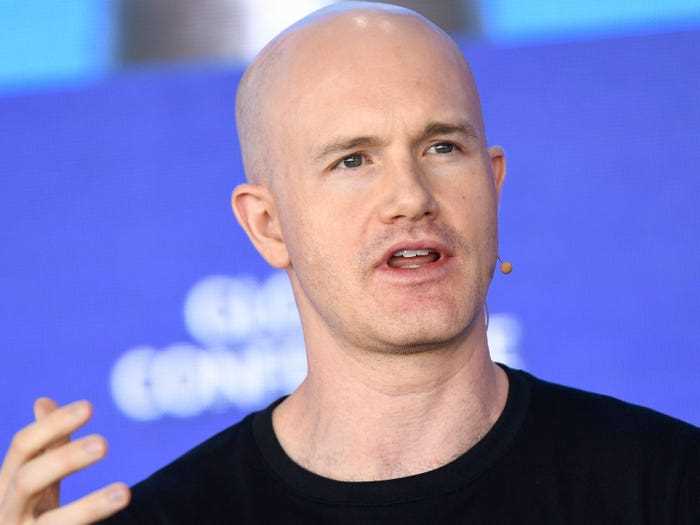

Are you an investor looking to navigate the volatile world of cryptocurrencies? Listen up – Brian Armstrong, the CEO of Coinbase, has just issued a warning that you need to hear.

Stay away from certain cryptocurrencies.

In a recent interview, Armstrong revealed that there are certain cryptocurrencies on the market that should be avoided at all costs. These digital currencies, according to Armstrong, have serious red flags that could spell disaster for unsuspecting investors.

“It’s crucial to do your homework and identify these warning signs,” Armstrong advised. “While there are many legitimate and promising cryptocurrencies out there, there are also scams and poorly designed projects that are out to take advantage of inexperienced investors.”

So, what are these warning signs? Armstrong highlighted a few key factors to watch out for:

- Lack of transparency: If a cryptocurrency lacks transparency in terms of its team, development roadmap, or overall project goals, it’s likely a red flag.

- Unrealistic promises: Be wary of projects that make unbelievable claims of huge returns or guaranteed profits. Remember, there are no guarantees in the cryptocurrency market.

- Unproven technology: Avoid cryptocurrencies that have untested or unproven technology. Look for projects that have a solid foundation and a clear use case.

“Investing in cryptocurrencies can be highly rewarding, but it’s also risky,” Armstrong emphasized. “By avoiding cryptocurrencies with these warning signs, investors can protect themselves and make more informed investment decisions.”

If you’re new to the world of cryptocurrencies or even if you’re an experienced investor, it’s crucial to heed Armstrong’s warning. Do your due diligence, research, and stay informed to avoid falling victim to scams and bad investments.

Why Coinbase CEO Warns Investors

Brian Armstrong, CEO of Coinbase, has recently issued a warning to investors about certain cryptocurrencies. Armstrong advises investors to steer clear of these particular digital assets due to their potential risks and lack of trustworthiness.

One of the main reasons for this caution is the prevalence of scams and fraudulent activities within the cryptocurrency industry. Armstrong states that many investors have fallen victim to various schemes, losing significant amounts of money in the process.

Another concern mentioned by the Coinbase CEO is the lack of regulation in the cryptocurrency market. Without proper oversight and regulations, it becomes challenging for investors to distinguish between legitimate projects and potential scams.

In addition to the risks associated with scams and lack of regulation, Armstrong believes that some cryptocurrencies are highly volatile and prone to sudden price fluctuations. This volatility can lead to significant financial losses for investors who are not prepared for such market movements.

To help investors navigate the cryptocurrency landscape, Coinbase has implemented strict listing criteria for the digital assets it supports. The company conducts rigorous due diligence to ensure that listed cryptocurrencies are legitimate and have a solid foundation.

| 1 | Prevalence of scams and fraudulent activities. |

| 2 | Lack of regulation in the cryptocurrency market. |

| 3 | High volatility and sudden price fluctuations. |

| 4 | Strict listing criteria and due diligence by Coinbase. |

Overall, Brian Armstrong’s warning serves as a reminder for investors to proceed with caution when investing in cryptocurrencies. Conducting thorough research, understanding the risks involved, and choosing reputable platforms are essential steps to mitigate potential losses in this rapidly evolving market.

Risky Cryptocurrencies to Avoid

While the cryptocurrency market offers exciting opportunities for investors, it is important to be cautious and avoid risky investments. Brian Armstrong, the CEO of Coinbase, has issued a warning to investors about certain cryptocurrencies that should be avoided.

1. ShadyCoin

ShadyCoin, despite its name, is a cryptocurrency that should be approached with extreme caution. It has a questionable reputation in the industry and has been involved in several controversies. Investing in ShadyCoin could lead to significant losses, and its lack of transparency should be a red flag for any investor.

2. VolatilityCoin

VolatilityCoin is another cryptocurrency that investors should stay away from. As the name suggests, this cryptocurrency is highly volatile, making it extremely unpredictable. While volatility can present opportunities for high returns, it also increases the risk of massive losses. Investing in VolatilityCoin is not for the faint-hearted.

These are just a few examples of risky cryptocurrencies to avoid. It is essential for investors to conduct thorough research and due diligence before investing in any cryptocurrency. Remember, it’s better to be safe than sorry in the world of cryptocurrency investments.

Potential Dangers for Investors

While the world of cryptocurrencies is filled with exciting investment opportunities, it is important for potential investors to be aware of the potential dangers and risks involved. Here are some key factors to consider before diving into the market:

1. Volatility: Cryptocurrencies are known for their extreme price volatility. The value of a cryptocurrency can experience sudden and significant fluctuations, which can result in substantial financial losses for investors. It is crucial for investors to have a high-risk tolerance and be prepared for the potential ups and downs of the market.

2. Lack of Regulation: Unlike traditional financial markets, cryptocurrencies are not regulated by any central authority or government. This lack of regulation can make cryptocurrencies more susceptible to fraud, manipulation, and other illegal activities. Investors must exercise caution and conduct thorough research before investing in any cryptocurrency.

3. Security Risks: The decentralized and digital nature of cryptocurrencies makes them vulnerable to hacking and security breaches. Investors must take appropriate measures to safeguard their digital assets, such as using secure wallets and following best cybersecurity practices. However, even with stringent security measures in place, there is always a risk of losing funds due to unforeseen security vulnerabilities.

4. Limited Adoption: Despite the growing popularity of cryptocurrencies, their widespread adoption is still limited. Many businesses and individuals do not accept cryptocurrencies as a form of payment, which can restrict their utility and liquidity. This lack of adoption may affect the long-term value and stability of certain cryptocurrencies.

5. Lack of Fundamental Value: The value of cryptocurrencies is primarily driven by market speculation and sentiment, rather than underlying fundamentals. This makes it challenging for investors to assess the true value of a cryptocurrency and predict its future performance. Investors should be cautious of investing in cryptocurrencies solely based on hype and speculation.

In conclusion, while cryptocurrencies offer exciting investment opportunities, potential investors must be mindful of the potential dangers and risks involved. It is crucial to thoroughly research, assess risk tolerance, and exercise caution to make informed investment decisions in the volatile world of cryptocurrencies.

Strategies to Protect Your Investments

Investing in cryptocurrencies can be a lucrative venture, but it also comes with risks. To protect your investments, it is crucial to implement effective strategies that help mitigate potential losses and ensure long-term gains. Here are some key strategies to consider:

1. Do thorough research

Before investing in any cryptocurrency, take the time to conduct extensive research. This includes analyzing the project’s fundamentals, team members, technological advancements, and market trends. By equipping yourself with all the necessary knowledge, you can make informed investment decisions.

2. Diversify your portfolio

One of the most effective ways to protect your investments is by diversifying your portfolio. Spreading your investments across different cryptocurrencies helps reduce the risk of losing all your funds if one specific coin experiences a decline. Consider investing in a mix of established cryptocurrencies and promising up-and-coming projects.

3. Set stop-loss orders

Stop-loss orders are an important risk management tool that can help protect your investments. By setting a stop-loss order, you determine a specific price at which your cryptocurrency holdings will automatically be sold if the price drops below a certain threshold. This can help limit potential losses and prevent emotional decision-making.

4. Keep an eye on market volatility

Cryptocurrency markets are highly volatile, with prices often experiencing significant fluctuations in short periods. Monitoring market volatility is essential to protect your investments. By staying informed about market trends, you can react quickly to potential risks or opportunities.

5. Secure your cryptocurrencies

Ensuring the security of your cryptocurrencies is crucial to protect your investments from hackers and cyber threats. Use reliable wallets to store your coins, implement two-factor authentication, and regularly update your software to the latest versions. Additionally, consider using hardware wallets for an extra layer of security.

| Strategy | Description |

|---|---|

| Thorough Research | Conduct extensive research on cryptocurrencies before investing to make informed decisions. |

| Diversify Your Portfolio | Spread your investments across different cryptocurrencies to reduce risk. |

| Set Stop-Loss Orders | Determine a specific price at which your investments will be sold to limit potential losses. |

| Monitor Market Volatility | Stay informed about market trends to react quickly to potential risks or opportunities. |

| Secure Your Cryptocurrencies | Use reliable wallets, two-factor authentication, and hardware wallets for added security. |

Importance of Research and Due Diligence

When it comes to investing in cryptocurrencies, it is crucial to prioritize research and due diligence. With the rapid growth of the cryptocurrency market, there are now thousands of digital assets available for investment. However, not all cryptocurrencies are created equal, and not all of them hold the same potential for long-term success.

Identifying Strong Investment Opportunities

Proper research allows investors to identify strong investment opportunities within the cryptocurrency market. This includes studying the underlying technology, team behind the project, market demand, and potential risks associated with the investment. By understanding these factors, investors can make informed decisions and navigate the market with confidence.

Minimizing Risks and Avoiding Scams

Research and due diligence are paramount in minimizing risks and avoiding scams in the cryptocurrency industry. While there are legitimate projects with promising prospects, there are also fraudulent schemes and fraudulent cryptocurrencies that pose significant risks to investors. Thorough research can help investors distinguish between legitimate projects and potential scams, safeguarding their investments.

Furthermore, by conducting due diligence, investors can identify any red flags or warning signs associated with a particular cryptocurrency. This can include checking if the project has a working product, a transparent and experienced team, and a strong community backing. By thoroughly assessing these aspects, investors can avoid falling victim to fraudulent projects.

In conclusion, thorough research and due diligence are essential when it comes to investing in cryptocurrencies. By understanding the factors that contribute to the success of a cryptocurrency and being able to distinguish scams from legitimate projects, investors can make informed decisions and safeguard their investments in this dynamic and potentially lucrative market.

What does Brian Armstrong warn investors about?

Brian Armstrong warns investors to steer clear of certain cryptocurrencies.

Why does Brian Armstrong give this warning?

Brian Armstrong gives this warning to protect investors from potential scams and losses.

Which cryptocurrencies should investors avoid?

Brian Armstrong doesn’t specify the exact cryptocurrencies to avoid, but he advises investors to be cautious and do thorough research before investing in any cryptocurrency.

What precautions should investors take before investing in cryptocurrencies?

Investors should take precautions by conducting thorough research, understanding the risks involved, and only investing what they can afford to lose.