In the evolving world of cryptocurrency, staking has attracted significant attention from investors and enthusiasts alike. Staking involves the process of holding and validating transactions on a blockchain network in exchange for earning rewards. While it has gained popularity as a way to earn passive income, concerns have been raised about its potential risks and the concentration of power it may bring.

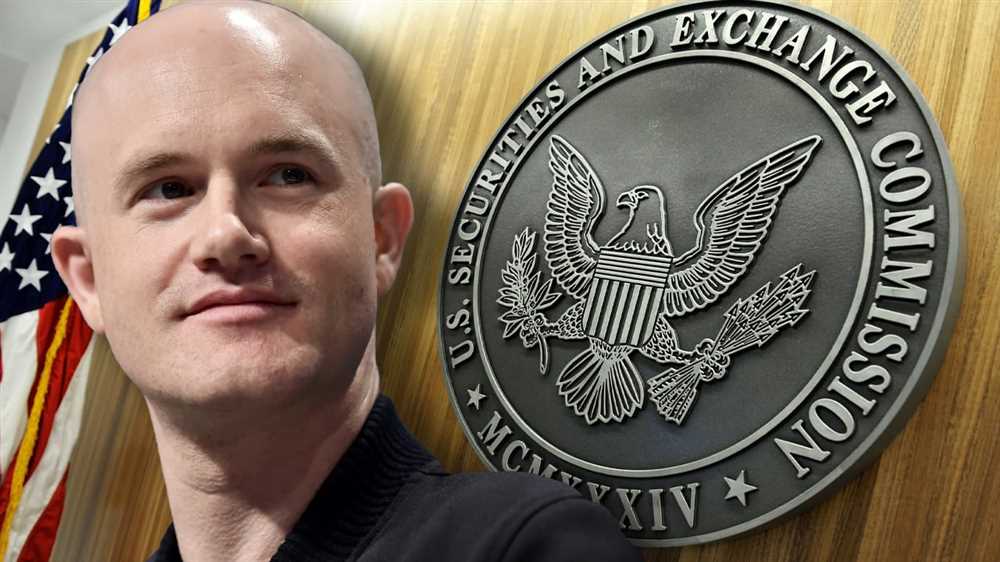

In a recent blog post, Coinbase CEO Brian Armstrong shared his thoughts on the growing trend of staking in the crypto industry. He acknowledged the appeal of staking for investors, as it offers a way to earn rewards on their cryptocurrency holdings without actively trading. However, Armstrong pointed out several key concerns that need to be addressed.

One of the main concerns raised by Armstrong is the potential for centralization of power in staking. As more investors participate in staking, there is a risk that a few large players or organizations may gain significant control over the network. This concentration of power could undermine the decentralized nature of blockchain and potentially lead to manipulation or censorship of transactions.

To address this concern, Armstrong suggested the need for a more distributed and decentralized staking ecosystem. He proposed the development of new protocols and technologies that would allow smaller investors to participate in staking and have a say in the network’s governance. By promoting inclusivity and preventing any one entity from dominating the staking process, the industry can ensure a fair and secure environment for all participants.

While staking presents exciting opportunities in the crypto industry, it is crucial to consider the potential risks and challenges associated with it. As the industry continues to evolve, it is vital for industry leaders like Brian Armstrong to raise awareness and build a sustainable staking ecosystem that benefits the entire crypto community.

Coinbase CEO Brian Armstrong: Concerns Raised

In the rapidly evolving world of cryptocurrency, one of the most pressing concerns raised by industry experts is the issue of staking. Staking refers to the process of holding and validating blockchain transactions in exchange for rewards. While staking offers the potential for significant returns, it also carries certain risks and challenges.

Brian Armstrong, the CEO of Coinbase, one of the largest cryptocurrency exchanges in the world, has recently expressed his concerns about staking in the crypto industry. In a blog post, Armstrong highlighted the need for greater education and awareness about staking, as well as the importance of responsible participation in the staking ecosystem.

One of the main concerns raised by Armstrong is the potential concentration of power among a few large staking providers. As staking requires a significant amount of capital and technical expertise, it could result in a small number of players dominating the staking market. This concentration of power could undermine the decentralized nature of many cryptocurrencies and lead to increased centralization.

In addition, Armstrong pointed out the risk of slashing, which refers to the penalty imposed on stakers who behave maliciously or fail to meet their obligations. Slashing can result in the loss of a portion or all of the staked funds, which can have severe consequences for individual stakers and the overall stability of the network.

To address these concerns, Armstrong called for industry-wide efforts to develop and implement best practices for staking. This includes ensuring transparency and accountability among staking providers, encouraging diversity in the staking ecosystem, and promoting education and awareness about the potential risks and rewards of staking.

As the crypto industry continues to grow and evolve, it is crucial for industry leaders like Brian Armstrong to raise awareness about the potential challenges and risks associated with staking. By working together to address these concerns, the industry can foster a more secure and decentralized ecosystem for staking and cryptocurrency as a whole.

About Coinbase and its CEO

Coinbase is a leading cryptocurrency exchange platform founded in 2012 by Brian Armstrong and Fred Ehrsam. It provides a secure and user-friendly platform for buying, selling, and storing various cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

Brian Armstrong, the CEO of Coinbase, is a well-known figure in the crypto industry. With a background in computer science and engineering, Armstrong became interested in the potential of blockchain technology and cryptocurrencies early on. He co-founded Coinbase with the mission of making cryptocurrencies accessible to everyone.

Under Armstrong’s leadership, Coinbase has grown significantly, becoming one of the most trusted and respected names in the cryptocurrency industry. With its emphasis on security, regulatory compliance, and customer support, Coinbase has gained the trust of millions of users worldwide.

Philosophy and Vision

Armstrong envisions a future where cryptocurrencies play a major role in the global financial system. He believes that by providing easy access to cryptocurrencies and improving the user experience, Coinbase can help drive mass adoption of digital assets.

One of Coinbase’s core values is to be a trusted and transparent platform. Armstrong has emphasized the importance of regulatory compliance and has worked closely with regulators to ensure that Coinbase operates within the legal frameworks of the countries it operates in.

Armstrong is also known for his commitment to philanthropy and his belief in the power of cryptocurrencies to create positive social impact. He has pledged to donate a significant portion of his wealth to charitable causes through the Giving Pledge initiative.

Conclusion

As the CEO of Coinbase, Brian Armstrong has played a pivotal role in shaping the crypto industry. Through his leadership, Coinbase has become a trusted platform for millions of users, facilitating the adoption of cryptocurrencies on a global scale. Armstrong’s vision and commitment to transparency and regulatory compliance continue to drive Coinbase’s success and position it as a leader in the industry.

The Staking Trend in the Crypto Industry

The concept of staking has gained significant popularity in the crypto industry in recent years. Staking allows cryptocurrency holders to actively participate in the network and earn rewards by locking up their tokens to support the network’s operations. This trend has been driven by the growing popularity of proof-of-stake (PoS) consensus algorithms, which offer an alternative to the energy-intensive proof-of-work (PoW) algorithms used by cryptocurrencies like Bitcoin.

By staking their tokens, individuals can contribute to network security and help to validate transactions. In return, they are rewarded with additional tokens. This has created a new avenue for individuals to earn passive income by simply holding their cryptocurrencies in a staking wallet.

The Benefits of Staking

There are several advantages to staking in the crypto industry:

- Earn Passive Income: Staking allows individuals to earn a passive income stream by simply holding their cryptocurrencies in a staking wallet.

- Support Network Security: By staking their tokens, individuals help to secure the network against potential attacks and malicious activities.

- Participate in Governance: Staking often gives individuals the right to participate in the governance of the network, allowing them to vote on protocol upgrades and other important decisions.

- Reduce Selling Pressure: Staking helps to reduce the selling pressure on the market by incentivizing holders to lock up their tokens, which can contribute to price stability.

The Challenges and Risks

While staking presents many benefits, there are also challenges and risks associated with it:

- Technical Complexity: Staking requires individuals to set up and manage a staking wallet, which may involve technical complexities and potential security risks.

- Market Volatility: The value of staked tokens can be subject to market fluctuations, which may affect the overall profitability of staking.

- Slashing Risks: In some staking networks, participants can face penalties or have their staked tokens slashed if they violate certain rules or engage in malicious activities.

- Centralization Concerns: Staking also raises concerns about centralization, as larger holders may have a greater influence on network governance and decision-making.

Despite these challenges, staking continues to gain traction in the crypto industry as more projects implement PoS consensus algorithms and provide staking opportunities to their users. It remains an attractive option for individuals looking to actively participate in the network and earn rewards in a decentralized manner.

| Pros | Cons |

|---|---|

| Earn passive income | Technical complexity |

| Support network security | Market volatility |

| Participate in governance | Slashing risks |

| Reduce selling pressure | Centralization concerns |

Staking in the Crypto Industry: Definition and Benefits

Staking has emerged as a popular activity in the crypto industry, offering investors the opportunity to earn passive income by participating in the validation and security of blockchain networks. In simple terms, staking involves holding and locking a certain amount of cryptocurrency in a wallet to support the operations of a blockchain network.

One of the key benefits of staking is the potential to earn rewards in the form of additional tokens. By staking their crypto holdings, users can actively contribute to the network’s consensus mechanism and help secure the blockchain. In return, they are rewarded with new tokens, which can be sold or reinvested to compound their earnings.

Another advantage of staking is its role in promoting network decentralization. Unlike traditional proof-of-work (PoW) consensus mechanisms, staking relies on validators who hold a stake in the network. This encourages greater participation from a diverse set of stakeholders, reducing the concentration of power and making the network more resilient to attacks.

In addition, staking presents a way for individuals to actively support blockchain projects they believe in. By staking their tokens, users are essentially voting with their economic stake and showing their confidence in the project’s long-term success. This can contribute to the growth and development of the network, as well as attract more participants.

Furthermore, staking offers a relatively low-risk investment strategy compared to other crypto activities. While market volatility can affect the value of the staked tokens, the rewards earned through staking can offset potential losses. This makes staking an attractive option for investors looking for a stable income stream in the crypto market.

To participate in staking, users typically need to meet certain requirements, such as holding a minimum amount of tokens and running a staking node or delegating their stake to a trusted third-party validator. It’s important for participants to understand the specific staking rules and risks associated with each blockchain network before getting involved.

In conclusion, staking has become a popular and lucrative activity in the crypto industry, providing investors with the opportunity to earn passive income, contribute to network security, promote decentralization, support blockchain projects, and mitigate investment risks. As the crypto market continues to evolve, staking is expected to play an increasingly important role in shaping the industry’s future.

Understanding Staking in the Crypto Industry

Staking has gained significant popularity in the crypto industry, and its growing importance cannot be overlooked. Staking is a unique mechanism that allows cryptocurrency holders to actively participate in blockchain networks by staking their assets and earning rewards.

In simple terms, staking involves holding a certain amount of a particular cryptocurrency in a wallet to support the network’s operations. By doing so, users become validators, who confirm and validate transactions on the blockchain. Validators are responsible for maintaining the network’s integrity, security, and consensus algorithm.

In return for their participation, validators are rewarded with additional cryptocurrency tokens. These rewards usually come from transaction fees or newly minted tokens in the network. The amount of rewards received depends on various factors, including the amount staked, the duration of staking, and the network’s overall performance.

Staking offers several advantages to cryptocurrency holders. First and foremost, it allows them to earn passive income on their holdings. Instead of keeping their assets idle in a wallet, users can put them to work and generate additional tokens. Staking also encourages healthy network participation and decentralization, as validators play a crucial role in maintaining the blockchain’s operations.

However, staking also comes with certain risks. Validators are required to lock their assets for a specified period, which can limit their liquidity and access to funds. Additionally, staking on networks with low security or poor performance can expose validators to potential losses.

As the crypto industry continues to evolve, staking is expected to play an increasingly important role. It has the potential to revolutionize how cryptocurrencies are secured, incentivize participation, and drive network growth. However, it is crucial for users to conduct thorough research and carefully evaluate the risks and rewards before engaging in staking activities.

The Potential Benefits of Staking

Staking has emerged as a popular option for cryptocurrency holders, offering several potential benefits. Here are some key advantages of staking:

1. Earning Passive Income: By staking their coins, individuals can earn passive income in the form of staking rewards. Staking allows users to participate in the network’s consensus mechanism and contribute to block validation, for which they are rewarded with additional tokens.

2. Supporting the Network: Staking is a way for users to support the blockchain network and contribute to its security and decentralization. By staking their coins, individuals help maintain the network’s integrity and ensure its smooth operation.

3. Lowering Volatility: Staking can help reduce the volatility of certain cryptocurrencies. When users stake their coins, they lock them up for a specific period, which reduces their supply in the market. This reduced supply can lead to a decrease in price volatility, making the cryptocurrency more stable.

4. Enhanced Governance Rights: Some blockchains offer governance mechanisms that allow stakers to participate in the decision-making process. By staking their coins, users gain voting power and can have a say in the network’s future development, such as protocol upgrades or changes to on-chain rules.

5. Encouraging Long-Term Holding: Staking incentivizes users to hold onto their coins for a longer period. Unlike trading where assets are bought and sold frequently, staking rewards are often earned over time and encourage a long-term investment approach.

6. Green Impact: Staking can have a positive environmental impact compared to traditional mining. Proof-of-stake (PoS) consensus mechanisms, which are commonly used in staking, consume significantly less energy compared to proof-of-work (PoW) mechanisms.

It’s important to note that staking also carries risks, including potential token slashing for misbehavior or technical vulnerabilities. Before engaging in staking, individuals should thoroughly research and understand the associated risks and rewards.

What are the concerns about staking in the crypto industry?

One of the concerns about staking in the crypto industry is the centralization of power. Staking allows users to lock up their cryptocurrency in order to support the network, but this can lead to a concentration of power in the hands of a few big players who have a significant amount of coins to stake. This can potentially lead to a loss of decentralization and control over the network.

How does staking work in the crypto industry?

Staking is a process in which users lock up their cryptocurrency in a wallet to support the network and validate transactions. In return for their support, users earn rewards in the form of additional cryptocurrency. Staking is often used in proof-of-stake (PoS) blockchain networks, where validators are chosen based on the amount of cryptocurrency they hold and are willing to lock up. This helps secure the network and maintain consensus.

What is Coinbase’s stance on staking?

Coinbase, a popular cryptocurrency exchange, has ventured into staking services and offers staking rewards to its users. However, there are concerns that Coinbase’s staking services contribute to the centralization of power in the crypto industry. Some argue that Coinbase’s large user base and ability to offer staking on multiple cryptocurrencies give the company disproportionate influence over the networks it supports. Others believe that Coinbase’s entry into the staking market is a positive sign for the industry and helps to further validate and promote the concept of staking.