In recent years, cryptocurrency adoption has been on the rise worldwide, and Mexico and other countries in Latin America are no exception. With their unique financial landscape and a growing number of tech-savvy individuals, these countries have become hotbeds for cryptocurrency use and innovation.

Mexico, in particular, has emerged as a strong player in the cryptocurrency market. The country has a large population of unbanked individuals, making it an ideal environment for cryptocurrencies to thrive. Cryptocurrencies offer a way for these individuals to access and manage their finances without traditional banking services. This has resulted in a significant increase in the adoption of cryptocurrencies, such as Bitcoin, in Mexico.

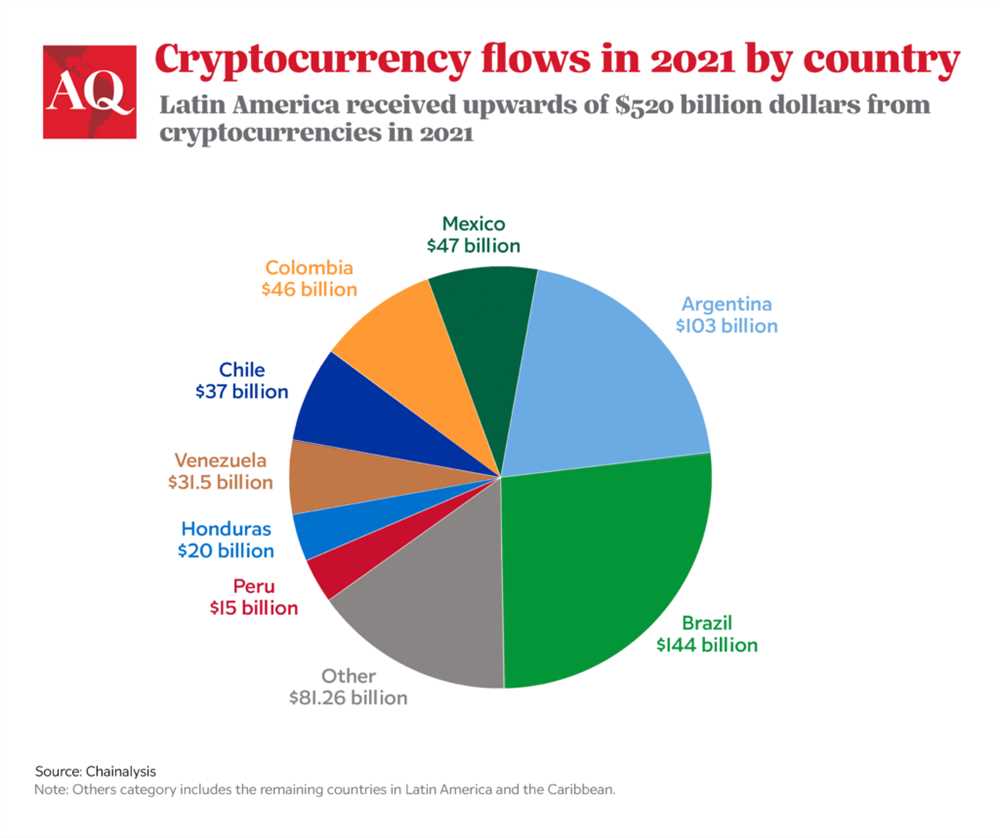

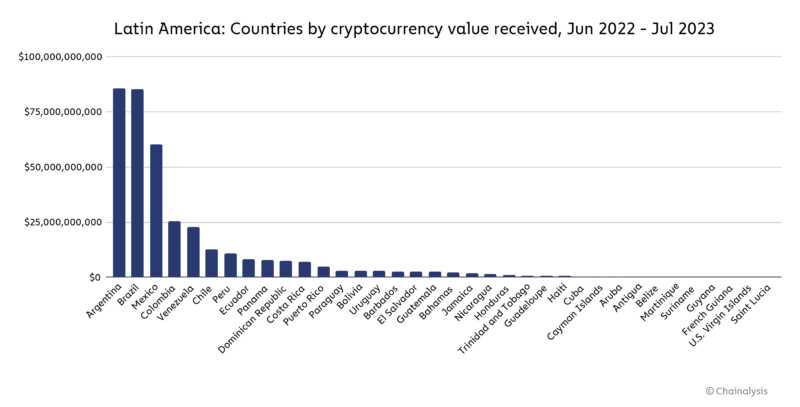

Latin America as a whole has also embraced cryptocurrencies, with countries like Brazil, Colombia, and Argentina quickly adopting digital currencies. The decentralized nature of cryptocurrencies appeals to citizens who are disillusioned with traditional financial institutions and governments. Cryptocurrencies provide an alternative form of payment and store of value, allowing individuals to have more control over their finances.

Furthermore, the remittance market in Latin America plays a significant role in the rise of cryptocurrency adoption. Many individuals in the region rely on remittances from family members working abroad. However, traditional remittance services can be expensive and slow, with high transfer fees and lengthy processing times. Cryptocurrencies offer a faster and more cost-effective solution, allowing individuals to send and receive money across borders in a matter of minutes.

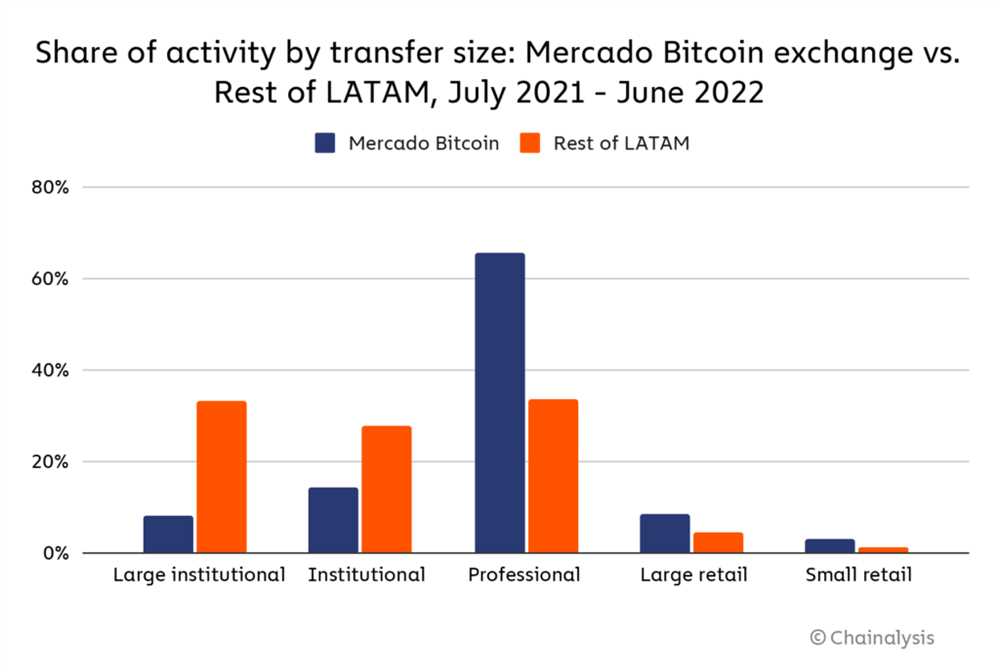

The rise of cryptocurrency adoption in Mexico and Latin America has also led to a surge in local cryptocurrency startups and exchanges. These companies are working towards creating a robust cryptocurrency infrastructure in the region, making it easier for individuals to buy, sell, and use digital currencies. This has not only contributed to the growth of the cryptocurrency market but also to the overall technological advancement in the region.

In conclusion, Mexico and Latin America are experiencing a significant rise in cryptocurrency adoption driven by various factors such as a large unbanked population, disillusionment with traditional financial institutions, and the need for faster and more affordable remittance services. As cryptocurrencies continue to gain traction, it is expected that the region will play a crucial role in shaping the future of the global cryptocurrency market.

The Growing Popularity of Cryptocurrencies in Mexico and Latin America

In recent years, cryptocurrencies have experienced a surge in popularity in Mexico and Latin America. This region has seen a significant increase in cryptocurrency adoption, with more individuals and businesses embracing these digital assets as a form of payment and investment.

One of the main drivers of cryptocurrency adoption in Mexico and Latin America is the lack of access to traditional banking services. Many people in the region are unbanked or underbanked, meaning they do not have access to basic financial services such as bank accounts or credit cards. Cryptocurrencies offer an alternative way for these individuals to store and transfer money securely without the need for a traditional bank.

Furthermore, cryptocurrencies provide a solution to the high remittance fees that are prevalent in Mexico and Latin America. Many people in the region rely on remittances from family members working abroad as a source of income. However, traditional remittance services often charge high fees for transferring money across borders. Cryptocurrencies enable individuals to send and receive money quickly and at a low cost, making them an attractive option for remittances.

In addition to the practical advantages, cryptocurrencies have also gained popularity among investors in Mexico and Latin America. With the volatility of traditional markets and the economic instability in the region, many individuals are looking for alternative investment options. Cryptocurrencies offer the potential for high returns and diversification, which has led to an increase in interest and investment in these digital assets.

The Role of Government Regulation

Government regulation has played a significant role in the rise of cryptocurrency adoption in Mexico and Latin America. While some countries in the region have embraced cryptocurrencies and implemented supportive regulations, others have taken a more cautious approach. The level of government involvement and regulation varies from country to country, which can impact the level of adoption and acceptance of cryptocurrencies.

Challenges and Future Outlook

Despite the growing popularity of cryptocurrencies in Mexico and Latin America, there are still several challenges that need to be addressed. One of the main challenges is the lack of education and awareness about cryptocurrencies. Many people in the region are still unfamiliar with how cryptocurrencies work and the potential benefits they offer.

However, with the increasing adoption and acceptance of cryptocurrencies, the future outlook for these digital assets in Mexico and Latin America is promising. As more individuals and businesses become familiar with cryptocurrencies and their advantages, it is likely that their popularity will continue to grow, opening up new opportunities for economic growth and financial inclusion in the region.

Advantages and Disadvantages of Cryptocurrency Adoption in the Region

Advantages:

1. Financial Inclusion: Cryptocurrency adoption can provide greater financial inclusion for individuals who may not have access to traditional banking services. This is particularly important in rural and underserved areas where banking infrastructure is lacking.

2. Lower Remittance Costs: Cryptocurrencies offer a cheaper and faster way to send money across borders compared to traditional remittance services. This can significantly reduce costs for individuals sending money to their families in other countries.

3. Protection Against Inflation: Many Latin American countries have experienced periods of high inflation. Cryptocurrencies can provide an alternative store of value, protecting individuals’ wealth from devaluation caused by inflation.

4. Transparency and Security: Blockchain technology, which underpins cryptocurrencies, provides a transparent and secure way to record transactions. This can help combat corruption and fraud, providing individuals and businesses with a more secure financial system.

Disadvantages:

1. Volatility: Cryptocurrencies are known for their price volatility, which can make them risky assets to hold. This volatility can make it challenging for individuals and businesses to plan and budget effectively.

2. Lack of Regulation: The lack of clear regulations surrounding cryptocurrencies can create uncertainty and pose risks for users. Without proper oversight, individuals may be exposed to scams, frauds, and other illegal activities.

3. Technological Barriers: Cryptocurrency adoption requires a certain level of technical knowledge and infrastructure. Many individuals in the region may not have access to the necessary technology or resources to participate in the cryptocurrency ecosystem.

4. Energy Consumption: The mining process used to create and verify cryptocurrencies consumes a significant amount of energy. In a region already facing environmental challenges, the energy-intensive nature of cryptocurrencies may raise concerns about sustainability.

In summary, while cryptocurrency adoption in Mexico and Latin America offers advantages such as financial inclusion, lower remittance costs, and protection against inflation, it also comes with challenges such as volatility, lack of regulation, technological barriers, and energy consumption.

Government Regulations and Policies Impacting Cryptocurrency Use

As cryptocurrencies gain popularity and adoption in Mexico and Latin America, government regulations and policies play a crucial role in shaping their use and acceptance within the region.

The Mexican government has taken a progressive stance towards cryptocurrencies, recognizing their potential benefits and risks. In March 2018, Mexico passed a comprehensive fintech law that included provisions for regulating cryptocurrencies. The law aimed to promote innovation while ensuring consumer protection and preventing money laundering. Under this framework, cryptocurrency exchanges must obtain a license from the Mexican central bank (Banco de México) and comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

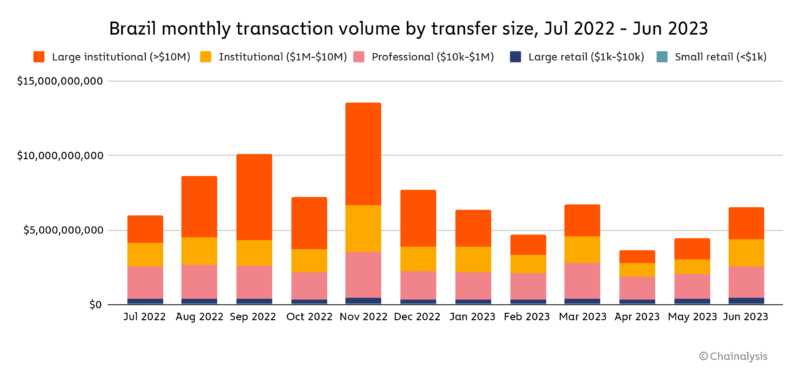

Brazil, another significant country in Latin America, has also implemented regulations to govern cryptocurrency use. In May 2020, the Brazilian government introduced a new law that requires cryptocurrency exchanges to abide by anti-money laundering (AML) rules and register with the country’s financial authorities. These regulations aim to bring transparency, security, and accountability to the cryptocurrency market while protecting users from illicit activities.

Other countries in the region, such as Argentina and Colombia, have taken a more cautious approach to cryptocurrency regulations. While they have not implemented comprehensive laws explicitly addressing cryptocurrencies, they rely on existing financial regulations to govern cryptocurrency transactions. However, both countries have shown an interest in exploring the potential benefits of blockchain technology and are considering developing specific regulations tailored to the cryptocurrency industry.

Despite varying regulatory approaches, the overall trend in Latin America is towards recognizing and embracing cryptocurrency adoption. Governments are making efforts to strike a balance between fostering innovation and protecting consumers and the financial system. By establishing clear regulatory frameworks, governments aim to reduce the risks associated with cryptocurrencies, such as money laundering and fraud, while creating an environment that encourages the growth of the industry.

It is worth noting that government regulations and policies regarding cryptocurrencies are continually evolving as governments learn from the experiences of other countries and adapt to the rapidly changing landscape of cryptocurrencies. These regulations and policies will continue to shape the future of cryptocurrency adoption in Mexico and Latin America.

As the region’s governments further refine their stance on cryptocurrencies, it is crucial for businesses and individuals interested in utilizing cryptocurrencies to stay informed and compliant with the latest regulations. This will help ensure the long-term sustainability and legal acceptance of cryptocurrencies in Mexico and throughout Latin America.

Future Trends and Opportunities for Cryptocurrency Growth in Mexico and Latin America

In recent years, cryptocurrency adoption in Mexico and Latin America has been steadily increasing. However, there are still plenty of opportunities for further growth and development in the region. This section will discuss some of the future trends and opportunities for cryptocurrency in Mexico and Latin America.

1. Increasing acceptance by retailers and businesses

One of the main drivers for cryptocurrency adoption is its acceptance by retailers and businesses. As more merchants in Mexico and Latin America start accepting cryptocurrencies as a form of payment, it will encourage more people to use and invest in these digital assets. This trend is already gaining momentum, with several major retailers in the region, such as e-commerce platforms and physical stores, now accepting cryptocurrencies.

2. Supportive regulatory environment

The regulatory environment for cryptocurrencies in Mexico and Latin America is still evolving. However, there is a growing recognition among governments and regulatory bodies about the potential benefits of cryptocurrencies, such as faster and cheaper cross-border transactions, financial inclusion, and increased economic activity. As regulators develop clear and supportive frameworks for cryptocurrencies, it will attract more investors, businesses, and users, thereby driving further growth.

A positive example is El Salvador, which recently became the first country in the world to adopt Bitcoin as legal tender. This move has attracted global attention and could pave the way for other countries in the region to follow suit.

3. Financial inclusion

One of the key advantages of cryptocurrencies is their ability to provide financial services to unbanked and underbanked populations. In Mexico and Latin America, where a significant portion of the population lacks access to traditional banking services, cryptocurrencies offer an alternative means of storing and transferring value. As awareness and understanding of cryptocurrencies increase, more people in the region will turn to these digital assets as a way to participate in the global economy.

| Opportunity | Description |

|---|---|

| Remittances | Remittances from Latin American countries are a major source of income for many families. Cryptocurrencies offer a faster, cheaper, and more secure way to send and receive money across borders, eliminating the need for expensive intermediaries. |

| Access to financial services | By leveraging cryptocurrencies and blockchain technology, individuals in remote or underserved areas can gain access to a wide range of financial services, such as borrowing, lending, and insurance, without needing a traditional bank account. |

| Small business growth | Entrepreneurs and small businesses in Mexico and Latin America can benefit from cryptocurrencies by accepting digital payments, accessing decentralized financing options, and participating in global markets without the need for expensive intermediaries. |

In conclusion, the future looks promising for cryptocurrency growth in Mexico and Latin America. Increasing acceptance by retailers and businesses, a supportive regulatory environment, and the potential for financial inclusion are key drivers that will fuel the expansion of cryptocurrencies in the region. As these trends continue to evolve, the adoption and use of cryptocurrencies are likely to become more mainstream, providing new opportunities for individuals, businesses, and the overall economy.

Is cryptocurrency adoption on the rise in Mexico and Latin America?

Yes, cryptocurrency adoption is indeed on the rise in Mexico and Latin America. The region has seen a significant increase in the use and acceptance of cryptocurrencies in recent years.

What factors have contributed to the rise of cryptocurrency adoption in Mexico and Latin America?

Several factors have contributed to the rise of cryptocurrency adoption in Mexico and Latin America. These include economic instability, the unbanked population, remittances from abroad, and a lack of trust in traditional financial institutions.