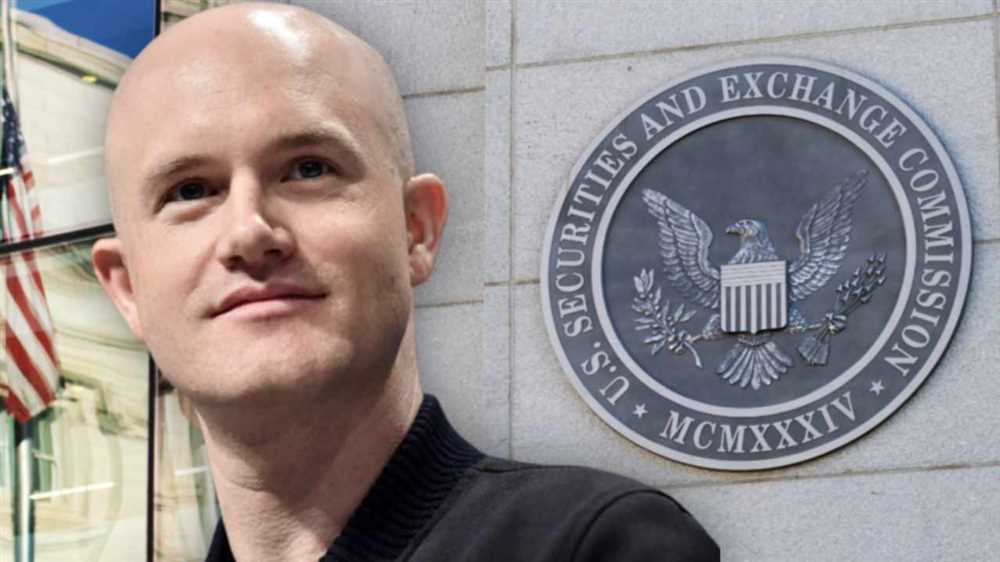

One of the main challenges with cryptocurrency regulations in the U.S. is the lack of consistency among different agencies and jurisdictions. The Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), and the Financial Crimes Enforcement Network (FinCEN) all have different approaches and definitions when it comes to cryptocurrencies.

This lack of uniformity creates uncertainty for businesses and investors, as it is often unclear which regulations apply to their activities. Additionally, outdated laws and regulations designed for traditional financial systems do not adequately address the unique characteristics and challenges of cryptocurrencies.

The Need for Clarity

Many industry leaders and experts believe that clear and comprehensive regulations are necessary for the long-term growth and stability of the cryptocurrency industry in the U.S. Clarity would provide a level playing field for companies, protect consumers from fraud and scams, and attract institutional investors who require regulatory certainty.

Regulations should also strike a balance between protecting investors and promoting innovation. Excessive regulation could stifle innovation and drive businesses and talent overseas, while insufficient regulation could leave investors vulnerable to fraud and market manipulation.

Furthermore, regulatory clarity could help the U.S. maintain its competitive edge in the global cryptocurrency market. Other countries such as Switzerland and Singapore have already established clear regulatory frameworks, attracting cryptocurrency businesses and investment.

Industry players, including Coinbase CEO Brian Armstrong, have expressed their willingness to work with regulators to establish clear rules that benefit all stakeholders. By engaging in open dialogue and collaboration, regulators and industry participants can develop regulations that strike the right balance and support the growth of the cryptocurrency industry.

Challenges Faced by Crypto Industry

The crypto industry has faced several challenges since its inception. These challenges have been primarily due to the evolving regulatory environment, market volatility, and security concerns.

1. Regulatory Environment

One of the biggest challenges faced by the crypto industry is the uncertainty surrounding the regulatory environment. Different countries and jurisdictions have taken different approaches to regulate cryptocurrencies and digital assets. This lack of uniform regulation makes it difficult for businesses and users to navigate the legal landscape and can hinder the growth and adoption of cryptocurrencies.

2. Market Volatility

Another significant challenge for the crypto industry is market volatility. Cryptocurrencies are known for their price fluctuations, which can be quite severe at times. This volatility can make it difficult for businesses and individuals to predict and plan for the future, leading to uncertainty and hesitation for adoption.

Furthermore, market volatility can also be exploited by malicious actors for fraudulent activities such as pump and dump schemes or market manipulation. Such activities can damage the trust and credibility of the crypto industry.

3. Security Concerns

Security is a critical issue that the crypto industry constantly faces. Cyber attacks targeting cryptocurrency exchanges and wallets have resulted in significant financial losses for both businesses and individuals. These security breaches not only compromise the funds and personal information of users but also erode trust in the crypto industry as a whole.

Additionally, the decentralized nature of cryptocurrencies can make it challenging to recover lost or stolen funds. The absence of a central authority to oversee transactions and provide recourse in the event of fraud adds another layer of complexity to security concerns.

Overall, the challenges faced by the crypto industry are multifaceted and require concerted efforts from industry players, regulators, and users to address them effectively. Regulatory clarity, increased security measures, and stable market conditions are necessary to foster trust and promote wider adoption of cryptocurrencies.

Importance of Clear Regulations

Clear regulations are paramount in the cryptocurrency industry to ensure its healthy growth and widespread adoption. Without clear and comprehensive regulations, the industry faces numerous challenges and uncertainties that hinder its development and potentially expose users to risks.

Protecting Investors

One of the main reasons why clear regulations are important is to protect investors. With well-defined rules and frameworks in place, investors can have more confidence in entering the cryptocurrency space, knowing that there are measures in place to safeguard their interests.

Clear regulations help to prevent fraudulent activities and scams, as they provide a legal framework for identifying and prosecuting bad actors. This not only protects individual investors but also helps to create a safer and more trustworthy ecosystem for everyone involved.

Promoting Innovation

Clear regulations also foster innovation within the crypto industry. When entrepreneurs and developers have a clear understanding of the rules and requirements, they can build and innovate without fear of unknowingly violating any laws. This promotes a vibrant and competitive market where ideas can flourish.

Moreover, clear regulations provide guidance on compliance and best practices. By adhering to these standards, businesses can focus on innovation rather than spending resources on legal battles or regulatory ambiguities.

By establishing a regulatory framework that encourages innovation and provides legal clarity, governments can position themselves as attractive destinations for crypto-related businesses and investments. This can lead to economic growth and job creation within this emerging industry.

Overall, clear regulations in the cryptocurrency industry are essential for protecting investors and promoting innovation. By providing a solid legal framework, governments can support the growth and development of this dynamic sector while ensuring the safety and integrity of the market.

How do U.S. regulations affect the cryptocurrency industry?

U.S. regulations have a significant impact on the cryptocurrency industry. They can determine the legality and regulatory framework within which cryptocurrency exchanges and businesses operate. Regulations can affect everything from how exchanges onboard users to how they handle customer funds and comply with anti-money laundering (AML) and know your customer (KYC) requirements.

What are the concerns of Coinbase CEO regarding U.S. regulations?

One of the main concerns of Coinbase CEO Brian Armstrong is the lack of clarity and consistency in U.S. regulations. He believes that unclear or conflicting regulations can stifle innovation and hinder the growth of the cryptocurrency industry. Armstrong also expresses concerns about potential regulatory overreach and the need for a balanced approach that fosters innovation while protecting consumers.

How does regulation impact customer privacy?

Regulations, especially those aimed at combating money laundering and terrorism financing, can impact customer privacy within the cryptocurrency industry. Exchanges and businesses may be required to collect and verify customer information, such as identity documents, and share this information with regulatory authorities or law enforcement when requested. This can raise concerns about the privacy and security of personal data.

What is Brian Armstrong’s stance on regulation?

Brian Armstrong believes that regulation is inevitable for the cryptocurrency industry and that it can bring important benefits, such as increased consumer protection and industry legitimacy. However, he emphasizes the importance of clear and sensible regulations that promote innovation and do not stifle the industry’s growth potential. Armstrong also advocates for a collaborative approach between regulators and industry participants to ensure that regulations are effective and fair.