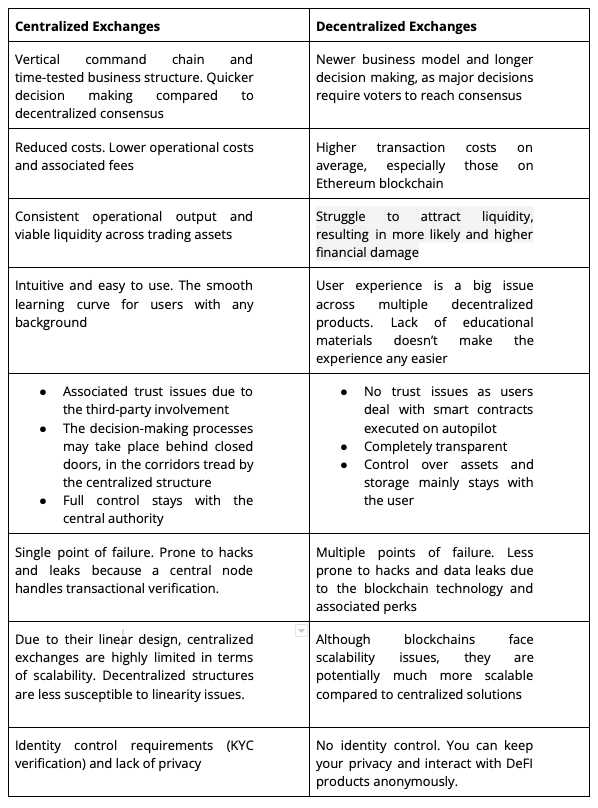

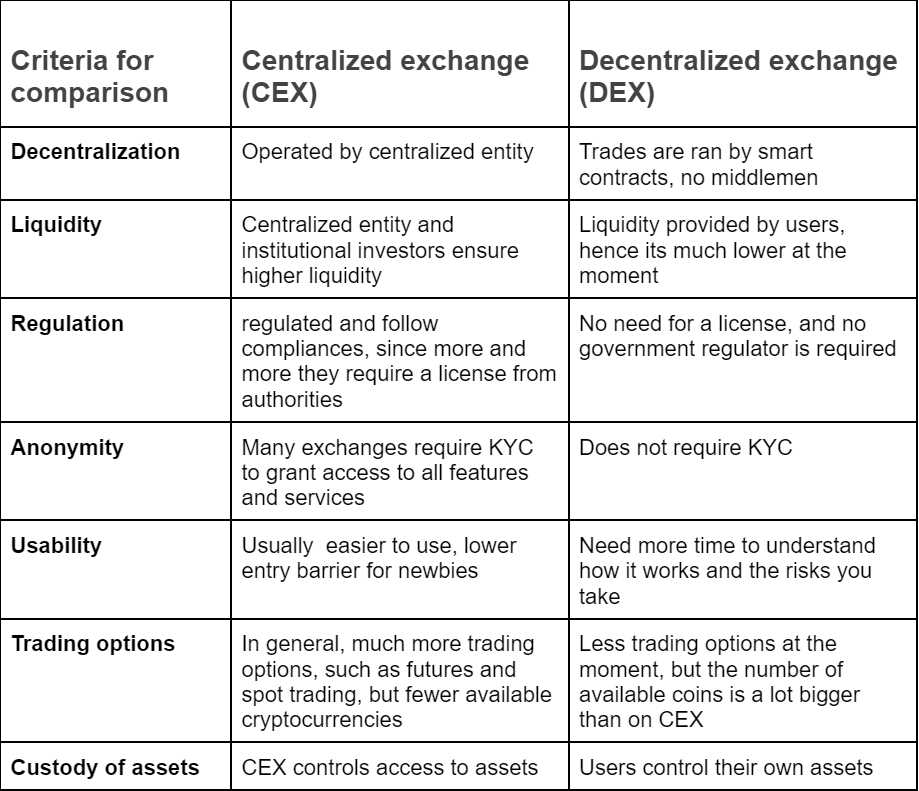

In the world of cryptocurrency trading, exchanges play a crucial role in facilitating the buying and selling of digital assets. Two popular types of exchanges that users can choose from are decentralized exchanges (Dex) and centralized exchanges. Both offer unique features and advantages, but understanding their differences is essential for making informed trading decisions.

A Dex, as the name suggests, operates in a decentralized manner, meaning it does not rely on a central authority to execute trades. Instead, transactions are directly conducted between users through smart contracts on a blockchain network, such as Tronlink. This decentralized nature ensures that users have full control over their funds and eliminates the need for intermediaries.

On the other hand, centralized exchanges function more like traditional stock exchanges. They have a central authority that controls and manages the exchange, matching buyers and sellers and executing trades on behalf of users. While centralized exchanges offer a more user-friendly interface and higher liquidity, they often require users to deposit their funds into the exchange, posing potential security risks.

One key advantage of Dex exchanges is their enhanced security. Since funds are not stored on a centralized server, Dex exchanges are less vulnerable to hacking attempts and attacks. Additionally, Dex exchanges typically do not require users to go through a lengthy registration process or provide personal information, preserving their privacy and anonymity.

However, Dex exchanges do come with their own challenges. Due to their decentralized nature, Dex exchanges might have lower liquidity compared to centralized exchanges. This means that trading volumes and available assets might be limited, making it harder for users to find the desired trading pairs. Furthermore, the execution speed on Dex exchanges can be slower due to the involvement of smart contracts.

In conclusion, understanding the differences between Dex and centralized exchanges is crucial for traders on Tronlink. Dex exchanges offer increased security and privacy, while centralized exchanges provide higher liquidity and user-friendly interfaces. By weighing the advantages and disadvantages of each type, traders can make informed decisions and choose the exchange that best meets their needs.

Overview of Dex and Centralized Exchanges on Tronlink

Dex and Centralized Exchanges are two different types of platforms available on Tronlink. Dex, short for Decentralized Exchange, operates on a peer-to-peer network and does not involve any intermediaries. On the other hand, Centralized Exchanges are traditional exchanges that are operated and controlled by a single authority.

While both types of exchanges enable users to trade cryptocurrencies, there are some key differences between them. Dex exchanges offer a greater level of decentralization, allowing users to maintain control over their funds and trade directly with other users. This eliminates the need for a central authority to hold and manage users’ assets.

Centralized Exchanges, on the other hand, often require users to deposit their funds onto the exchange’s platform, entrusting the exchange with the responsibility of handling and securing their assets. These exchanges usually have higher trading volumes and liquidity, as they are often more popular among traders.

One of the advantages of using Dex exchanges on Tronlink is that they offer a higher level of privacy, as users are not required to provide personal information or go through a KYC (Know Your Customer) process. This can be appealing to users who prioritize anonymity.

On the other hand, Centralized Exchanges usually have more user-friendly interfaces and provide additional services such as margin trading and lending options. They also often have better customer support and faster transaction speeds compared to Dex exchanges.

It is important for users to consider their preferences and priorities when choosing between Dex and Centralized Exchanges on Tronlink. Dex exchanges may be suitable for those who value privacy, decentralization, and direct peer-to-peer trading. Centralized Exchanges, on the other hand, may be more suitable for those who prioritize convenience, user-friendly interfaces, and additional trading features.

Ultimately, both types of exchanges have their own advantages and disadvantages, and users should carefully evaluate their options before making a decision.

Understanding the concept of decentralized exchanges

Decentralized exchanges (DEXs) are a type of cryptocurrency exchange that operates on a decentralized platform. Unlike centralized exchanges, which rely on a third party to hold users’ funds and facilitate transactions, DEXs allow users to trade directly with each other on a peer-to-peer basis.

One key characteristic of DEXs is the absence of a central authority or intermediary. Instead, DEXs rely on smart contracts, which are self-executing contracts with the terms of the agreement written directly into the code. These smart contracts handle the validation and execution of trades, ensuring that transactions are secure and transparent.

By removing the need for a centralized authority, DEXs offer several advantages. First, they eliminate the risk of hacks or theft of funds held by a centralized exchange, as users remain in control of their own wallets. Additionally, DEXs provide greater privacy and censorship resistance, as there is no central entity with the power to block or monitor transactions.

However, DEXs also come with their own set of challenges. Due to their decentralized nature, DEXs may have lower liquidity compared to centralized exchanges, which could impact the speed and efficiency of trades. Additionally, the lack of a central authority means that there is no customer support or recourse in the event of a dispute.

In conclusion, decentralized exchanges offer a new and innovative approach to cryptocurrency trading. By leveraging smart contracts and removing the need for intermediaries, DEXs provide users with greater control, privacy, and security. While there are still challenges to overcome, DEXs are gaining popularity and are an important part of the evolving crypto ecosystem.

Exploring the functionalities of centralized exchanges

A centralized exchange is a platform where transactions are conducted through a trusted third party. In contrast to decentralized exchanges (DEX), which rely on smart contracts and blockchain technology, centralized exchanges are controlled by a single entity that manages the order books and executes trades.

Centralized exchanges offer several functionalities that distinguish them from DEXs:

1. Centralized control: Centralized exchanges have a central authority that manages and regulates the platform. This centralization allows for easier enforcement of regulations and compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

2. Enhanced liquidity: Centralized exchanges often have higher trading volumes and deeper liquidity pools compared to DEXs. This means that traders can easily buy or sell assets without impacting the market price.

3. User-friendly interfaces: Centralized exchanges typically provide intuitive and user-friendly interfaces, making them more accessible to newcomers and less technically-inclined users. These platforms often offer features like live price charts, order books, and trading indicators to assist users in making informed trading decisions.

4. Advanced trading options: Centralized exchanges often offer advanced trading options like margin trading, futures trading, and options trading. These features allow experienced traders to leverage their positions and potentially increase their profits.

5. Customer support: Centralized exchanges usually have dedicated customer support teams that can address user inquiries and provide assistance in a timely manner. This is particularly important in the event of any technical issues or security concerns.

While centralized exchanges provide these additional functionalities, they come with some drawbacks. Centralized exchanges are susceptible to hacking attempts and require users to trust the platform with their funds. Additionally, the centralized nature of these exchanges contradicts the underlying principles of decentralization and autonomy that blockchain technology aims to achieve.

It is important for users to carefully consider their trading needs and preferences before choosing between a centralized exchange and a decentralized exchange like Tronlink’s DEX. Both types of exchanges have their own advantages and limitations, and it is up to the individual to decide which platform aligns best with their trading style and risk tolerance.

Benefits of using Dex over Centralized Exchanges on Tronlink

- Security: Decentralized exchanges (Dex) offer enhanced security compared to centralized exchanges. With Dex, users have full control of their funds, as they are stored in their wallets. This eliminates the risk of a centralized exchange getting hacked or going bankrupt.

- Privacy: Dex provides a higher level of privacy compared to centralized exchanges. Users can trade directly from their wallets without the need to create an account or provide personal information. This protects their identity and financial information from being exposed.

- Non-Custodial: Unlike centralized exchanges, Dex operates on a non-custodial model. This means that users’ funds are not held by a third party or exchange. Instead, trades are executed directly on the blockchain through smart contracts, ensuring that users maintain control and ownership of their assets.

- Lower Fees: Dex generally have lower fees compared to centralized exchanges. This is because there is no need for intermediaries or middlemen, as trades are conducted peer-to-peer. Users only pay for the transaction fees on the blockchain, resulting in more cost-effective trading.

- Global Access: Dex provides users with global access to cryptocurrencies. As long as users have access to a Tronlink wallet and an internet connection, they can trade with anyone in the world. This eliminates the geographical restrictions that are often imposed by centralized exchanges.

- Transparency: Dex offers transparency by allowing users to view all transactions on the blockchain. Every trade and transaction is recorded on the public ledger, ensuring that no manipulations or fraudulent activities can go unnoticed.

- No KYC Requirements: Dex platforms do not require users to undergo Know Your Customer (KYC) procedures. This means that users can trade without disclosing personal information or going through the verification process commonly required by centralized exchanges.

In summary, using a Dex on Tronlink provides users with enhanced security, privacy, and control over their funds. It also offers lower fees, global accessibility, transparency, and avoids the need for KYC procedures. These advantages make Dex a preferred choice for many cryptocurrency traders and investors.

Increased security and privacy

When it comes to decentralized exchanges (DEX) on Tronlink, the level of security and privacy is significantly higher compared to centralized exchanges. This is due to the nature of the decentralized nature of DEX, which removes the need for a central authority to hold users’ funds and personal information.

One of the main advantages of DEX is the use of smart contracts to facilitate transactions. These smart contracts are powered by blockchain technology, making them highly secure and resistant to hacking or manipulation. Unlike centralized exchanges, DEX do not hold users’ funds directly, reducing the risk of large-scale hacks or thefts.

In addition, DEX on Tronlink provide users with a greater level of privacy. Since DEX do not require users to go through a KYC (Know Your Customer) process, users can trade and interact with the platform anonymously. This helps protect users’ personal information from being exposed to potential hackers or malicious actors.

Furthermore, DEX on Tronlink offer users the ability to maintain control of their funds at all times. Instead of depositing their funds into a centralized exchange’s wallet, users can trade directly from their own wallets using Tronlink. This eliminates the need to trust a third party with the custody of their funds, ensuring a higher level of security and reducing the risk of funds being lost or frozen.

Overall, the increased security and privacy provided by DEX on Tronlink makes them an attractive option for users who value the protection of their funds and personal information. By leveraging blockchain technology and eliminating the need for centralized authorities, DEX on Tronlink offer a more secure and private trading experience compared to centralized exchanges.

Greater control over funds

One of the key advantages of using a decentralized exchange (DEX) on Tronlink is the greater control over funds it offers. Unlike centralized exchanges, which usually require users to transfer their funds to the exchange’s custody, DEX platforms allow users to retain control of their funds throughout the trading process.

With a DEX, users can connect their wallets directly to the exchange and execute trades from their own wallets. This means that users never have to transfer their funds to a third party, reducing the risk of theft or hacking. Additionally, it allows users to maintain ownership of their funds at all times and have instant access to their assets.

Furthermore, DEX platforms on Tronlink utilize smart contracts to facilitate peer-to-peer trading. These smart contracts are executed on the blockchain and ensure that trades are conducted securely and transparently. With the use of smart contracts, users can trust that their funds will be handled securely and that trades will be executed as intended.

Overall, the greater control over funds provided by DEX platforms on Tronlink enhances the security and flexibility of trading. Users can trade directly from their own wallets, maintain ownership of their funds, and rely on smart contracts to ensure secure and transparent trading.

Advantages of Centralized Exchanges on Tronlink

Centralized exchanges on Tronlink offer several advantages that make them appealing to traders and investors:

- Liquidity: Centralized exchanges usually have higher liquidity compared to decentralized exchanges. This means that there are more buyers and sellers on the platform, increasing the chances of finding a suitable trade at a desired price.

- Trade Execution: Centralized exchanges offer faster and more efficient trade execution. Orders are matched instantly, ensuring that trades are executed without delay.

- Advanced Trading Features: Centralized exchanges often provide advanced trading features such as margin trading, stop-loss orders, and trading charts. These features enable traders to implement more complex trading strategies and manage risk effectively.

- Security: Centralized exchanges implement robust security measures to protect user funds and personal information. They have dedicated security teams and sophisticated systems in place to detect and prevent fraudulent activities.

- Customer Support: Centralized exchanges typically offer responsive customer support to assist users with any issues or concerns. They have dedicated support teams that can be reached through various communication channels, including live chat, email, and phone.

- Fiat Integration: Some centralized exchanges on Tronlink allow users to deposit and withdraw fiat currencies, such as USD or EUR. This feature provides convenience for users who want to easily convert their cryptocurrencies to fiat or vice versa.

While centralized exchanges have their advantages, it is important to note that they also come with certain drawbacks, such as reliance on a trusted third party and the potential for censorship.

Overall, centralized exchanges on Tronlink offer a range of benefits that make them suitable for traders and investors looking for high liquidity, advanced features, and strong security.

Higher liquidity

One of the main advantages of centralized exchanges is their higher liquidity compared to decentralized exchanges (DEXs). Liquidity refers to the ease of buying or selling an asset without significantly impacting its price. Centralized exchanges have more participants and trading volume, resulting in deeper order books and better price execution.

With higher liquidity, traders on centralized exchanges can quickly enter or exit positions, leading to better trading opportunities. They can execute larger orders without slippage, which is the difference between the expected price and the actual execution price. Additionally, centralized exchanges usually offer advanced trading features such as margin trading and futures contracts, further increasing liquidity and trading possibilities.

On the other hand, decentralized exchanges, like the ones available on Tronlink, often struggle with lower liquidity. This is because DEXs rely on liquidity pools generated by individual users rather than a centralized order book. As a result, the depth of the order book can be shallower, leading to wider bid-ask spreads and potentially higher price volatility.

| Centralized Exchanges | Decentralized Exchanges (DEXs) |

|---|---|

| Higher liquidity | Lower liquidity |

| Deeper order books | Shallower order books |

| Advanced trading features | Basic trading features |

However, it’s worth noting that the liquidity of decentralized exchanges is constantly improving as more users participate in these platforms. Additionally, decentralized exchanges offer benefits such as enhanced privacy, custody of funds, and reduced dependency on intermediaries.

In conclusion, while centralized exchanges generally have higher liquidity and more advanced trading features, decentralized exchanges provide alternative benefits. The choice between a DEX or a centralized exchange ultimately depends on the specific needs and preferences of individual traders.

Quicker transaction processing

One of the main advantages of decentralized exchanges (DEX) on Tronlink is the faster transaction processing compared to centralized exchanges. With DEX, transactions are completed directly on the Tron blockchain, eliminating the need for intermediaries or third-party providers. This enables quicker execution and settlement of trades, as there is no waiting time for order books to match, or for trades to be confirmed by central servers.

Additionally, DEX transactions on Tronlink are executed in a peer-to-peer manner, meaning that trades are conducted directly between individual users. This eliminates the need for multiple layers of approval and verification, which can slow down the transaction process on centralized exchanges.

Furthermore, DEX transactions on Tronlink benefit from the fast and efficient nature of the Tron blockchain itself. Tron is designed to handle high transaction volumes and boasts fast block times, ensuring that trades are processed quickly and with minimal delays.

Overall, the quicker transaction processing offered by DEX on Tronlink provides traders with a more efficient and seamless trading experience. This speed advantage can be especially beneficial in volatile markets, where quick execution and settlement of trades can make a significant difference in profitability.

Main Differences between Dex and Centralized Exchanges on Tronlink

Dex (Decentralized Exchange)

Dex is a type of exchange that operates on a decentralized network, such as Tronlink. It allows users to trade directly with each other without the need for an intermediary.

One of the main differences between Dex and centralized exchanges is that Dex does not rely on a central authority to hold and manage funds. Instead, transactions are carried out using smart contracts, which automate the execution of trades.

Another key difference is that Dex offers increased privacy and security compared to centralized exchanges. Since transactions are recorded on the blockchain, they are immutable and transparent, reducing the risk of fraud or manipulation.

Centralized Exchanges

Centralized exchanges, on the other hand, operate under the control of a central authority. They act as intermediaries, holding users’ funds and facilitating trades on their behalf.

One of the main advantages of centralized exchanges is their user-friendly interface and ease of use. They often offer more advanced trading features, such as margin trading and futures contracts.

However, centralized exchanges also come with some disadvantages. They are vulnerable to hacking and theft since they store users’ funds in a central location. Additionally, they may require users to complete know-your-customer (KYC) procedures, compromising privacy.

Conclusion

In summary, the main differences between Dex and centralized exchanges on Tronlink are the decentralized nature of Dex, which eliminates the need for intermediaries, and the increased privacy and security it provides. Centralized exchanges, on the other hand, offer user-friendly interfaces and more advanced trading features but come with the risk of hacking and lack of privacy. Ultimately, the choice between Dex and centralized exchanges will depend on the individual’s preferences and priorities.

Ownership of funds

When it comes to the ownership of funds, there is a significant difference between decentralized exchanges (DEX) and centralized exchanges on Tronlink.

With decentralized exchanges, users have full ownership and control over their funds. This means that users hold the private keys to their wallets and have the ability to manage and transfer their funds directly on the blockchain. The funds are not held or controlled by any centralized authority or third party.

On the other hand, centralized exchanges operate more like traditional financial institutions. When users deposit funds into a centralized exchange, they are essentially giving custody of their funds to the exchange. The exchange holds and manages the funds on behalf of the users. Although users can trade and make transactions on the exchange, they do not have direct control over their funds as the private keys are held by the exchange.

This difference in ownership has implications for security and control. With decentralized exchanges, users have a higher level of security as they are not relying on a centralized entity to safeguard their funds. Additionally, they have more control over their funds as they can manage and transfer them as they see fit.

However, centralized exchanges may offer certain advantages such as enhanced liquidity and user-friendly interfaces. They also provide additional services like margin trading and lending.

In conclusion, decentralized exchanges provide users with full ownership and control over their funds, while centralized exchanges require users to trust the exchange with their funds. It is essential for users to consider their priorities and choose the type of exchange that aligns with their needs and preferences.

Control over private keys in Dex

One of the key differences between decentralized exchanges (Dex) and centralized exchanges is the control over private keys. In a Dex, users have complete control and ownership over their private keys, ensuring a higher level of security and autonomy.

Private keys are the cryptographic keys that enable users to access and manage their digital assets. In a centralized exchange, users typically do not have direct access to their private keys. Instead, the exchange holds and manages the keys on behalf of the users.

This lack of control over private keys in centralized exchanges raises concerns around security and trust. Users have to rely on the security measures implemented by the exchange, which may be susceptible to hacking or other security breaches.

On the other hand, in a Dex, users have the sole ownership of their private keys. This means that users have full control over their assets and can securely manage their funds without having to rely on any third-party entity.

The control over private keys in Dex provides users with increased security, privacy, and independence. Users do not need to worry about their assets being vulnerable to hacks or the potential misuse of their keys by centralized exchanges.

However, with great power comes great responsibility. Users must be diligent in safeguarding their private keys as losing them can result in the permanent loss of access to their assets.

Overall, the control over private keys in Dex grants users greater control, security, and autonomy over their digital assets, making them a preferred choice for individuals who value decentralization and user empowerment.

| Decentralized exchanges (Dex) | Centralized exchanges |

| Users have complete control and ownership over their private keys. | Users do not have direct access to their private keys. |

| Private keys enable users to access and manage their digital assets. | The exchange holds and manages the keys on behalf of the users. |

| Users have increased security, privacy, and independence. | Users rely on the security measures implemented by the exchange. |

| Users need to be diligent in safeguarding their private keys. | Users do not have to worry about managing their private keys. |

Capability of centralized exchanges to hold user funds

Centralized exchanges, unlike decentralized exchanges (DEXs), have the capability to hold user funds in custodial wallets. This means that when users deposit their funds into a centralized exchange, they are effectively handing over control of their funds to the exchange.

Centralized exchanges have the responsibility of ensuring the security of these custodial wallets and protecting user funds from theft or hacking attempts. They typically employ various security measures, such as cold storage, multi-signature wallets, and security audits, to ensure the safety of user funds.

This capability of holding user funds can be convenient for users who prefer to have their funds managed by a trusted third party, rather than managing their own private keys and wallets. It also allows for easy trading and liquidity, as users can easily deposit and withdraw their funds on the exchange.

However, this centralized control of user funds also carries risks. Users need to trust that the exchange will act in their best interest and not misuse or misappropriate their funds. There have been cases of centralized exchanges being hacked, going bankrupt, or engaging in fraudulent activities, resulting in the loss of user funds.

It is important for users to carefully research and choose reputable centralized exchanges that have established a track record of security and trustworthiness. It is also advisable for users to only keep funds on the exchange that they are actively trading, and store larger amounts of cryptocurrency in secure personal wallets.

Overall, while centralized exchanges offer the capability to hold user funds, users should be aware of the risks involved and take appropriate measures to protect their assets.

Trading process and order book

When it comes to trading on decentralized exchanges (DEX) and centralized exchanges (CEX) on Tronlink, there are some key differences in the trading process and order book.

On a DEX, the trading process is peer-to-peer and does not involve a central authority. Traders interact directly with each other through smart contracts on the blockchain. This means that trades are executed quickly and transparently. However, since there is no central authority, liquidity on DEXs can sometimes be lower than on CEXs, which may result in wider bid-ask spreads and less favorable prices.

On the other hand, CEXs have a centralized order book managed by the exchange itself. This allows for higher liquidity, tighter spreads, and more trading options. Traders place their buy and sell orders in the order book, and the exchange matches these orders based on price and volume. The order book displays the current bids and asks, allowing traders to see the depth of the market and make informed decisions.

There are advantages and disadvantages to both DEXs and CEXs. DEXs offer more control over funds and require no sign-up or KYC (Know Your Customer) procedures. However, they may have limited trading options and lower liquidity. CEXs, on the other hand, provide a wider range of trading pairs and higher liquidity, but require users to trust the central authority with their funds.

It is important for traders to understand the differences between DEXs and CEXs before deciding which type of exchange to use. Factors such as trading preferences, liquidity needs, and security concerns should be considered when choosing a platform for trading cryptocurrencies on Tronlink.

Decentralized trading on Dex

Decentralized trading, also known as peer-to-peer trading, allows users to trade directly with each other without the need for intermediaries. With Dex on Tronlink, users have the ability to trade cryptocurrencies in a decentralized manner, keeping control of their assets in their own wallets.

One of the key benefits of decentralized trading on Dex is the removal of middlemen, such as centralized exchanges. This means that users do not have to rely on a centralized authority to facilitate their trades, reducing the risk of hacking, manipulation, and censorship.

Another advantage of Dex trading is the increased privacy and anonymity it provides. Since trades are conducted directly between users, there is no need to disclose personal information or go through a registration process. This helps users protect their identities and maintain their privacy.

Dex also offers a more transparent trading experience. All transactions are recorded on the blockchain, which can be publicly accessed and audited. This transparency ensures that all trades are fair and can be verified by anyone.

Furthermore, Dex trading provides users with a wide range of available cryptocurrencies to trade. Since Dex is not limited to a specific set of tokens, users have the opportunity to trade a variety of assets, including Tron-based tokens and other cryptocurrencies.

However, it is important to note that Dex trading may have some drawbacks compared to centralized exchanges. For example, the liquidity on Dex platforms may not be as high as on centralized exchanges, making it more difficult to execute large trades.

In summary, Dex trading on Tronlink offers users the ability to trade cryptocurrencies in a decentralized, secure, and transparent manner. With increased privacy and a wide range of available assets, Dex provides a viable alternative to centralized exchanges for those who value control and anonymity in their trading activities.

FAQ:

What is Tronlink?

Tronlink is a wallet extension that allows users to interact with decentralized applications (dApps) on the Tron blockchain.

What are some advantages of using a decentralized exchange (DEX) on Tronlink?

Some advantages of using a DEX on Tronlink include increased security and privacy, as transactions are performed directly on the blockchain without the need for a central authority. Additionally, DEXs typically offer a wider range of supported tokens compared to centralized exchanges.

Are there any disadvantages to using a DEX on Tronlink?

Yes, there are some potential disadvantages to using a DEX on Tronlink. One of the main disadvantages is the potential for lower liquidity compared to centralized exchanges. This can result in higher slippage and slower trade execution times. Additionally, DEXs may have limited trading features and advanced order types compared to centralized exchanges.